Fraud

DWF and insurers win in personal injury data dispute

A High Court judgment has dismissed claims against DWF Law brought by Ersan and Co Solicitors, reinforcing the rights of insurers and their legal teams to process data in suspected fraudulent personal injury claims.

FCA lays out road map to tackle motor insurance costs

The Financial Conduct Authority has outlined what caused motor insurance costs to skyrocket in recent years and explained the steps the regulator, providers and the government should take to reduce premiums.

Woodgate & Clark flags uptick in neurodiverse fraud referrals

Woodgate & Clark has seen an uptick in fraud referrals involving neurodiverse customers.

Dashcam footage exposes fake injury claim against Axa

A £74,000 personal injury and vehicle damage claim against Axa has been rejected after dashcam footage showed the claimant wasn’t even in the vehicle at the time of the collision.

Ageas issues warning over recruitment scam

Ageas has drawn attention to a scammer claiming to advertise positions at the business over WhatsApp, prompting potential victims to stay vigilant.

Spotlight: How agentic AI is redefining claims transformation

From complex documentation to final decisions, agentic AI is transforming how claims are handled. But instead of replacing people, it works alongside them, argues Grady Behrens at Shift Technology.

Gang of eight convicted after ‘largest’ nuisance call case

Eight men have been convicted of unlawfully accessing and obtaining one million people’s personal information from vehicle repair garages to generate potential leads for personal injury claims.

Clearspeed raises $60m for ‘high growth’

Clearspeed has raised $60m (£44m) in series D funding, bringing the company’s total funding to $110m.

Claims and Fraud Awards 2025 shortlist revealed

Insurance Post can reveal the businesses and individuals who have been shortlisted for the 2025 Insurance Post Claims and Fraud Awards.

Spotlight: Unstable and rising claims drive insurer automation

As inflation, fraud and extreme weather push up claims’ volumes and costs, insurers are turning to automation and AI to manage demand, improve service and stay competitive, writes Chris Marshall.

Diary of an Insurer: Aviva’s Katriona Cunningham

With teams based across Perth, Norwich, Sheffield, Belfast, and Maxim, near Glasgow, Katriona Cunningham, policy application fraud lead at Aviva, tends to travel a bit for work and also taxis her girls to gymnastics, tennis, and swimming.

Allianz makes £200k saving after butchered claim

Allianz has saved £200,000 after a complex injury claim was dropped due to the discovery of contradictory surveillance footage and social media evidence.

Big Interview: Mark Eastham, Avantia

Mark Eastham, CEO of Home Protect and Avantia Group, reveals how he will turn the business into the first insurer to have an artificial intelligence-driven operating model, plus whether an acquisition of the non-standard home insurer could be on the…

Questions raised by insurers’ lopsided AI investments

Editor’s View: Artificial intelligence is reshaping the way insurers operate, but Emma Ann Hughes wonders if a lopsided focus on investing in point of sale at the expense of the claims experience could raise eyebrows at the regulator and erode…

Navigating record claims in the generative AI era

As generative artificial intelligence reshapes the insurance landscape, industry experts joined the Insurance Post podcast to share how the sector is adapting to record claims volumes and shifting customer expectations.

Can insurers harness the power of Generative AI?

Generative artificial intelligence has the market buzzing around its huge potential for business growth, but at this early stage, Rachel Gordon warns many factors need careful consideration.

Ageas CUO on generative AI’s return on investment

Tom Quirke, chief underwriting officer at Ageas, unpicks the insurer’s return on investment in generative AI to date and reveals why adopting the technology has been a worthwhile endeavour.

Ifed cracks down on ghost broking amid 52% increase

The City of London Police’s Insurance Fraud Enforcement Department has led several operations targeting illegal ghost brokers, amid a 52% increase in the practice.

Big Interview: Tobias Taupitz, Laka

Tobias Taupitz, Laka CEO and co-founder, shares how the bicycle insurance company hopes to become the leading provider of green mobility cover in Europe plus the organic and inorganic paths he intends to take to achieve that goal.

Decant adds embedded cover amid whisky scam surge

Following its partnership with Embri, Decant’s CEO has told Insurance Post that embedded insurance will help reassure investors amid a surge in whisky investment scams.

Is Axiom Ince the start of a new era of SFO investigations?

The Serious Fraud Office’s crackdown in the Axiom fraud case is a key example of the agency’s statement of intent and raises the bar on insurers to self-police corporate fraud, according to Elliott Kenton, partner in the regulatory team at Weightmans and…

How insurers should tackle the luxury watch theft crisis

Rob McCarthy, non-executive director at insurtech Embri, outlines how the insurance industry can take a proactive role in tackling high-value item crime.

Staying ahead of insurance fraud in times of crisis

As if natural disasters weren’t devastating enough, catastrophic events create perfect opportunities for fraudsters to exploit insurers scrambling to process claims quickly.

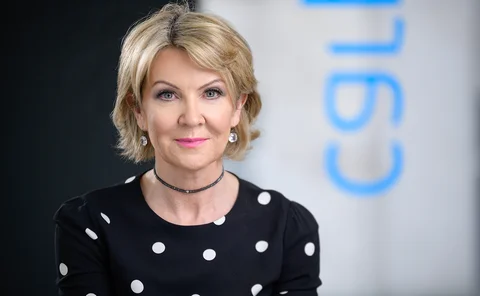

Donna Scully, Carpenters Group

Donna Scully is joint owner and director of insurance and legal services provider Carpenters Group and she isn't afraid of fearlessly tackling topics such as fraud and social mobility in the sector.