Articles by Emma Ann Hughes

Have your say: Shape the future of Insurance Post

Insurance Post wants you to help shape the future of the award-winning publication by taking part in its latest readership survey.

Insurtech Review of the Year 2025

Insurtechs came of age in 2025, shifting from disruption to deep integration, proving artificial intelligences real-world value, expanding globally, and cementing their role as essential partners driving insurance innovation and modernisation.

FCA tries to clarify bullying and harassment standards for insurers

The Financial Conduct Authority has issued final guidance setting out how insurers must address bullying, harassment and violence, after 95% of consultation respondents called for further clarification.

A Christmas Carol for insurance’s digital dilemmas

Editor’s View: Insurers to confront the ghosts of past technology missteps in order to claim a more connected, brighter future, according to Emma Ann Hughes who is under the influence of Charles Dickens this Christmas.

Record-breaking total for Insurance Day for Dementia

More than 152 firms took part in this year's Insurance Day for Dementia on 27 November raising a record-breaking £431,000 from the annual event.

Beazley CEO warns of more big brand cyber attacks in 2026

Beazley CEO Adrian Cox has warned that 2026 could be the year a major global brand suffers lasting damage, or even fails, following a severe cyber outage.

Regulators outline plans to grow UK mutuals sector

A package of measures aimed at accelerating the growth of the UK’s mutuals sector has been unveiled by the Financial Conduct Authority and Prudential Regulation Authority.

Q&A: Julian Roberts, WTW

As climate volatility disrupts long-established farming traditions, Julian Roberts, managing director of risk and analytics (alternative risk transfer solutions) at WTW, explains why parametric insurance could be the tool that helps farmers plus the…

Property insurance pay-outs hit record £4.6bn

Association of British Insurers members paid out a record £4.6bn in property insurance claims during the first nine months of the year.

Big Interview: Hugh Kennaway, President of Cila

From jumping out of planes to global energy loss adjuster and volunteer police constable, new Chartered Institute of Loss Adjusters president Hugh Kennaway is a man with a mission: to expand the reach of the professional body.

Lloyd’s flags sharp decline in future female underwriting leaders

Lloyd’s is facing a shrinking pipeline of female underwriting talent, with new data revealing women remain significantly under-represented at senior levels.

FCA’s Sheldon Mills to exit regulator

Sheldon Mills, executive director of consumers and competition at the Financial Conduct Authority, is set to leave the City watchdog.

Teens see cyber risks clearly – but don’t know insurance basics

Today’s teenagers understand the risks that will shape the insurance market of 2045 but are confused about the cover they need today, research has revealed.

Lessons to learn from Lloyd’s investigation into Neal

Editor’s View: Lloyd’s examination of former CEO John Neal’s conduct raises difficult questions about oversight, culture and transparency, which Emma Ann Hughes argues the insurance market can no longer afford to shrug off.

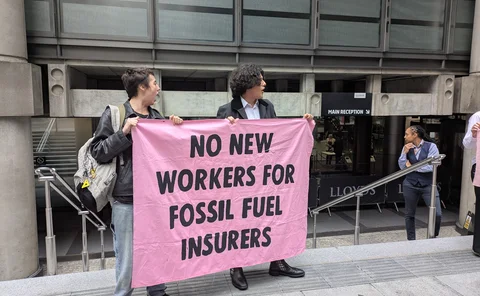

Climate activists disrupt S&P insurance conference

Climate change protesters disrupted S&P Global Ratings’ European Insurance Conference in London this afternoon (20 November), forcing multiple pauses to the programme.

Big Interview: Simon McGinn, CEO of Dual UK

Simon McGinn, CEO of Dual UK, is betting on regional expansion, specialist expertise and empowering underwriting talent, rather than pursuing takeovers, to double the MGA business by 2030.

Dual’s McGinn outlines plan to accelerate MGA’s expansion

Simon McGinn, CEO of Dual UK, has revealed how he intends to accelerate the growth of the MGA business.

Insurers stuck in scaling trap as IT lags ambitions

Insurers may be more determined than ever to accelerate product innovation, but new data suggests outdated IT infrastructure is standing in the way of that ambition.

How Dual’s data capability is transforming the MGA

Simon McGinn, CEO of Dual, has shared how the MGA’s data capability has been transformed in recent years and is accelerating the growth of the business.

Axa CIO reveals ROI on AI

Artificial intelligence has resulted in a significant uptick in the number of customers Axa retains, according to the insurer’s chief information officer Natasha Davydova.

ABI urges MPs to hardwire insurance into national resilience

The government must embed insurers at the heart of national resilience planning and involve the sector at the earliest stage of major policy decisions, Association of British Insurers director general Hannah Gurga told industry leaders.

Five insurance trailblazers to celebrate on International Men’s Day

Editor’s View: Ahead of International Men’s Day on Wednesday (19 November) Emma Ann Hughes reflects on the male trailblazers who are reshaping the insurance industry by leading with empathy, allyship and action.

HCC International is the nation’s best performing underwriter

HCC International is the best-performing underwriter in the UK general insurance market, according to Insurance DataLab.

AM Best warns protectionism is fragmenting insurance market

Rising protectionism is threatening to reverse years of global insurance market integration and increase costs for international carriers, AM Best has warned.