Articles by Emma Ann Hughes

FCA’s Sheldon Mills to exit regulator

Sheldon Mills, executive director of consumers and competition at the Financial Conduct Authority, is set to leave the City watchdog.

Teens see cyber risks clearly – but don’t know insurance basics

Today’s teenagers understand the risks that will shape the insurance market of 2045 but are confused about the cover they need today, research has revealed.

Lessons to learn from Lloyd’s investigation into Neal

Editor’s View: Lloyd’s examination of former CEO John Neal’s conduct raises difficult questions about oversight, culture and transparency, which Emma Ann Hughes argues the insurance market can no longer afford to shrug off.

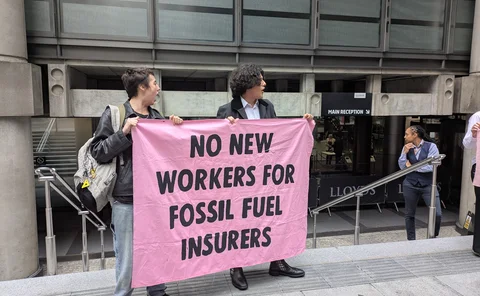

Climate activists disrupt S&P insurance conference

Climate change protesters disrupted S&P Global Ratings’ European Insurance Conference in London this afternoon (20 November), forcing multiple pauses to the programme.

Big Interview: Simon McGinn, CEO of Dual UK

Simon McGinn, CEO of Dual UK, is betting on regional expansion, specialist expertise and empowering underwriting talent, rather than pursuing takeovers, to double the MGA business by 2030.

Dual’s McGinn outlines plan to accelerate MGA’s expansion

Simon McGinn, CEO of Dual UK, has revealed how he intends to accelerate the growth of the MGA business.

Insurers stuck in scaling trap as IT lags ambitions

Insurers may be more determined than ever to accelerate product innovation, but new data suggests outdated IT infrastructure is standing in the way of that ambition.

How Dual’s data capability is transforming the MGA

Simon McGinn, CEO of Dual, has shared how the MGA’s data capability has been transformed in recent years and is accelerating the growth of the business.

Axa CIO reveals ROI on AI

Artificial intelligence has resulted in a significant uptick in the number of customers Axa retains, according to the insurer’s chief information officer Natasha Davydova.

ABI urges MPs to hardwire insurance into national resilience

The government must embed insurers at the heart of national resilience planning and involve the sector at the earliest stage of major policy decisions, Association of British Insurers director general Hannah Gurga told industry leaders.

Five insurance trailblazers to celebrate on International Men’s Day

Editor’s View: Ahead of International Men’s Day on Wednesday (19 November) Emma Ann Hughes reflects on the male trailblazers who are reshaping the insurance industry by leading with empathy, allyship and action.

HCC International is the nation’s best performing underwriter

HCC International is the best-performing underwriter in the UK general insurance market, according to Insurance DataLab.

AM Best warns protectionism is fragmenting insurance market

Rising protectionism is threatening to reverse years of global insurance market integration and increase costs for international carriers, AM Best has warned.

Can insurers keep their climate promises?

Whether insurers are truly delivering on their climate commitments or just talking a good game is explored in the latest episode of the Insurance Post Podcast.

Best Insurance launches proposition for military veterans

Best Insurance is offering tailored insurance products to Britain’s armed forces veterans.

Yates exits EIS after almost four years

Rory Yates announced Friday (31 October) was his last day as chief strategy officer at EIS Ltd.

Insurers double tech hires as AI climbs agenda

UK insurers have more than doubled the number of new board appointees with technology expertise over the past year, outpacing their banking and asset management peers.

Halloween horror stories haunting insurers

Editor’s View: It’s that spine-tingling time of year again, when the nights draw in, shadows lengthen across Leadenhall Market, and Emma Ann Hughes shares scary stories about insurance.

Providing cover for construction

From green buildings and supply chain bottlenecks to keeping premiums viable amid increasingly complex projects – the latest Insurance Post Podcast explores how changes in the construction sector are causing insurers to adapt.

Big Interview: Chris Lay, CEO of Marsh McLennan UK

Chris Lay, Marsh McLennan’s UK CEO and Insurance United Against Dementia chair, shares his plans for the next phase of the campaign, plus his growth plans for the 154-year-old broking giant.

Marsh McLennan CEO shares plan to be ‘better, not just bigger’

Marsh McLennan UK CEO Chris Lay has shared his plans to build a business “for the next 154 years” exclusively with Insurance Post.

Loss adjusting evolves as people skills match technical know-how

The traditional role of a loss adjuster as a purely technical expert is rapidly evolving, research from the Chartered Institute of Loss Adjusters has revealed.

IUAD aims to shape dementia data and NHS plans

Insurance United Against Dementia chair Chris Lay has said the insurance industry has a critical role to play in shaping dementia care through better data and influencing NHS policy.

Lockerbie Memorial restoration saved as BLW and Aviva step in

Broker BLW Insurance and Aviva have arranged bespoke cover for the restoration of the former Dryfesdale Church as it is transformed into the Lockerbie Memorial Church Museum.