Articles by Emma Ann Hughes

Insurers double tech hires as AI climbs agenda

UK insurers have more than doubled the number of new board appointees with technology expertise over the past year, outpacing their banking and asset management peers.

Halloween horror stories haunting insurers

Editor’s View: It’s that spine-tingling time of year again, when the nights draw in, shadows lengthen across Leadenhall Market, and Emma Ann Hughes shares scary stories about insurance.

Providing cover for construction

From green buildings and supply chain bottlenecks to keeping premiums viable amid increasingly complex projects – the latest Insurance Post Podcast explores how changes in the construction sector are causing insurers to adapt.

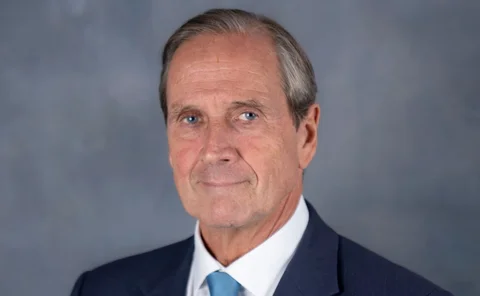

Big Interview: Chris Lay, CEO of Marsh McLennan UK

Chris Lay, Marsh McLennan’s UK CEO and Insurance United Against Dementia chair, shares his plans for the next phase of the campaign, plus his growth plans for the 154-year-old broking giant.

Marsh McLennan CEO shares plan to be ‘better, not just bigger’

Marsh McLennan UK CEO Chris Lay has shared his plans to build a business “for the next 154 years” exclusively with Insurance Post.

Loss adjusting evolves as people skills match technical know-how

The traditional role of a loss adjuster as a purely technical expert is rapidly evolving, research from the Chartered Institute of Loss Adjusters has revealed.

IUAD aims to shape dementia data and NHS plans

Insurance United Against Dementia chair Chris Lay has said the insurance industry has a critical role to play in shaping dementia care through better data and influencing NHS policy.

Lockerbie Memorial restoration saved as BLW and Aviva step in

Broker BLW Insurance and Aviva have arranged bespoke cover for the restoration of the former Dryfesdale Church as it is transformed into the Lockerbie Memorial Church Museum.

Is home insurance fit for the future?

How the growing number of claims from floods, fires, and faulty technology has put traditional home insurance policies to the test is the focus of the latest Insurance Post Podcast.

Marsh and Allianz lead winners at CII Exam Awards

This year’s Chartered Insurance Institute Apprenticeship Awards and Qualification Prizegiving saw several major insurance groups collect multiple honours.

Big Interview: Xavier Laurent, CEO of Covéa Insurance

In his first major UK interview, freshly appointed CEO of Covéa Insurance Xavier Laurent shares how he will keep the provider on the course set by his predecessor Georges de Macedo, and explains why he won't chase growth for growth’s sake.

Covéa’s new CEO vows to prioritise profit over growth

Covéa’s incoming CEO Xavier Laurent has pledged to build on his predecessor Georges de Macedo’s turnaround success by keeping the UK business focused on profitability.

SMEs lose faith in growth and their insurers

Small and medium-sized business confidence fell to historic lows in the second quarter of 2025 – and their trust in insurers weakened alongside it.

Commission clarity shouldn’t stop at motor finance

Editor’s View: While the Financial Conduct Authority currently believes only motor finance commission arrangements warrant a compensation scheme, Emma Ann Hughes warns similar payment practices in general insurance could soon face greater scrutiny.

AI that could hit insurers with wave of court cases wins backing

Artificial intelligence-driven claims technology capable of causing a surge in court-bound insurance disputes has won the financial backing of a law firm backing and is now being piloted with a major loss assessor, Insurance Post can exclusively reveal.

Q&A: Nick Pomeroy, QRG Specialty

Nick Pomeroy, head of reinsurance and broking at QRG Specialty, reflects on his journey from decades at industry heavyweights to helping build a nimble challenger in the London Market.

Top 100 UK Insurers 2025: Axa

Axa slips one place to ninth position on this year’s Top 100 UK Insurers list, but the provider plans to grow by being a market mover, not follower, through harnessing data and technology.

Top 100 UK Insurers 2025: Allianz

Allianz is ranked tenth again in Insurance Post’s Top 100 UK Insurers list thanks to disciplined pricing, new partnerships, and digital transformation.

Business interruption insurance after Covid-19

How has business interruption insurance changed since the pandemic – and whether the lessons of Covid-19 are really being applied today – is the focus of the latest Insurance Post Podcast.

Top 100 UK Insurers 2025: Aviva

Aviva Insurance Limited is ranked number 1 and Aviva International Insurance Limited is ranked number 2 once again on Insurance Post’s Top 100 UK Insurers list.

Top 100 UK Insurers 2025: Bupa

Bupa once again appears in sixth place on Insurance Post’s Top 100 UK Insurers 2025 list, with growth plans focused on becoming the world’s most customer-centric healthcare company.

Top 100 UK Insurers 2025: Admiral

Admiral has climbed from seventh to fifth place on this year’s Insurance Post Top 100 UK Insurers list, thanks to strong profit growth and the acquisition of More Than's renewal rights.

Top 100 UK Insurers 2025: Intact Insurance

Intact Insurance, formerly known as RSA, has held firm in fourth place on this year’s Top 100 UK Insurers list thanks to bold investments in technology, faster claims resolution, and its One Commercial programme.

Flood Re calls for property flood resilience to be made mainstream

Flood Re has kicked off this year’s Flood Action Week with a call for government, insurers, lenders and homeowners to work together to make property flood resilience a mainstream part of protecting property across the UK.