Claims

Beazley's Catherina MacCabe on the mounting pressure on D&Os

Directors and officers are coming under ever closer scrutiny as pressure is mounting to comply with gender, cyber and environmental requirements, explains Catherina MacCabe, head of the International Management Liability focus group at Beazley.

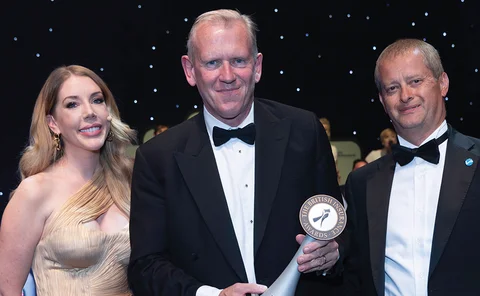

British Insurance Awards 2018: Full list of winners, their stories and photos

Former Churchill and LV general insurance boss John O’Roarke took home the Achievement prize last night at the British Insurance Awards, where his new employer Aviva was among the big winners.

Robots will control claims future: PWC

Future insurance claims will be settled with little to no human involvement and insurers will have to adapt to the impact of technology if they are to survive, a report from PWC has found.

ABI calls for tougher building regulations in wake of Grenfell tragedy

The Association of British Insurers has reiterated its call on a ban of flammable cladding on high rise buildings and called on building regulators and legislators to learn from the past and mandate sprinkler systems in new build tower blocks.

Analysis: Is Lemonade losing its fizz?

Will Lemonade’s losses see its success go flat?

Blog: Costs of aviation claims rocketing as technology taking off

Aviation claims costs are rising, fuelled by expensive technology repairs, explains John Bayley, regional director for Europe and Russia at McLarens Aviation.

Prime Minister urged to step in over Glasgow School of Art insurance claims

The MP for Glasgow Central has urged the Prime Minister to step in over a perceived lack of support from insurance companies for those affected by the fire that spread through Glasgow School of Art.

Thatcham Research awards Automotive Academy graduates

Thatcham Research held its annual apprentice graduation and award ceremony yesterday, which formed part of ABP’s Body Repair Industry Apprentice Awards.

GDPR: In Depth: The GDPR time bomb

The implementation date of the General Data Protection Regulation is less than a year off but the industry’s attention is elsewhere, with issues like Brexit, the General Election and the discount rate looming large on the horizon.

Thatcham CEO Shaw steps down due to ill-health

Thatcham Research CEO Peter Shaw is stepping down from his role with immediate effect due to ill-health.

Risk management: Analysis: Intellectual property: Creative cover

The significance of intellectual property risks has not translated into a large demand for IP insurance policies - yet.

Risk management: Analysis: Councils: Local challenges

Local government insurance has to deal with emerging risks. How is it adapting as competition increases?

Risk management: Analysis: Cargo theft on the rise

International cargo theft has a huge impact on the frequency and severity of insurance claims and the problem is increasing.

Risk management: Analysis: Zoo insurance: A walk on the wild side

Zoo insurance is a niche market, with only a few underwriters and brokers, all very much focused on managing a ferocious variety of risks for visitors, staff and animals.

Bupa's Alex Perry: There is no health without mental health

Insurers need to turn their focus to mental health, one of the biggest people issues facing UK businesses, writes Alex Perry, CEO of Bupa Insurance UK.

FCA to launch signposting service for people with pre-existing medical conditions

The City watchdog will create a service to direct people with cancer and other pre-existing medical conditions to affordable travel insurance.

Ex-Quindell firm to target 10% of med reporting market

Former Quindell business Mobile Doctors has laid out plans to capture 10% of the medical report market by 2021.

Analysis: Social media is making virtual kidnap and ransom a reality

In a world where political volatility is rife and where an individual’s net worth and lifestyle are discoverable through a Google search or Instagram feed, kidnap for ransom has never been easier or more lucrative. As the threat to clients increases, so…

Week in Post: How much are your limbs worth?

One of the highlights of the World Cup so far was watching Portuguese defender Pepe collapse in agony after receiving a pat on the back from Moroccan player Mehdi Benatia. But when you see how much footballers insure their body parts for, it isn’t really…

The Post Claims Awards 2018: Full list of winners

Who won what at the 2018 Post Claims Awards held last night at the Royal Garden Hotel?

Blog: Dreamvar, the continuing nightmare for PI insurers?

Solicitors and their professional indemnity insurers are in effect underwriting the legitimacy of property transactions on a strict liability basis, following a recent court decision analysed by Phil Murrin, partner at DAC Beachcroft.

Verisk acquires Validus IVC

Verisk has acquired automated subrogation platform provider Validus IVC to offer its customers automated claims processing.