Claims

Analysis: Liability war rages over Grenfell-style cladding replacement claims

A battle is raging over who is liable for costs to replace cladding on high-rise residential buildings across the country

IFB issues caveat on insurance fraud figures

Crime numbers that show a decline in insurance fraud are not likely to be representative, the Insurance Fraud Bureau has warned.

Rising Star: Fiona Simpson, Cunningham Lindsey

Fiona Simpson is a senior adjuster for Cunningham Lindsey. She started at Allianz Global Corporate & Specialty after studying insurance law and has since worked her way up the adjusting ladder.

Shares in Hastings fall owing to rising claims costs

Hastings Direct said it experienced an unforeseen increase in claims costs due to adverse weather conditions experienced during the beginning of 2018.

Blog: What Cambridge Analytica means for AI in claims

Insurers and lawyers trying to automate claims through artificial intelligence must be careful not to violate ethical boundaries, explains Andrew Dunkley, head of analytics at BLM, pointing to the Cambridge Analytica scandal as a warning sign.

Civil Liability Bill gets second reading in Lords

Peers in the House of Lords examined the Civil Liability Bill yesterday in the Bill's second reading.

State of the Broker Nation 2018: Probing broking

Michèle Bacchus spoke to brokers to find out their thoughts on regulation, their trade body and their opinion of the UK insurance market

Post-Grenfell research lays bare fire safety test failures

Research conducted on behalf of the insurance industry in the wake of the Grenfell Tower fire has exposed the scale of fire safety testing failures.

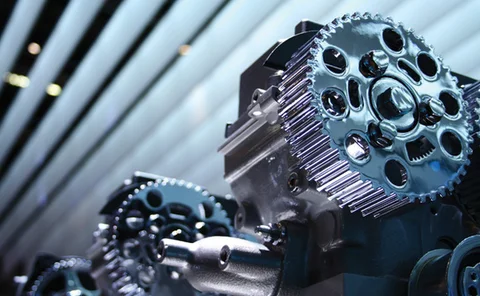

The ABI credit hire GTA needs to better reflect today's vehicle technology

Insurers and credit hire organisations need to work together to create a new general terms of agreement to better reflect today’s engines. That is the view of Europcar UK business development director James Roberts, who adds all parties will benefit if a…

Sedgwick appoints Malcolm Hughes as Ireland CEO

Sedgwick has appointed Malcolm Hughes as CEO of its Ireland operations.

Roundtable: Where next for personal injury reform?

Discount rate and whiplash reforms are going through parliament. Will the outcome be beneficial to all?

Obituary: Norman Cottington, industry mourns rehab 'trailblazer'

Norman Cottington, a revolutionary in the field of rehabilitation and case management in the personal injury sector, passed away suddenly on 11 April.

Lloyd's appoints partners on insurtech lab

Lloyd’s has appointed insurtech specialist L Marks and The Boston Consulting Group to support the set up and operation of its Innovation Lab.

Lust for trust: can public trust be restored in insurance?

Nick Marson, founder of Parallel Mind, talks to commentators from across the insurance market to garner their views of how the insurance market can respond with one collective voice to meet the challenge of restoring public trust

Campaigners call for ONS to collate motor data for policymakers

Exclusive: Campaigners have called for the Office of National Statistics to collate motor insurance statistics for use in parliament.

This week: Proceedings and premiums

This week the UK has been focused on court cases and Inquiries.

Sedgwick UK shakes up leadership team after Cunningham Lindsey merger

Stewart Steel has been named CEO of Sedgwick UK, which will be formed from a merger of Cunningham Lindsey and Vericlaim.

Konsileo to offer 'bespoke' customer data for underwriting

Konsileo said its service will improve the claims process for insurers by providing underwriters more insight into risks.

HDI's Jens Wohlthat on the need for hardening

Natural catastrophe risks reveal the need for industrial cover rate hardening, writes Jens Wohlthat, member of the HDI board of management.

Blog: Insurers should cover recyclables price volatility

The reluctance of current players in the waste sector to manage recyclables price risk presents opportunities for the insurance sector, explains Surabhin Chackiath, waste and resource management consultant at SLR Consulting.

Das v Asplin: Prosecution outlines arguments on fraud charges

The trial of former Das CEO Paul Asplin continued today (18 April) at Southwark Crown Court.

Motor premiums have already started to fall: Fitch

Insurers have already started to reduce motor premiums ahead of the government’s proposed whiplash and discount rate reforms.

Blog: Time to talk about psychological rehab

Insurers must embrace psychological rehabilitation in the same way that they have physical, explains Jonny Cook, founder and chairman of Corporé.

Cunningham Lindsey to be rebranded Sedgwick following acquisition

Cunningham Lindsey will be subsumed under the Sedgwick brand following the acquisition of the adjuster last year.