Artificial intelligence (AI)

CII and FCA warn AI could put vulnerable customers at risk

The Chartered Insurance Institute has unveiled new guidance to help firms better support vulnerable customers, and warned a rush to adopt AI tools risks compounding harm for those most in need.

FCA’s Sheldon Mills to exit regulator

Sheldon Mills, executive director of consumers and competition at the Financial Conduct Authority, is set to leave the City watchdog.

Teens see cyber risks clearly – but don’t know insurance basics

Today’s teenagers understand the risks that will shape the insurance market of 2045 but are confused about the cover they need today, research has revealed.

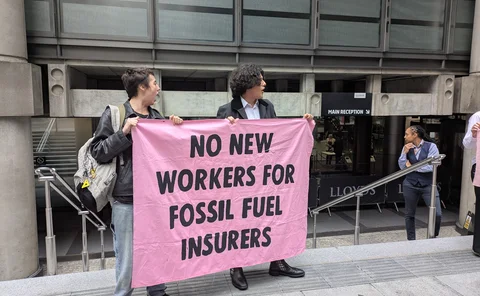

Climate activists disrupt S&P insurance conference

Climate change protesters disrupted S&P Global Ratings’ European Insurance Conference in London this afternoon (20 November), forcing multiple pauses to the programme.

Spotlight: Reinforce customer integrity by stopping fraud earlier in the sales process

Insurance providers risk leaving their digital channels exposed to organised fraud. Strengthening fraud defences at the point of sale can protect the customer ecosystem, reduce operational costs and create competitive advantage, argues Paul Brockway,…

Q&A: Jake Wells, Meshed

Jake Wells, co-founder and chief operating officer of Meshed, discusses the insurtech’s vision of providing high quality service to small-to-medium businesses through the artificial intelligence-native broking platform.

Asia Pacific Insurance Technology Awards winners revealed

Insurance Post is delighted to announce the winners of the 2025 Asia Pacific Insurance Technology Awards.

Davies CEO warns agentic AI investment ‘imperative’ for survival

Davies group CEO Dan Saulter has argued investment in agentic artificial intelligence is an “imperative” and not an “option”.

Axa CIO reveals ROI on AI

Artificial intelligence has resulted in a significant uptick in the number of customers Axa retains, according to the insurer’s chief information officer Natasha Davydova.

Webinar: Learn about AI underwriting lessons from the front line

The conversation around AI in underwriting is shifting, from what’s possible to what’s already in play.

Q&A: Rob Kemp, Aon

Rob Kemp, head of commercial risk at Aon, speaks to Insurance Post regarding his role so far, the broker's recent M&A activity, and its investments in AI.

Aon expects new AI tool to cut claims resolution time by up to 20%

Aon is targeting a 10 to 20% improvement in its claims resolution time in the first year of deployment of its new artificial intelligence claims tool.

Is claims service the new battleground in a softening market?

Trade Voice: Richard Napoli, chair of the CII Claims Community board and UK claims and legal services director at Markel, looks at how insurers can differentiate themselves as competition heats up.

Allianz to re-platform commercial products over next two years

Allianz Commercial is in the process of moving all its products over to a new platform, chief distribution officer Nick Hobbs has told Insurance Post.

Q&A: Etienne Legangneux, Vet-AI

Etienne Legangneux, CEO of Vet-AI, discusses the opportunities for the firm’s AI triage tools to assist insurers in reducing claims and retaining customers in an increasingly price competitive market.

Compare the Market CEO dismisses ChatGPT taking over PCWs

Compare the Market CEO Mark Bailie has argued the question of Chat GPT taking over from price comparison websites is “fundamentally flawed”.

Insurers double tech hires as AI climbs agenda

UK insurers have more than doubled the number of new board appointees with technology expertise over the past year, outpacing their banking and asset management peers.

Guidewire CEO maps insurance sector’s AI transformation

Guidewire CEO Mike Rosenbaum has outlined how he thinks generative artificial intelligence and large language models will change the insurance industry.

Q&A: Mark Miller, Insurevision

Mark Miller, founder and CEO of Insurevision, discusses with Insurance Post how the firm’s artificial intelligence computer vision technology has the capacity to begin telematics 2.0 and fulfil the untapped potential of the original technology.

Mea CEO argues AI can now impact combined ratio

Mea CEO Martin Henley has argued agentic artificial intelligence success could be measured against its impact on an organisation’s combined ratio.

60 Seconds With... Resilience’s Si West

From fending off cyber villains to mentoring global security teams, Si West, director of customer engagement at Resilience, blends digital defence with dad jokes and a dash of Queen.

MS Amlin predicts AI will replicate outsourcing consequences

The impact of artificial intelligence on the insurance workforce will be similar to the effect of outsourcing, according to MS Amlin chief people officer Gemma Lines.

Q&A: Haris Khan, Novee

Haris Khan, CEO and co-founder of Novee discusses how the firm will execute its mission to solve efficiency and data visibility challenges for underwriting technology.

AI that could hit insurers with wave of court cases wins backing

Artificial intelligence-driven claims technology capable of causing a surge in court-bound insurance disputes has won the financial backing of a law firm backing and is now being piloted with a major loss assessor, Insurance Post can exclusively reveal.