Artificial intelligence (AI)

Could AI widen the insurance gap?

While artificial intelligence dominates forecasts for the future of insurance, Jarrod Johnson, director of Scenario Risk Partners, argues other technologies like drones and mobile risk-assessment tools may be the ones that hold the key to closing the UK…

Insurers Forecast of 2026

Insurers are heading into 2026 well-capitalised, technologically accelerated and increasingly data-driven but softening markets, geopolitical volatility and emerging risks are set to test their resilience in the year ahead.

Broker Forecast for 2026

Brokers are bracing for a soft but fiercely competitive market in 2026 shaped by economic pressures, rapid digitalisation and widening technological divides.

Insurtech forecast for 2026

Insurtech sector leaders expect to stand stronger, smarter and more pragmatic than ever in 2026 by shifting from experimentation to execution, embedding artificial intelligence at scale, strengthening data foundations and proving their value through real…

MGAs Review of the Year 2025

2025 was a landmark year for MGAs, marked by record growth, major partnerships, technological innovation and expanding global reach, even as soft market conditions and pricing pressures tested resilience across the sector.

Blog: What you told me you want from risk management

Risk management needs to scale, hit harder and modernise fast. Johnny Thomson, head of strategic planning at RiskSTOP Group, reveals the industry’s top demands – and how data and AI are already reshaping what insurers, brokers and clients expect.

Broker Review of the Year 2025

A softening market put downward pressure on brokers revenue in 2025 but businesses that embraced digital breakthroughs and delivered exceptional service have succeeded in holding on to their clients in a competitive market.

Insurance perils of driving home for Christmas

As motorists get ready to celebrate Christmas, Emma Ann Hughes examines the road risks of the festive period, explores accident-prevention strategies, and checks whether insurers’ claims teams are as prepared for seasonal challenges as Santa’s elves are…

Potholes put councils on legal front line over road repairs

As pothole-related injury and damage claims increase, Georgia Milton, paralegal at DWF, warns councils and insurers must navigate complex legal duties, evidential hurdles and financial risks in proving when liability begins.

A Christmas Carol for insurance’s digital dilemmas

Editor’s View: Insurers to confront the ghosts of past technology missteps in order to claim a more connected, brighter future, according to Emma Ann Hughes who is under the influence of Charles Dickens this Christmas.

Q&A: Dan Sandler, Veridox

Dan Sandler, founder of Veridox, explains the insurtech’s unconventional, community-focused approach to developing the AI-powered forensic document and image manipulation analysis platform.

First Central to cut 160 Jobs

First Central is consulting on significantly reducing its workforce and outsourcing roles to its South African office in the new year, Insurance Post can reveal.

Insurers target call centre job cuts as tech adoption advances

A report has suggested Allianz Partners is looking to get rid of call centre staff, while Post understands Markerstudy is also considering its call centre personnel numbers over the next few years.

Video Q&A: Shift Technology’s George Robbins on Agentic AI and claims transformation

In the latest Insurance Post video we caught up with Shift Technology’s head of UK, Ireland and Nordics George Robbins to discuss the key areas that insurers need to consider when thinking about using Agentic AI in claims transformation.

Insurance in step with AI

At a recent webinar hosted by Insurance Post in association with Hyland, insurers explored how agentic AI could reshape underwriting, claims and fraud – and the challenges of keeping humans in the loop.

CII and FCA warn AI could put vulnerable customers at risk

The Chartered Insurance Institute has unveiled new guidance to help firms better support vulnerable customers, and warned a rush to adopt AI tools risks compounding harm for those most in need.

FCA’s Sheldon Mills to exit regulator

Sheldon Mills, executive director of consumers and competition at the Financial Conduct Authority, is set to leave the City watchdog.

Teens see cyber risks clearly – but don’t know insurance basics

Today’s teenagers understand the risks that will shape the insurance market of 2045 but are confused about the cover they need today, research has revealed.

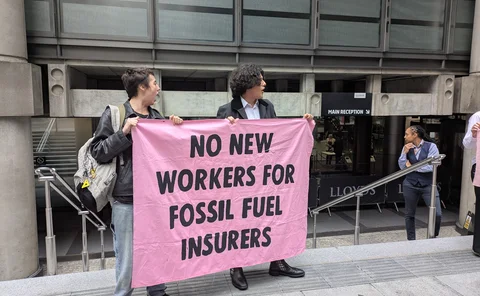

Climate activists disrupt S&P insurance conference

Climate change protesters disrupted S&P Global Ratings’ European Insurance Conference in London this afternoon (20 November), forcing multiple pauses to the programme.

Spotlight: Reinforce customer integrity by stopping fraud earlier in the sales process

Insurance providers risk leaving their digital channels exposed to organised fraud. Strengthening fraud defences at the point of sale can protect the customer ecosystem, reduce operational costs and create competitive advantage, argues Paul Brockway,…

Q&A: Jake Wells, Meshed

Jake Wells, co-founder and chief operating officer of Meshed, discusses the insurtech’s vision of providing high quality service to small-to-medium businesses through the artificial intelligence-native broking platform.

Asia Pacific Insurance Technology Awards winners revealed

Insurance Post is delighted to announce the winners of the 2025 Asia Pacific Insurance Technology Awards.

Davies CEO warns agentic AI investment ‘imperative’ for survival

Davies group CEO Dan Saulter has argued investment in agentic artificial intelligence is an “imperative” and not an “option”.

Axa CIO reveals ROI on AI

Artificial intelligence has resulted in a significant uptick in the number of customers Axa retains, according to the insurer’s chief information officer Natasha Davydova.