Technology

Hello...? Why do British insurers struggle to ‘do an Adele’ and conquer the US?

Content Director's View: With the sale of Admiral-owned Compare.com to Insurify, Jonathan Swift muses on why British personal lines insurers struggle to translate success at home across the Atlantic.

The future of insurance personalisation

In this podcast from Duck Creek Technologies, Rob Savitsky and Mathew Stordy chat with Bryan Falchuk about the future of insurance personalisation.

In it, to win it! The British Insurance Awards 2023 deadline is 8 days away

With a closing date of 17 March, you will need to start preparing your 2023 British Insurance Awards entries sooner rather than later to make the cut; and be in with a chance of winning at the industry’s most prestigious insurance awards show.

Insurtech 2.0 must embrace the concept of brokers

Flock CEO Ed Leon Klinger said in order for insurtechs to continue to grow their scale and distribution capabilities, they needed to use the concept of brokers.

Implications of shelving the autonomous transport bill

Blog: With the removal of the bill, Kennedy's corporate affairs lawyer Roger Davis, and partner Niall Edwards explore the implications for insurers, and how insurers can collaborate with other stakeholders during the waiting period.

Big Tech makes too much money out of insurers to compete with them

Big Tech firms have little incentive to become full-stack insurers themselves – they are making more than enough money servicing the industry to compete with it.

Power of the collective: The rise of insurance associations

Insurance fraud is now seen as a collective industry problem, resulting in the formation of associations dedicated to harnessing the global power of insurance data and analytics.

Jensten buys three brokers; CFC launches IP solution; Optio appoints CEO

Friday Round Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Big Interview: Crawford CEO Verma on averting the silver tsunami

Stepping up to the hotseat at the beginning of the pandemic might have initially phased him, but Crawford group CEO Rohit Verma tells Jonathan Swift how embracing technology, local empowerment, and being alive to the ‘silver tsunami’ has seen him make…

‘Hardly any insurance players put customers at the heart of the product,’ says Beale

Dame Inga Beale has said radical thinking is needed to change insurance, encouraging insurtechs to continue challenging the current way of operating.

How to deliver a superior customer experience

Consumers have become more discerning about insurance buying and with household incomes now being squeezed hard, it is incumbent on insurance providers to really listen to their customers and provide relevant products.

Speed and accuracy define personalised quoting for small business owners

The need for speed, accuracy and personalisation are reshaping the underwriting landscape for small commercial property risks.

Cloud migrations and third parties present cyber security challenges, says Resilience

Cloud migrations and digital transformation projects are increasing organisations’ risk of being susceptible to cyber attacks, managing general agent Resilience warns.

OIC’s Martin Saunders reflects on the portal’s journey to success for claimants

Following recent feedback that the portal is not operating correctly, Martin Saunders, head of service for Official Injury Claim addresses some of the more recent media inaccuracies and sheds light on why the portal is a successful route to justice for…

Use of data risks social harm, warns Lloyds Bank insurance director

The insurance industry’s increasing use of data risks is fueling financial exclusion, Lloyds Bank’s head of general insurance has said.

Efficient reinsurance management: The million dollar question

Reinsurance is a vital part of the insurance ecosystem, and yet the administration, calculation, and accounting processes between insurers and reinsurers are often siloed.

Navigating the next two years in cyber insurance

Blog: Nour Alnuaimi, CEO and founder of Upsurance, considers why demand for cyber insurance from certain segments of the market is still lagging.

Power of the collective: Singapore insurers unite to fight fraud

Insurers across Singapore have joined forces as part of the General Insurance Association (GIA) to detect and disrupt fraud.

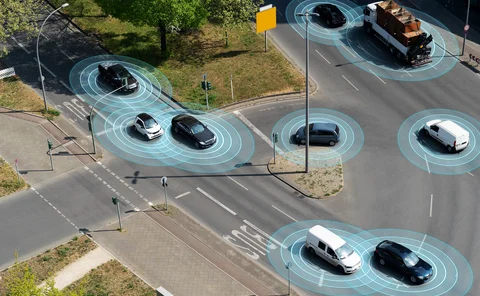

Tech trends #17: Connected cars and the future of motor insurance

Companies from Ford to Tesla are racing to rollout vehicles that connect with outside systems, promising whole new opportunities for P&C insurers - including personalised, "pay-how-you-drive" coverage, automated FNOL, and more.

Data replaces doubt for small commercial underwriting

This blog highlights how an integrated predictive analytics model can help insurers to deliver underwriting excellence for different lines of business in different ways and the key benefits of personalising the underwriting process.

Why insurance customers are demanding more on payments

Blog: With cost-of-living concerns bringing the speed at which claims are paid to one of the top priorities for consumers, Darren Lane, business development manager at Solaris, explores why insurers need to move away from legacy technology to keep up…

Assurant’s focus on innovation increases fraud detection

Assurant and Shift Technology have been working together to detect claims fraud since 2018.

Intelligent communication platforms spur all-round improvements in claims performance

This blog highlights how intelligent communication platforms can drive noticeable improvements in claims performance and ensure insureds receive the personalisation that will make them loyal customers for years to come.

Shift exceeds expectations with underwriting risk detection

One of Shift’s European P&C clients conducted a review to identify applications for Shift’s AI decisioning capabilities, to address challenges for its underwriting team.