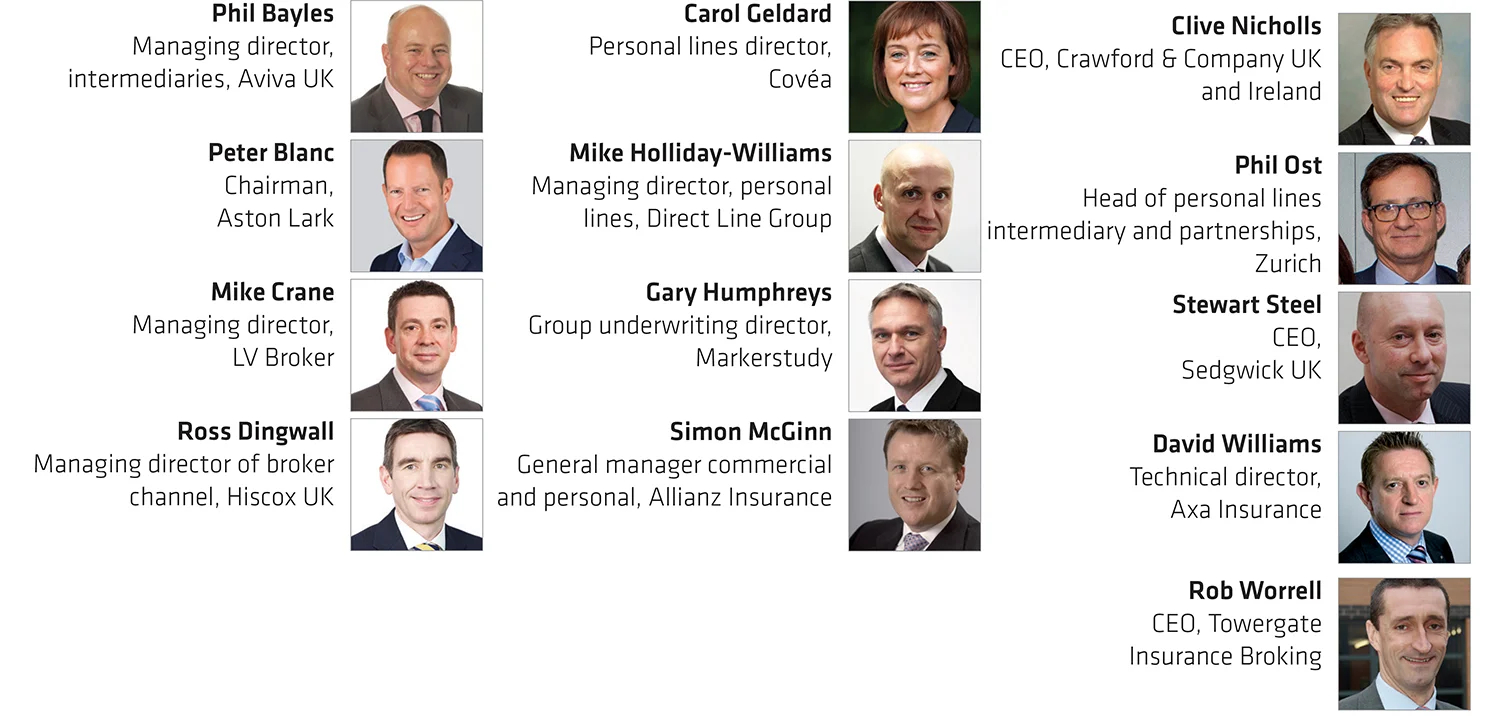

British Insurance Awards: 25 glorious years: Industry figures reflect on their experiences

Next year the British Insurance Awards will be held for the 25th time. To celebrate the silver anniversary of the most prestigious event in the insurance calendar, a host of BIA regulars recount where they were when the awards were first unveiled and reflect on some of their favourite memories

What were you doing in 1994 when the British Insurance Awards launched?

Phil Bayles, managing director, intermediaries, Aviva UK: I was 27 years old, living in London and working for the AA running its motor manufacture relationships.

Peter Blanc, chairman, Aston Lark: I was a 23 year old account executive with Farr Insurance in Chelmsford – I didn’t own a dinner suit and would never have been invited to attend the BIAs.

Mike Crane, managing director, LV Broker: I was heading up commercial underwriting for Commercial Union in Bristol. I have very fond memories of working with great people in a brilliant market.

Ross Dingwall, managing director of broker channel, Hiscox UK: I was working for Scottish General as an inspector based out of Bristol covering the South West England and Wales.

Carol Geldard, personal lines director, Covéa: I was working for Green Flag in 1994, but at the time of the first BIA ceremony itself I was sipping sangria with my sister in Menorca.

Mike Holliday-Williams, managing director, personal lines, Direct Line Group: I was part of the WH Smith graduate programme. Working in the retail sector was the best type of training for a career in insurance.

Gary Humphreys, group underwriting director, Markerstudy: I was a deputy underwriter for Crowe Motor Policies at Lloyd’s.

Simon McGinn, general manager commercial and personal, Allianz Insurance: I was an account executive at the Commercial Union working in the west end of London. Being based in Pall Mall meant I had some swanky parts of west London to look after and a fair amount of selling commercial lines, personal lines and high net worth insurance to brokers went on in nearby hostelries. I developed a keen taste for chicken and bacon sandwiches and Chilean Chardonnay during that period, which hasn’t left me to this day.

Clive Nicholls, CEO, Crawford & Company UK and Ireland: 1994 was a special year for me as I became a Fellow of the Chartered Institute of Loss Adjusters, which demonstrates commitment to knowledge, ethical and professional standards. At that time, I was an adjuster for GAB Robins specialising in casualty claims and was a director of the special risks division. I still take a keen interest in the casualty sector and ever-evolving global legislation.

Phil Ost, head of personal lines intermediary and partnerships, Zurich: I actually started my career with Zurich as a marketing assistant in that very same year, so will hit my 25th anniversary a few months before the next BIA. And I still remember my very first task – to call the motor insurance telesales lines of all the major direct writers and, using a stop watch, measure the speed that their call centres answered the phone, compiling the results into a benchmarking report for senior management. Only 10 calls per company so it was clearly highly statistically valid.

Stewart Steel, CEO, Sedgwick UK: I was working in Sheffield for loss adjusters, Thomas Howell Group (subsequently acquired by Crawford), having been promoted to my first management role there in 1990.

David Williams, technical director, Axa Insurance: I was based at our Maidstone Office. I remember demonstrating this new-fangled thing called the internet to our brokers on 14.4kbps then 28.8k dial-up modems. It took ages to load pages, even though they were mainly text, but we were all incredibly impressed at the time.”

Rob Worrell, CEO, Towergate Insurance Broking: I was 25 and in the second year of running The Insurance Partnership in Hull.

What was the first BIA you attended and what was your over-riding memory?

Bayles: The first awards I attended was in 2014. I remember the party atmosphere and the sunglasses selfies. The tropical heat was memorable too.

Blanc: The first BIAs I attended was probably early 2000’s but I would have had far too much to drink to remember anything about it – I was young, what can I say?

Crane: In 2001 I was lucky enough to attend my first BIA. The scale and style of the event was immense.

Geldard: I can’t remember the first awards ceremony I attended, or how many I’ve attended, but there have been many. My over-riding memories are always the great atmosphere, great company, great music and, of course, the legendary mornings after the night before.

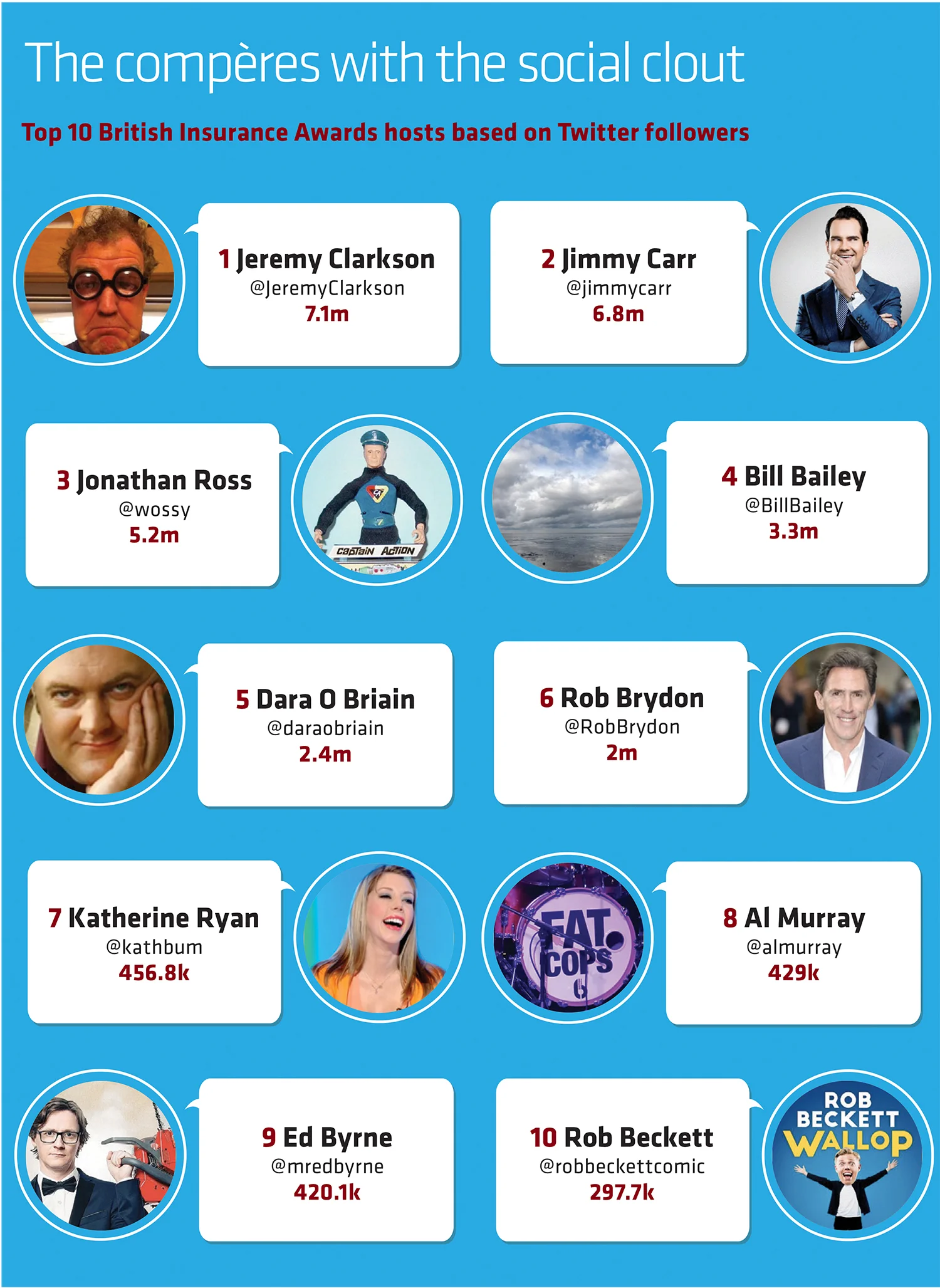

Holliday-Williams: I first attended the BIAs in 2008 when comedian Rob Brydon was hosting. My over-riding memory of the evening was RSA More Than being nominated for awards in two categories and unfortunately not winning.

Humphreys: I don’t remember the year but the entertainment was great.

McGinn: 2005 was my first BIAs and I remember thinking how old everyone was (now that’s me). There was lots of champagne going around and plenty of catching up with people you hadn’t seen for a while.

Nicholls: My first memory of the BIAs was in 1997 when GAB Robins under the name ‘Robins Response’ won the Loss Adjuster of the Year category. I was absolutely delighted as this reflected the hard work and commitment of all the people involved in GAB Robins’ personal lines business.But my overall recollection of the awards is that every year has been professionally managed and has positively promoted innovation in insurance.

Ost: It was probably not until the mid-noughties that I went to my first one. And while I can’t remember it, I do remember 2013 when my managing director (at the time) and I went to a pre-drinks function with BGL and arrived fashionably late at a now fully seated, packed Albert Hall. Imagine the horror when the usher looked at our tickets and pointed to our table which was at the very front and under the lectern where comedian Jimmy Carr had already started his intro. Can you imagine?

Steel: I believe I first attended the BIA in 2002 or 2003. Then as now, I was delighted to attend and thoroughly enjoyed a fabulous evening with the market.

Williams: It was one of the early ones, the first one at the Albert Hall, I think. It was themed after Last Night of the Proms and had people waving Union Jacks and everything. I was incredibly impressed and, coming from the provinces, so surprised to see so many insurance people in one place – and didn’t they look good in all their finery.

Worrell: 2001 – it was big and the first national event I had ever attended.

How many have BIAs have you attended in total?

Bayles: I’ve attended every one since my first, so five.

Blanc: I must have attended 15 or so – how old am I?

Crane: Every year since 2001.

Dingwall: I have attended at least eight, maybe a few more

Holliday-Williams: I have attended six or seven times.

Humphreys: I’ve lost count.

Nicholls: I may have missed one or two but I believe I have attended the majority. It is one of the highlights in the event calendar.

McGinn: Every one since including 2005 so 14 in total. And I’ve enjoyed them all in one way or another although, despite what people say, they are always better when you leave with an award.

Ost: I reckon between eight and 10 but haven’t counted.

Steel: I’ve been to most of the BIA events since my first attendance – perhaps 12 in all.

Williams: I don’t know exactly but would say fast approaching 20, I’ve been privileged to be able to go most years.

Worrell: I’m not 100% sure, but guessing about 15.

What is your favourite memory of the BIAs you have attended?

Bayles: My favourite memory would have to be when we won General Insurer of the Year for the first time in 2017.

Blanc: Favourite memory was winning Commercial Lines Broker of the Year in 2007 when I was running FMW Risk Services. We’d booked a table but ended up in a box on the second floor so naturally assumed we hadn’t won – imagine my surprise when the announcement came and I had to sprint down two flights of stairs to collect the trophy. Then started a very expensive night indeed – note to self – don’t invite Phil Cunningham (now Direct Commercial CEO) to choose drinks in a club in the West End.

Crane: Best ever moment was in 2012, when LV won General Insurer of the Year. Fantastic achievement and a very long celebration that followed.

Dingwall: They are always a fantastic event at a great venue but my lasting memories are the great bands that they have for the entertainment. The BIA’s choice of band is always a perfect fit for the audience – I’ve never seen so many insurance professionals dancing at their table.

Geldard: I always enjoy the BIAs, but my favourite memory is the occasion I had no memory because I’d partied so hard I had to extend my hotel check-out twice the following day.

Holliday-Williams: Comedian Al Murray hosting the 2015 Awards with a 1970s night theme. It was a memorable event for both the music and the comedy.

Humphreys: Musician Midge Ure of Ultravox.

Nicholls: It goes without saying that the best nights are when the team goes home with a trophy – there is a huge sense of pride when your hard work has been recognised by your peer group. I am always excited to see whether we make the shortlist every year and will be planning for 2019 shortly.

McGinn: The band Human League entertained us at the 2013 awards. They are a band from my era that I really liked and it was clear from the large number of black-tied attendees strutting their stuff on the floor of the hall before dinner had even been served that I was far from alone in that view.

Ost: My favourite memory is the choir that in recent years performs the musical accompaniment to each awards – they are truly brilliant, talented and have great energy.

Steel: I’d have to say the events do somewhat blur into one another with the passage of time – nothing to do with the wine (honest) or advancing years – but I always come away feeling proud to be part of such a valuable and varied industry with so many wonderful and colourful personalities. Of course, it’s always an added pleasure when we are nominated for and win the odd award.

Williams: Young achievers. Not the wardrobe malfunction on the big screen that so excited TV presenter Jeremy Clarkson one year. But two of my team were finalists in 2006 [Poppy Crane and Richard Walker], then we went on to win it in 2007 [Donna Claydon] and 2008 [Jon Nottingham]. It felt really good seeing the focus we had on developing people being recognised, and how quite rightly proud the individuals were of what they had achieved.

The BIAs are now 25 years old; what would you describe as the biggest shift in the insurance sector during that time?

Bayles: It’s an ever-changing landscape, and the competition and challenges are constantly shifting. However, I would say that we are in the middle of the single biggest change right now, and that is digitisation.

Blanc: Biggest shift is clearly the increasing importance of technology but much to our credit, it’s still people skills that win the day.

Crane: So much has changed in the way the sector looks and operates. It’s amazing the number of companies that have been created and disappeared during the period, but there is one constant that the BIAs manages to recognise is that it is the great people in the sector that make it successful and enjoyable to be part of.

Dingwall: There have been so many changes but the biggest shift is the volume of business being sold direct. Direct Line changed the landscape of personal lines insurance when it was launched and the trend for different distribution channels has continued and is still evolving today.

Geldard: The most noticeable shift I’ve seen is that there are many more ‘visible women’ working in insurance now and greater diversity too. The awards themselves are also more embracing with more companies represented, reflecting the changing nature of our industry. I don’t think there’d have been a diversity and inclusion award 25 years ago.

Holliday-Williams: New technology combined with boundary less innovation is changing how and what we insure.

Humphreys: Aggregators.

McGinn: The customer is now genuinely at the forefront of the industry’s decision making and they are consulted before products and services are designed to make sure they are fit for purpose. I remember when insurance people would get together in darkened rooms and work out ways to sell things to people with very little or no customer input. I’m glad those days are behind us.

Nicholls: There can be no doubt that the rise of technology and the increasingly complex landscape of risks has had a massive impact on insurance and claims. We are able to respond quicker, and to respond in more detail than we ever were before. The challenge will be for the insurance sector to keep up with customer expectations driven by the on-demand service from the likes of the retail sector.

Ost: Aggregators aside, it has to be all things digital. And on that note while I can’t prove it, I reckon I could have been Zurich’s first global internet user. In late 1994, an IT guy plugged a modem into my computer and I was asked by the MD to take on a six month watching brief of the new ‘world wide web’ and ‘internet superhighway’. Looking back, it was a truly terrible experience in those early days.

Steel: Without a doubt, innovation is a key driver of change in this industry. In our own way, as an industry we have proved adept at introducing new products and new ways of doing business embracing the technologies of the day. There have been times when I’ve looked at the shortlist for awards and seen names of businesses I’ve never heard of, that subsequently go on to become industry staples.

Williams: Technology. We have lots of it now, being used to varying degrees of effect. Back then, things were much more manual.

Worrell: For me personally, it’s certainly more inclusive. In the old days, diversity was inviting me as a token Northerner.

If you could give anyone a BIA for their services to the insurance sector over the last 25 years, who would it be and why?

Bayles: Swifty [or Post director of content Jonathan Swift for the uninitiated], for populising the urban folksy look and for his relentless pursuit of the truth.

Blanc: My personal assistant would be a good contender but as for ‘industry veterans’ I’d throw a few names into the ring including the leaders of the various consolidators who have been incredibly influential. We ought to acknowledge the influence and assistance the industry has had from Lord David Hunt, current British Insurance Brokers’ Association chairman – he gets a vote from me.

Crane: Swifty, constantly challenging and holding us all to account.

Dingwall: I would give one to Robert Hiscox as I had the pleasure of working at Hiscox when he was leading the business. He built a fantastic business and installed the values that continue to live within the business today. Truly inspirational.

Holliday-Williams: My choice would have to be Adrian Brown. He is and has always been a great advocate of insurance throughout his career at RSA and now Ardonagh. He is incredibly supportive of graduates and young achievers, as well as having the biggest network of insurance peers and colleagues that genuinely like him.

Humphreys: [A Plan CEO] Carl Shuker – he championed the independent high street broker and proved it works too.

Nicholls: I would like to recognise the efforts of Peter Gregg who was formerly the chief executive of GAB Robins, a president of Chartered Institute of Loss Adjusters and whose achievements have largely gone unnoticed except by those who worked with him. I have much to thank him for personally as his mentorship and guidance gave me many career opportunities. His strength of character was inspirational and his belief in encouraging people in the next step of their career is something that still guides me today.

McGinn: Steve White [CEO, British Insurance Brokers’ Association] has done a great job in instilling energy into Biba and the May conference epitomises that drive. White also works tirelessly to promote the interests of smaller brokers in a way that deserves wider recognition.

Ost: It would have to be Amanda Blanc, our new CEO, Europe, Middle East and Africa. Clearly I have no bias but here is someone who is truly inspiring, has led with real authenticity and who has the biggest network of anyone I’ve ever met who all wax lyrical about how good she is to work with.

Steel: In my area of the industry, I would say former Cunningham Lindsey CEO Gerry Loughney – but I’m pretty sure he’s already rightly been recognised. He showed exceptional commitment and professionalism during his loss adjusting career, which I greatly admire.

Williams: My earliest memories include [former Post editor-in-chief] David Worsfold compering the event in his white dinner jacket. I would give him the award for the great work he has done on behalf of the Insurance Charities – and for being brave enough to wear that jacket in public.

Worrell: Ian Hakes, my old chairman of The Insurance Partnership. He is now in his 55th year of broking and is aged 72 and is still a top quality client facing broker. Although he is only doing four days per week, he’s a real inspiration to me.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk