Insurtech

Insurtech collaboration set to transform the claims ecosystem

The insurance claims sector is in the midst of a mini revolution as specialist insurtech providers look to work together, embrace collaboration and accelerate the adoption of a smart insurance claims ecosystem, says Jeremy Hyams, founder of Synergy Cloud.

How generative AI is everything, everywhere in insurance all at once

How insurers have been able to swiftly pilot generative artificial intelligence, prove the value of embracing this technology and roll it out across the wider business is examined by Insurance Post Editor Emma Ann Hughes.

EU AI Act may block smaller insurtechs from market entry

Smaller insurtechs in the artificial intelligence sector will be subject to additional regulatory oversight due to the European Union AI Act, which may prevent them from making it into the market, according to Sixfold CEO Alex Schmelkin.

Diary of an Insurer: Peppercorn AI's Nigel Lombard

Nigel Lombard, CEO and founder of insurtech Peppercorn AI, shares a week in the life of a start-up, which includes remote working, investor meetings and gaining B Corp status.

Axa and Zego reject generative AI for pricing

Axa and Zego have ruled out using generative artificial intelligence for pricing due to compliance concerns.

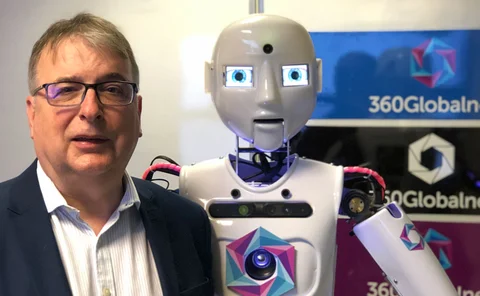

Q&A: Paul Stanley, 360Globalnet

Paul Stanley, CEO & founder of 360Globalnet, speaks to Insurance Post about the software firm’s growth, digital claims, and the benefits of no-code systems.

Scanning the horizon for connected and complex risks

Post Podcast: How insurers are scanning the horizon, spotting risks, and pricing services and products appropriately in an increasingly complex, interconnected world is the topic of the latest Insurance Post Podcast.

Impact of fraud reaches unprecedented UK levels

In the UK, the impact of fraud on individuals, businesses and the public sector has reached unprecedented levels.

Three examples of intelligent automation in insurance

Intelligent automation in insurance is a powerful tool that reduces human error and the need to perform repetitive tasks manually.

One in 10 claim images flagged for potential fraud

One in 10 images from claims have been flagged for fraud concerns, according to Kaye Sydenham, Verisk’s anti-fraud product manager.

Q&A: Daniel Grimwood-Bird, McKenzie Intelligence Services

Daniel Grimwood-Bird, head of sales and marketing at McKenzie Intelligence Services, shares how the provider of geospatial data and analytics plans to insurance industry plans to make it big in the UK and US.

Power List: Ones to watch in insurance in 2024

Here are the ones to watch who narrowly missed out on a place in this year’s Insurance Post Power List, but based on their role, career to date and growing influence look set to feature in future rankings.

Louise O’Shea, CFC

Louise O’Shea was appointed group CEO at CFC in January 2024 having served as an independent non-executive director since 2021.

Insurance influencer argues AI scares the ‘antiquated’ industry

The insurance industry is terrified of AI, which could delay its adoption in the insurance industry, according to Instagram insurance influencer TheHardMarket.

Insurtechs outpacing large insurers in using cloud cyber risk data

Big insurers in the cyber insurance space need to emulate insurtechs in adopting technology that can integrate cybersecurity-enhancing data from cloud providers, according to Monica Shokrai, Google Cloud’s head of business risk and insurance.

Q&A: Matt Hicks, Recorder

Matt Hicks, chief commercial officer and co-founder of Recorder, a new London-based insurtech from the creators of Codat, explains how he has built a platform and artificial intelligence co-pilot for brokers.

Cytora to streamline ‘time-consuming’ data gathering within large fleets

Cytora has partnered with risk management platform SambaSafety in a bid to streamline workflows and improve risk selection of motor insurance for large fleets.

Flock teases more deals as it expands into taxi fleets

Commercial fleet insurtech Flock has entered a capacity partnership with The Acorn Group, targeting black taxi as well as Uber fleets.

Blog: How can insurers make like-for-like EV replacement vehicles a reality?

The variety and cost of vehicles makes credit hire replacement more challenging than ever.

The rise and risks of AI contract drafting and analysis

There has recently been an increase in the number of startups bringing artificial intelligence (AI) contract drafting and analysis tools to market.

Insurance and artificial intelligence: Four emerging trends for 2024

If 2023 was the year AI captured headlines and demonstrated potential, what can we expect in the next year? What will be the impact of this exciting new technology?

Urban Jungle to use latest funding to expand product range

Home insurance startup Urban Jungle has raised £11.2M in its latest funding round led by existing investors, including Sony.

Hughub enters into administration

Insurance software provider Hughub has been placed into administration due to a lack of funding.

Wakam looking to exploit ‘unlimited UK potential’ following regulator approval

French B2B2C insurer Wakam has received approval by the Financial Conduct Authority and Prudential Regulation Authority to launch a UK subsidiary.