Insurtech

Guest podcast: How AI transforms automation and workflows

The AI era is still young, but early adopters are already seeing the benefits. If you want to stay ahead of the game, it’s critical to understand AI’s trajectory.

Ageas confirms exclusive talks over Saga ‘partnership’

Ageas has confirmed it has entered into negotiations with Saga for the distribution of motor and home insurance products to Saga's customers.

Automated claims management: Three pillars of success

In contrast to traditional approaches, automated claims management systems optimise underwriting efficiency with advanced algorithms and machine learning.

Treloar returns to insurance on Zego’s board

Steve Treloar is returning to insurance after more than a year out of the industry, as he is appointed to Zego’s board, Insurance Post can reveal.

The genie in the bottle: improving outcomes in income protection claims

At a recent Insurance Post roundtable in association with EvolutionIQ, specialists explored the challenges and opportunities for income protection insurers in supporting the ‘back to work’ mission.

Transforming the insurance industry with process intelligence

To truly become data-driven, insurers need solutions that make it easy to transform raw information into insights that lead to action.

Video Q&A: Access PaySuite’s Luke Gall

In the latest Insurance Post video, Access PaySuite product and engineering director, Luke Gall discusses the pain points he sees in the insurance sector and how his employer can help address them.

Earnix ‘not in the same boat’ as other insurtechs

Earnix is “not in the same boat” as other insurtechs as it looks to continue its growth plans, its CEO Robin Gilthorpe has told Insurance Post.

Kingfisher’s commercial acquisition; RSA’s D&O product; Zurich’s head of SME

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Lloyd’s Lab sets up insurtech investor panel

Lloyd’s Lab has set up an investor panel aimed at offering expertise and advice on the financial landscape and fundraising initiatives for insurtechs on its accelerator programme.

Q&A: John Dunn, Brokerbility

After more than 18 months into his role as MD of Brokerbility, John Dunn catches up with Insurance Post to discuss bring clarity to the networks, refreshing tired shcemes, and how he hopes to help partners and members "outperform the market"

Big Interview: Sten Saar, Zego

Sten Saar, co-founder and CEO of Zego, speaks to Damisola Sulaiman about the challenges of building an insurtech in an evolving landscape, the lessons he learned entering the complex world of insurance as an outsider, plus his plans for growing the…

Zego CEO outlines plan to become household name in motor

Zego CEO Sten Saar plans to focus on UK consumer and telematics for the next phase of the insurtech’s growth.

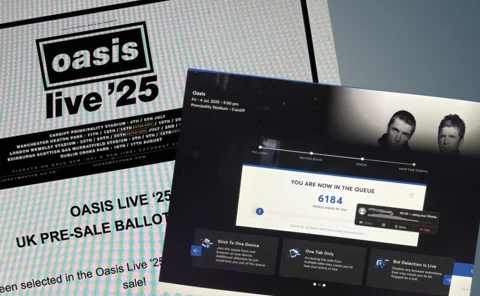

Lessons insurers should learn from Ticketmaster’s dynamic pricing

Editor’s View: Emma Ann Hughes questions whether the fallout from Ticketmaster’s dynamic pricing approach to selling Oasis tickets could have an impact on insurance premiums.

Electric vehicles and the future of motor insurance

How will the rise of electric vehicles and the FCA’s Consumer Duty affect the car hire and replacement vehicle market?

Leveraging specialist talent to support specialty insurers

Shaun Geils, global head of insurance at IQ-EQ, examines how traditional insurers can capitalise on lay-offs in the technology sector.

How to be a Lemonade-like insurtech

How to go from being a smart start-up to a large-scale insurtech player is the topic of Insurance Post Top Tips video starring Melissa Collett, CEO of Insurtech UK.

Electric opportunities for total loss claims

Getting motorists behind the wheel of an electric vehicle for a real-world experience could help overcome barriers to adoption.

Twenty firms face off for Lloyd’s Lab spots

The Lloyd’s Lab pitch day for its 13th cohort saw 20 firms go head-to-head for one of 10 spots in the market’s 10-week fast track programme for “fresh ideas” to challenge the insurance industry.

CoreLogic’s Garret Gray on what the future holds for insurance

The president of global insurance solutions at CoreLogic, Garret Gray, gives Saxon East the lowdown on INTRConnect Europe and what the future potentially holds for the insurance industry.

Fraud Spotlight: Working together to prevent insurance fraud

The fight against insurance fraud is a complex and multifaceted challenge that requires a concerted effort across the market. This article highlights the barriers to effective collaboration and how disparate elements can be aligned to create an effective…

Whose role is it anyway? Helping consumers with the lasting impact of the cost of living crisis

68% of Europeans think insurance premiums are excessively high, highlighting the importance for many to access affordable products.

Fraud Spotlight: ID fraud now hardest to spot, say insurance leaders

Identity fraud was named as the fraud typology most difficult to detect, according to the 2024 Insurance Post Fraud Survey sponsored by LexisNexis Risk Solutions.

Big Interview: Matthew Hill, Chartered Insurance Institute

Matthew Hill, the third CEO of the Chartered Insurance Institute in as many years, knows only 10 Downing Street has had a faster revolving door than the industry’s professional body in recent years.