Technology

AI should be used to fight crash for cash fraudsters

The increase in crash for cash incidents involving motorbikes is far more dire than it initially seems, warns Roi Amir, CEO of insurance technology company Sprout.ai, who argues the solution is to fight artificial intelligence with AI.

Big Interview: Paul Brand, Convex

Paul Brand, group CEO of Convex, sits down with Harry Curtis to discuss the insurer and reinsurer’s plans to hit and surpass $5bn GWP, the difficulties of technology adoption, and why he thinks current market conditions are “brittle”.

CrowdStrike event focuses minds on cyber ‘grey rhinos’

July’s CrowdStrike outage has trained the attention of companies buying cyber insurance and the industry itself on the spectre of systemic, high-impact events with potentially catastrophic consequences.

Transforming insurance: Strategic budgeting for a digital-first future

The insurance industry is at a pivotal moment where digital transformation is no longer a choice but a necessity. So, how do you decide what to prioritise in next year’s budget to accelerate your journey into a data-driven P&C insurance organisation?

Allianz, RSA and Zurich to debate threat of AI in insurance fraud

With digital manipulation threatening to put additional pressure on claims handlers, as deception becomes harder to spot.

How insurers can navigate the threat of biased AI

Dean Standing, chief customer officer of consultancy Sagacity, outlines why insurers should take more care when handling customer data to train artificial intelligence pricing models.

Could climate change drive an insurance availability crisis?

Climate change is one of the greatest, long-term risks facing the insurance sector.

Webinar: Is it time the ABI GTA had specific rates for electric vehicles to change insurers' attitudes?

With over a million electric vehicles on UK roads, they are becoming increasingly important for motor insurers in managing portfolio growth and claims costs.

ICEYE insurance head reveals plans for nat cat solutions

Stephen Lathrope, global head of insurance at space technology company ICEYE, has outlined the company’s plan to provide solutions targeted at a range of natural catastrophe perils.

Radar satellites promise to transform insurer flood responses

Space technology company ICEYE’s constellation of radar-equipped satellites gives insurers the ability to have a more informed response to floods just hours after they occur, its global head of insurance Stephen Lathrope has said.

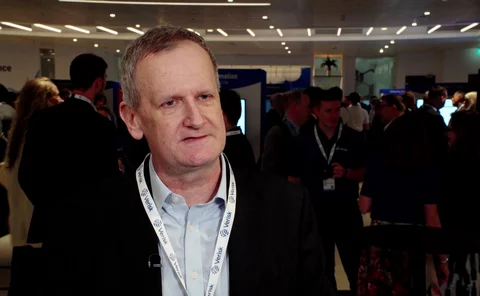

Verisk London 2024: Key takeaways

In the fourth and final video recorded at the Verisk Insurance Conference in London, Insurance Post content director Jonathan Swift spoke to delegates and speakers about the lessons they learned at this year’s event.

Axa XL extends cyber cover to internal GenAI risks

Axa XL has extended its cyber insurance coverage to emerging generative artificial intelligence risks, but risks associated with popular GenAI chatbots such as ChatGPT and Microsoft Copilot remain out of scope.

Verisk London 2024: Evolving fraud trends

In the third in a series of videos recorded at the Verisk Insurance Conference in London, Insurance Post editor Emma Ann Hughes met with industry experts to discuss fraud trends.

Spotlight: Why insurance can't afford to ignore RegTech

Within the insurance industry, regulatory pressures are intensifying, operational costs are soaring, and the ever-present threat of compliance violations could destabilise entire businesses.

Spotlight: Tackling insurance's regulatory tsunami

Waves of regulatory initiatives are driving up costs, reducing profitability and slowing down business for insurance firms. This spotlight focuses on how insurance firms can respond to these challenges and address the regulatory tsunami.

Seven ways to modernise the claims experience - using what you already have

Filing a claim is a policyholder’s greatest moment of vulnerability and truth. How connected and competitive is your claims experience?

Sprout AI targeting one billion customers by 2030

Roi Amir, CEO of Sprout AI, said the firm is looking to reach one billion customers within five to seven years, and confirmed when the company will expand into pet and travel.

Spotlight: Inclusive payment options are a must in a digital world

As insurers pursue the path to smoother digital journeys and payments, they risk losing customers who find themselves ‘digitally excluded’, says Luke Gall, product and engineering director, Access PaySuite

Verisk London 2024: Experience the possible

In the first in a series of videos recorded at the Verisk Insurance Conference in London, Insurance Post editor Emma Ann Hughes interviewed speakers and delegates about the transformative power of data, analytics, and artificial intelligence.

Axis cuts application processing time by 97% using AI

Axis has reduced its insurance application processing time from an average of 30 minutes to 60 seconds using Sixfold’s artificial intelligence underwriting solution.

Clearspeed in talks with each of the ‘top eight’ UK insurers

Following the announcement that RSA is adopting Clearspeed’s voice analysis technology, the firms MD Ranjit Mana has confirmed to Insurance Post that the firm is in talks with several UK insurers.

Q&A: Caroline Bedford, Edii

Caroline Bedford, founder and CEO of Edii, shares insights on the insurance industry's evolving approach to innovation and technology adoption, the impact of generative artificial intelligence, and her firm's efforts to foster diversity and inclusion.

Spotlight: Insurance's regulatory burden - are we to blame?

Seemingly relentless waves of regulatory change are battering the insurance sector.

2024 AI handbook for insurance leaders

AI will touch nearly every aspect of insurance - from broker operations to underwriting to risk management to claims processing and beyond. Insurers that adopt AI effectively will have an insurmountable advantage.