Technology

Aviva to roll out ‘transparent’ broker portal

Aviva’s MD for commercial and chief distribution officer, David Martin has revealed to Insurance Post that, in November, the insurer will be rolling out a new broker portal.

Spotlight: Why we need risk management for everyone, not just the 2%

For over 200 years, the insurance industry has understood the benefits of risk management in reducing and controlling exposure. But in a world of emerging and evolving risks, the traditional way of making improvements through site surveys creates a…

Big Interview: Sten Saar, Zego

Sten Saar, co-founder and CEO of Zego, speaks to Damisola Sulaiman about the challenges of building an insurtech in an evolving landscape, the lessons he learned entering the complex world of insurance as an outsider, plus his plans for growing the…

Only 3% of underwriters reckon pricing tech is perfect

A staggering 97% of UK actuaries and underwriters see room for improvement in the pricing technology they use, according to research from hyperexponential.

Zego aims to double staff output through AI use

Zego CEO Sten Saar plans to double staff output through generative artificial intelligence use.

Insurance knowledge ‘secondary’ for insurtechs

Speaking at the Earnix Excelerate conference, ManyPets chief underwriting officer Justin Clarke said knowledge of insurance has taken a backseat to knowledge of software for insurtechs.

Q&A: Kaye Sydenham, Verisk

Kaye Sydenham, product manager - anti-fraud at Verisk, discusses her background, digital media manipulation, and data issues in travel insurance fraud.

Raise your hand to smash through glass ceiling

Aishling Meyler, assistant vice-president for technology at LexisNexis Risk Solutions in UK and Ireland, says to smash through the insurance industry's glass ceiling you need to raise your hand and get involved.

How to improve product development pathways

What insurers can do to stop product launches from being a long, slow, hard slog is covered by Chris Kitchener, VP of product management of Applied Systems, is the latest Insurance Post Top Tips video.

MIB holds ‘initial’ talks with stakeholders about modernising CUE

The Motor Insurers’ Bureau has held initial talks with stakeholders about the possibility of modernising its claims database, CUE.

ABI fraud head hails joint effort in combating cannabis farm property claims

The insurance industry’s efforts to stamp out the ongoing problem of illegal cannabis farms in partnership with the police and other agencies, has been singled out as a sign of the potential of what can be done with wider data sharing.

Howden and Microsoft launch climate risk platform

Howden has collaborated with Microsoft on a platform aimed at enabling clients to manage climate risk and increase climate resilience.

Esure makes ‘sizeable’ savings from gen AI applications

Esure has said it could potentially save up to 8% on its frontline operations, and claims resource costs through generative artificial intelligence use.

Instanda’s Shipley on why meritocracy should replace metrics

Sara Shipley, chief human resources officer at Instanda, on the power of no longer chasing metrics but instead genuinely seeking talent in all its forms.

Thatcham urges car makers to design with insurance in mind

Thatcham Research's CEO Jonathan Hewett has told Insurance Post that he hopes Thatcham's new vehicle rating system will ensure that car manufacturers see insurability as a design attribute.

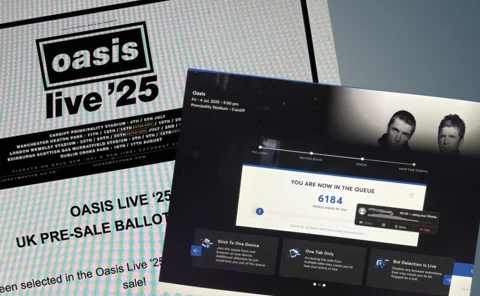

Lessons insurers should learn from Ticketmaster’s dynamic pricing

Editor’s View: Emma Ann Hughes questions whether the fallout from Ticketmaster’s dynamic pricing approach to selling Oasis tickets could have an impact on insurance premiums.

The genie in the bottle: improving outcomes in income protection claims

A healthy and active workforce is key to a thriving UK economy, but too many people remain on the sidelines. A recent Insurance Post roundtable explored the challenges and opportunities for income protection insurers in supporting the ‘back to work’…

Electric vehicles and the future of motor insurance

How will the rise of electric vehicles and the FCA’s Consumer Duty affect the car hire and replacement vehicle market?

CFC’s Beattie on the pitfalls of following tech buzz

View from the Top: George Beattie, head of innovation at CFC, warns the industry is in danger of focusing too strongly on headline grabbing technology rather than the business and customer outcomes it can deliver.

Almost all claims handlers believe AI is creating fraudulent claims

94% of UK insurance claims handlers believe at least 5% of claims are being fraudulently created or altered using artificial intelligence.

Leveraging specialist talent to support specialty insurers

Shaun Geils, global head of insurance at IQ-EQ, examines how traditional insurers can capitalise on lay-offs in the technology sector.

Spotlight: Why insurance can’t afford to ignore RegTech

With growing regulatory demands, Zoë Parsons, marketing manager of REG Technologies, points out that RegTech is increasingly a necessity rather than a luxury for insurers.

How to be a Lemonade-like insurtech

How to go from being a smart start-up to a large-scale insurtech player is the topic of Insurance Post Top Tips video starring Melissa Collett, CEO of Insurtech UK.

Seven out of 10 underwriters fear AI will take their job

Research from Hyperexponential has revealed that 69% of underwriters are concerned about being replaced by artificial intelligence in the next five years.