Personal

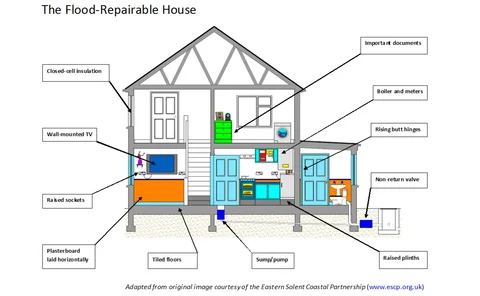

Blog: The 130 missed opportunities to make a flooded home resilient

Many opportunities are missed to make properties flood-resilient instead of just repairing them, write Dr Jessica Lamond and Dr Rotimi Joseph, respectively associate professor and visiting fellow at the University of the West of England Bristol. They…

Whiplash fraudster given two month prison sentence

A whiplash fraudster has been handed a two month prison sentence and been ordered to pay £14,000 in costs.

68% of homeowners think it’s acceptable to omit application information

Over half of UK homeowners believe it is acceptable to omit or adjust information in their application to keep their insurance premiums low, according to survey findings.

Insurers could face claims worth millions following British Steel Pensions Scheme transfers

Insurers could face millions of pounds worth of professional indemnity claims arising from negligent financial advice given to those transferring out of the British Steel Pensions Scheme last year.

Insurers to fund personal injury IT gateway

Exclusive: The government has accepted an offer in principle from the insurance industry to fund a new IT gateway to allow litigants in person access to the claims portal.

Saga appoints Patrick O’Sullivan as chairman

Saga has appointed Patrick O’Sullivan as chairman with effect from 1 May 2018.

Spotlight on ADAS: Why ADAS is not a fit and forget system

With more Advanced Driver Assistance Systems being installed on cars, Alistair Carlton, technical manager at National Windscreens, says insurers shouldn't underestimate the demand for ADAS calibration.

Spotlight on ADAS: Is everyone ready for ADAS?

As assistance systems are making cars safer, but also more costly to repair, insurers would love a database listing which features are fitted on which vehicles - but motor manufacturers aren’t sharing that information yet

Hiscox found not guilty in ICO criminal prosecution

Hiscox has been found not guilty of breaching the Data Protection Act in a court case brought against it by the Information Commissioner’s Office.

Blog: Mystery deepens as founder and funder of peer-to-peer insurtech Hey Guevara deny knowledge of relaunch

You can never keep a good revolutionary down.

Cigna Insurance Services pulls out of travel market

Exclusive: Cigna Insurance Services has pulled out of the travel insurance market.

Blog: Escape of water claims must be investigated to stop rising cost

Insurers want to tackle the rising costs of escape of water claims but not enough are investigated to detect fraud or identify third-party liability, argues John Gow, operations manager and senior investigator, IFIC Forensics.

Six out of 10 opposed to fixed costs on NHS negligence cases

Six out of 10n respondents believe that government plans to cap clinical negligence claims against the NHS are a bad idea, according to a consultation paper.

Axa's Evan Waks on getting post-Brexit certainty

As UK insurers wonder how to continue trading in European Union countries after Brexit, Evan Waks, chief risk officer at Axa UK, argues a transition period would offer much needed certainty.

Blog: Need a new CEO? You could do worse than look at your claims manager

Roll back six years and I remember David Williams, on taking a new role as director of underwriting at Axa, calling for parity in remuneration between claims professionals and others.

Ageas's François-Xavier Boisseau on fake pricing scandals

Insurers do not quote racist premiums, writes François-Xavier Boisseau, CEO insurance at Ageas UK, urging the sector to better educate the public on how pricing works.

Whiplash reforms could come in April next year

The government will implement its personal injury reforms in April next year, sources have said.

Insurtech Policy Castle seeks £1m in investment as it looks to grow

Insurtech start-up Policy Castle has become the latest venture to seek funding, with a stated ambition to raise £1m.

Emerging Asia fastest growing GI market in 2018

Emerging Asia is set to remain the world’s fastest growing general insurance market in 2018.

Blog: Personal and cyber - connecting the dots

James Tucker, smart technology manager at Allianz, explains why insurers should consider creating an all-encompassing personal cyber cover.

Interview: Charlotte Halkett and Darius Medora, Buzzvault Insurance

Charlotte Halkett, one of the founding members of Insure the Box, caused waves when she moved to launch an insurance business of a removals booking firm Buzz Move in September last year.

Insurtech start-up Homelyfe offers household product that can be bought in 85 seconds

An insurtech start-up has today launched an app enabled home and contents product that can be bought as quickly as 85 seconds.

Ghost brokers defraud public of £631,000 over three years

Ghost brokers have defrauded the public of £631,000 over the past three years.

Driverless car data access a 'big priority' for ABI

Insurers need to have access to the accident data produced by connected cars, a conference heard.