Personal

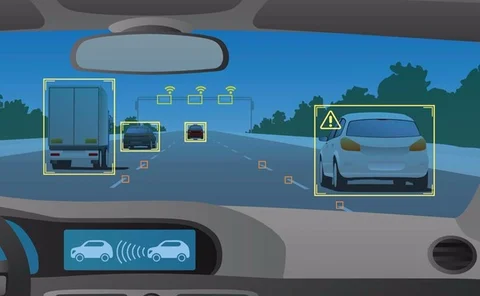

Driverless car data access a 'big priority' for ABI

Insurers need to have access to the accident data produced by connected cars, a conference heard.

MIB could help OEMs share accident data with insurers

The Motor Insurers’ Bureau could act as a platform for car manufacturers to share with insurers accident data generated by autonomous vehicles, a conference heard.

Axa's Williams warns motor insurers against becoming obsolete

Motor insurance is going to be "massively impacted” by the advent of autonomous vehicles, a senior Axa executive has warned.

Volvo to launch autonomous cars in 2021

Volvo is “fairly confident” it can start selling autonomous vehicles to individual drivers in 2021, a conference heard.

Editor's comment: An explosive start to the year

I started this year in style watching the fireworks over Sleeping Beauty’s castle at Disneyland Paris. Looking at January’s headlines the insurance industry has also started this year with a bang.

Interview: ABC Investors - Bunker, Cassidy, Castle, Horton and O’Roarke

With their restrictive covenants expiring at the end of 2017, the former LV general insurance management are now free to re-enter the market. Jonathan Swift speaks to the quintet about their new consortium ABC Investors, digital innovation and what it…

Liverpool fire response 'sets a dangerous precedent', says Axa's Blanc

Exclusive: Insurers who have waived the excess of policyholders affected by the Liverpool car park fire are setting "a dangerous precedent”, Axa UK and Ireland CEO Amanda Blanc has said.

Brokers informed: Real world threats demand bespoke solutions

High-net-worth individuals may be concerned by online threats, but it’s physical attacks that worry them most. Tara Parchment, Chubb’s head of European personal risk services, analyses the numbers.

Brokers informed: The perils of escape of water claims for HNW clients

Escape of water claims are reaching an all-time high and the risk can be even more prevalent in the high-net-worth sector. From bespoke wet rooms to expensive technology, with homeowners away for extended periods, the damage can prove complex and…

Clyde & Co pilots online personal injury arbitration platform

Clyde & Co is piloting an online arbitration system for personal injury claims.

LV's Martin Milliner on delivering the insurance promise

Some insurers waited until their policyholders' frustration made the headlines to give some comfort after the Liverpool car park fire, regrets Martin Milliner, director of claims at LV, urging the profession to deliver on its promises in order to build…

Ten insurtech start-ups to watch in 2018 - part two

Today we feature a second quartet of businesses with their eye on the disruption prize, all of which will be worth watching out for as the year progresses.

Ten insurtech start-ups to watch in 2018 - part one

There does not appear to be any slowdown in the number of insurtech start-ups that are aiming to mark their mark on the insurance sector.

Connected cars pose terror risk, conference hears

Connected cars are vulnerable to hacking and therefore pose a terror risk, a conference in Budapest heard.

Blog: Brexit could leave motor insurers without room for manoeuvre

British drivers who have a car accident in the European Union can currently seek redress through UK courts but Brexit could change that. Mark Hemsted, partner at Clyde & Co, lists the points to keep an eye on.

BGL’s Stuart Walters on exempting underwriting from GDPR consent requirements

The insurance industry needs to push for amendments to the Data Protection Bill, argues Stuart Walters, chief information officer at BGL Group.

Government call for evidence on holiday sickness claims closes

The Civil Procedure Rule Committee's call for evidence on holiday sickness claims closes today.

Analysis: Employee benefits: Perking up at work

Insurers are investing in employee benefits as a way to recruit and retain staff - and they go beyond the core elements of pension, life and health cover to sometimes include quirky perks

Justice Select Committee needs to prove its mettle over personal injury reforms

As the Justice Select Committee prepares to hear oral evidence about the government's personal injury proposals, Carpenters director Donna Scully bemoans the unrepresentative makeup of those giving evidence at a time when those in power need to be held…

Legal Update: What insurers need to know about harassment claims

As the number of harassment claims increases, insurers should consider whether they're best covered under general liability policies or specialist employment policies, recommends Joe McManus, partner at Kennedys.

Ageas and Tesco Bank in U-turn over Liverpool car park fire

Ageas and Tesco Bank have said they will refund any excesses paid by car-owners in relation to the Liverpool car park fire, amid widespread anger from customers.

Updated: Insurers slammed over Liverpool fire response

Insurance companies have been slammed by motorists for their response to the Liverpool car park blaze.

UK's first sharia-compliant home insurance launches

The UK’s first sharia-compliant home and landlord insurance has been launched by Insure Halal.

Editor's comment: Will Amazon give a little or take a lot?

I’m a big fan of Amazon. Although I’m not a Millennial, I’m used to getting the products I want delivered to where I want, when I want, without too much fuss.