Claims

Diary of an Insurer: Admiral’s Danielle Jones

Danielle Jones, social purpose leader at Admiral, is adding to the social impact team, takes part in a terrarium-making session and is inspired by Freddie Flintoff’s Field of Dreams show.

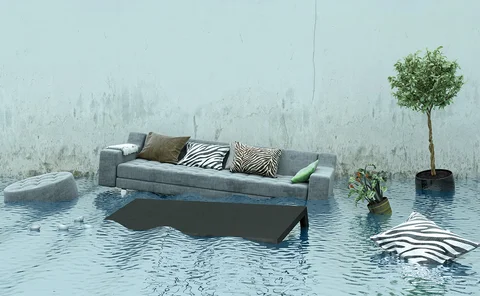

Labour’s building ambitions fail to factor in insurance

The government’s overhaul of the planning system to accelerate housebuilding and deliver 1.5 million homes over this parliament has been slated by insurers for failing to consider flood risk.

Aviva and Acturis partner to simplify claims process

Aviva has launched its application programming interface with Acturis, designed to streamline the claims process for brokers.

Why I’m dreaming of subsidence this Christmas

Editor’s View: Rather than our days being merry and bright, this Christmas looks set to be wet and windy rather than white, causing Emma Ann Hughes to dream of subsidence rather than snowman building this December.

Spotlight: Buildings underinsurance – a hybrid solution?

The issue of underinsurance has created a dynamic landscape of both opportunity and challenge in the field of buildings insurance valuations. Johnny Thomson explains how the current period calls for innovative solutions that align with technological…

Transformative power of sport for those with life-changing injuries

The Paralympics serves as a reminder there is a real person at the end of every claim, with Kate Duffy, partner at Clyde & Co, pointing out insurers have a duty to support initiatives which aid the rehabilitation process.

Spotlight: Buildings underinsurance – what can be done?

While tackling underinsurance can lead to greater levels of trust between an insurer and the policyholder, failure to take action can have significant downsides including reputational damage and even legal action, writes Tim Evershed

Spotlight: Why buildings underinsurance is bad for business

Based on current statistics, the insurance industry has some way to go in tackling buildings underinsurance. But for brokers that make a concerted effort to address this issue, client loyalty is a potential reward that cannot be ignored, as Tim Evershed…

Ireland construction trends: Industry report

HSB's report considers the key trends that are influencing Ireland’s construction market prospects and impacting construction insurance risks, from the small tool theft epidemic to the modern technologies which could enable the high demand for…

Insurance claims process automation: Three areas to automate

New and advanced technologies are paving the way for smoother, more efficient claims handling. Claims processing automation can streamline routine tasks, reduce risk of errors, and enhance customer satisfaction.

Policy Expert reveals lessons learnt after customer complaints

Steve Hardy, CEO of Policy Expert, outlines the changes it made following issues with the claim of a dissatisfied customer who then went on to create an action group.

Lying motor claims lawyer lands in legal labyrinth

HF and Admiral have secured a finding of fundamental dishonesty against a lawyer who lied about injuries following several road traffic accidents.

McLarens warns cash-strapped councils against self-insuring social housing

As the crisis in social housing continues, Gordon Winstanley, public sector lead at McLarens, observes local authorities are looking to reduce their insurance spend but he warns this is not without risks.

Lord Chancellor announces UK-consistent Ogden rate

Lord Chancellor Shabana Mahmood has announced her intention to increase the personal injury discount rate to 0.5% from -0.25%, in line with Scotland and Northern Ireland.

Industry demands small claims limit increase

Several figures in the insurance industry have urged the government to increase the small claims track limit.

Storm Bert shows insurers must demand building rules change

Editor’s View: If you want to know why people recoil, rather than embrace you, when you say you work in insurance, Emma Ann Hughes recommends you type into Google: ‘What does the insurance industry need to do about the growing number of named storms?’

Axa accused of threatening to pull cover from brain injury victim

Axa Partners reportedly insisted that a woman suffering from multiple brain injuries must be repatriated against the advice of her doctors, or face losing her travel insurance coverage.

Inspecting and impressing in the gadget insurance market

Ahead of Black Friday (29 November) the latest Insurance Post Podcast explains how gadget insurers are increasingly looking at the way devices are used rather than the likelihood of the component parts ceasing to work when it comes to underwriting and…

Sign up to watch Ageas, Esure and Zurich discuss AI in claims automation

There has been a lot of talk about straight through processing when it comes to claims.

Average cost of lithium battery fire claims hits £50k

The average cost of fire-related home insurance claims involving lithium batteries has hit £50,000, according to data from Allianz.

Axa triumphs over Google-spoofing advertiser

Keoghs and Axa have thwarted an attempt by a credit hire organisation to claim unrecovered hire charges from a consumer who was the victim of Google-spoofing fraud.

Jingle bells and legal spells: Navigating Christmas laws

With the increased usage of social media, people’s behaviour at any work-related party can be posted to a global audience in seconds.

Sticking to the rules is key to OIC success

Shirley Woolham, CEO of Minster Law, reflects on what the legal and insurance profession needs to do to ensure the Official Injury Claims portal delivers for claimants.

Diary of an Insurer: MS Amlin's Kate Bandhu

Kate Bandhu, head of casualty claims at MS Amlin, stays connected with accounts, looks to expand the use of robots to new areas, and finds the best interactions are face-to-face.