Social media

FCA outlines insurance regulation plans

The Financial Conduct Authority has promised to improve access to insurance, scrutinise claims handling, get to grips with artificial intelligence and cyber risks, plus slash red tape over the year ahead.

How is the fight against ghost brokers evolving?

Following a 52% increase in ghost broking in 2024, Tom Luckham explores how the fight against fraudulent insurance policies and their facilitators is changing.

The camper van and motorhome insurance risks we never saw coming

The world of motorhoming has rapidly evolved since Comfort Insurance started 1995. Here It highlights some of the surprising risks the provider didn’t see coming, showing the evolving nature of risks and the need to always be looking ahead.

Winners of British Insurance Technology Awards 2025 revealed

The winners of the second British Insurance Technology Awards were unveiled last night (23 September) at a The Brewery in London.

Experts weigh up AI threats and opportunities within fraud

At Insurance Post’s Claims and Underwriting Clubs last week, experts discussed how fraudsters are increasingly exploiting artificial intelligence while insurers are also using the technology to fight back.

Aviva’s DLG takeover: Why social media can’t be an afterthought

After Aviva completed its £3.7bn takeover of Direct Line, Adam Biddle, CEO of marketing agency Gh0st, explores why social media visibility is critical when financial brands merge.

Insurance push needed to tackle women’s rugby online abuse

Imogen Mitchell-Webb, head of sport at law firm HF, has called on insurers and brokers to assist in curbing the prominence of online abuse in women’s rugby.

Big Interview: Helen Sanson, CEO of The Insurance Charity

Helen Sanson, the new CEO of The Insurance Charity, is on a mission to modernise the 122-year-old institution, expand its reach across the sector, and make sure her organisation helps more workers in the industry overcome hardship.

MBC’s Clear rebrand; MS Amlin’s simplification; CFC chief tech officer

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

British Insurance Technology Awards 2025 shortlist revealed

Insurance Post can reveal the businesses and individuals who have been shortlisted for the 2025 British Insurance Technology Awards.

Rebranding LV and RSA in a fragmented media world

Editor’s View: As RSA becomes Intact and LV’s GI arm transforms into Allianz, Emma Ann Hughes considers the challenges that insurers face when trying to gain brand recognition without the old certainties of mass media.

Ifed cracks down on ghost broking amid 52% increase

The City of London Police’s Insurance Fraud Enforcement Department has led several operations targeting illegal ghost brokers, amid a 52% increase in the practice.

Donald Trump and Elon Musk

Donald Trump’s re-election as US president, with Elon Musk as his right-hand man, created many challenges for the UK insurance industry.

Gibson, Johnson and Malik... do we read too much into parting words?

Content Director’s View: With a trio of senior claims managers moving on in recent weeks, Jonathan Swift reflects on whether they were given enough due praise, and as a consequence did their outgoing employers open themselves up to people reading too…

Is ‘cancel culture’ creeping into insurance?

Following the launch of the UK’s first ‘cancel culture’ insurance product, Tom Luckham explores the effect that ‘culture war’ is having on the insurance industry.

Penny Black’s Social Diary: Allianz’s dancing; Insurtech stands

Penny Black is back, sharing the tittle-tattle she overheard at insurance industry events, reviewing the quality of buffets at conferences and giving a thumbs up – or down – to the sector’s social media posts.

Income protection gap opens door to fraud

Fraud Spotlight: An uncertain employment market and insufficient policy cover could spur a rise in fraudulent income protection claims.

MP says social media firms in ‘last chance saloon’ over ad spoofing

Both social media firms and insurance companies must do more to tackle ghost broking, Luke Charters, MP for York South told the Association of British Insurers’ fraud conference.

Why we need women’s networks now more than ever

Editor’s View: The insurance industry needs women’s networks now more than ever, Emma Ann Hughes argues, especially given the popularity of the likes of online influencer Andrew Tate and US President Donald Trump.

Over one in four businesses impacted by protests and civil unrest

More than one in four UK businesses were impacted by civil unrest last year, according to research from Gallagher.

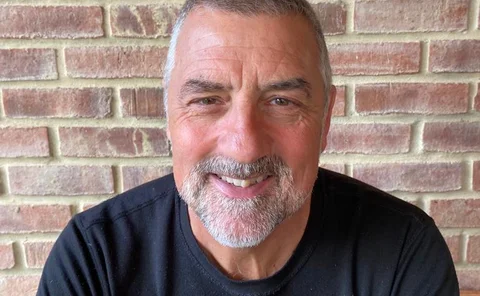

Big Interview: Steve Tooze, Extinction Rebellion

Steve Tooze, spokesperson for climate pressure group Extinction Rebellion, tells Damisola Sulaiman about the group’s motivations for targeting the insurance industry, responds to questions from the companies his organisation has targeted and shares plans…