Analysis: The future of pricing – Data and technology

Insurers are coming under increasing pressure to develop new ways of pricing. But, while data and technology hold the key, insurers face some significant challenges as they move to this brave new world.

The need to evolve is being driven by a number of different factors. For starters, there’s financial pressure, exacerbated by the longest soft market in history. “There’s too much capacity across the market,” says Mohammad Khan, partner and head of general insurance at PWC. “When prices are flat or reducing, insurers must find ways to make money.”

Regulatory interest is also driving change, with the Financial Conduct Authority making customer outcomes the focus of insurance businesses. Further impetus was added to this following last year’s super-complaint from Citizens Advice regarding pricing practices and penalties for disengaged consumers.

Consumers want something different too. Paul Ridge, head of insurance at Sas UK & Ireland, says that while it’s been the norm to take out a 12-month policy and renew each and every year, this is rapidly becoming out-of-date. “The new demographics, the millennials and generation Z, are less likely to own a car or a home so they want a different insurance proposition,” he explains. “Insurers have to consider how they should adapt to deliver the products their customers want and remain competitive in this market.”

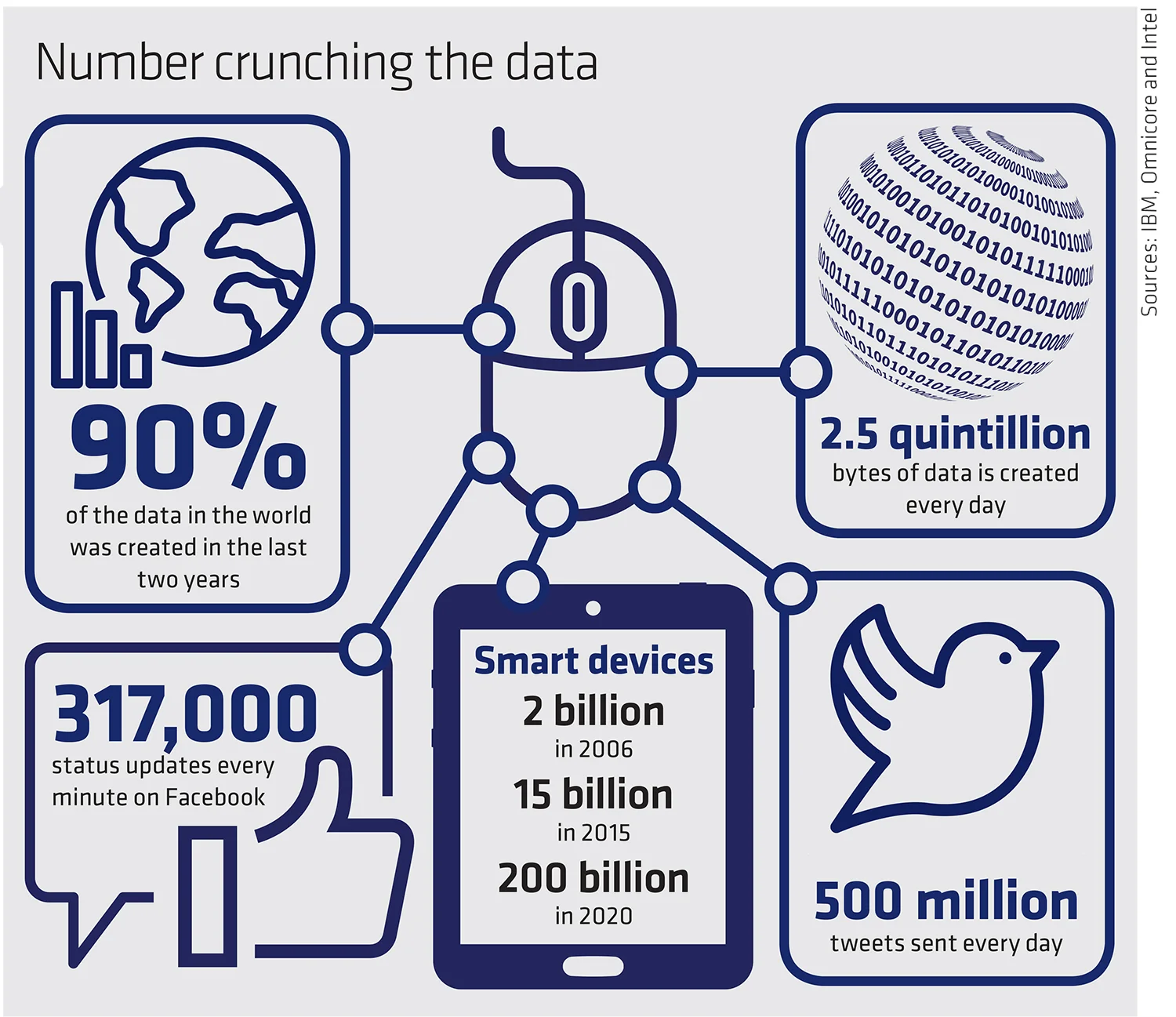

Fortunately, advances in both technology and the amount of data that is readily available give insurers a means to respond to these pressures. Overcoming the challenges this transition brings will be essential.

Data opportunities

Around 2.5 quintillion bytes of data are created every day according to IBM but, while much of this will be irrelevant, insurers are already able to use more information to gain insight into risk. As an example, Neil Clutterbuck, chief underwriting officer at Allianz, points to the 160 different data sources the government recently opened up. “These data sources present opportunities to an insurer, especially if you’re able to find correlation to the performance of the business.”

This data enrichment exercise enables insurers to price more accurately while also enhancing the customer experience. For example, rather than ask a property owner how far their building is from a river, this information can be gleaned from a satellite image of the area.

But this is very much the beginning of the data journey. As well as tapping into other data sources, the Internet of Things will provide a constant stream of data that could be used to enhance the way insurers operate. To illustrate this, Khan points to the cargo market where some of the manufacturers of containers are fitting them with transmitters. “This data enables an insurer to gain a much better understanding of the risk,” he explains. “They can see exactly where the cargo is and, if it’s lost, knowing where and when this happened will help with future pricing. Having this data also means they can pay a claim, without the policyholder even needing to report it.”

Know your source

But the availability of more data isn’t automatically a green light to pricing improvements. Insurers need to be careful about which data they decide to use.

Inappropriate use of data can cause serious reputational issues. Tony Sault, UK general insurance market lead at EY, says there’s a thin line between using data to benefit the customer and being seen as snooping on them. “Insurers need to be aware of the ethical issues around using customer data,” he explains, pointing at one insurer that, following backlash from customers, was forced to stop using data from Facebook to price business. “Consumers don’t realise how open this data is but, while they’re happy for insurers to use it to catch fraudsters, they do regard it as for their own personal use.”

The introduction of the General Data Protection Regulation has added to this reputational risk too. Ridge says that the regulations make people more sensitive about how their data is used. “Insurers must have processes in place around how they manage customer data,” he says. “It’s forcing insurers to be more transparent about what data they hold.”

As well as open data and information already held by insurers, it’s also possible to buy proprietary data sets. These can turbocharge the insight an insurer is able to get on a risk, but Iqbal Bhamani, UK general insurance analytics lead at EY, recommends caution when introducing any new data.

Handle with care

Bhamani says there is a danger that an external data set could push an insurer to make assumptions that are no longer permitted. To illustrate this, he points to a data set containing information about consumers, including their occupation. “Stating your occupation is housewife is a proxy for gender, which insurers are not allowed to use in pricing,” he says. “This is an obvious example but the correlation might not always be immediately apparent. To avoid this, insurers must ensure data is validated and that they have strong robust governance and scenario testing in place.”

Insurers’ own data can also cause problems. Unfortunately, as insurers haven’t always had this data focus, it isn’t always guaranteed that it will be as clean as it needs to be. As an example, Kate Wells, managing director of Azur Underwriting, points to insurers’ data on properties. “The date of construction wasn’t always a rating factor so insurers sometimes went for a blanket date such as 1900. This will need to be cleaned up.”

Even where data is clean, insurers can also face challenges using the data they have. Wells says that historically systems have built up around financial reporting requirements, leaving insurers with data silos for claims, underwriting and so on. “Bringing it together can be hard, especially where they want to integrate it with new, potentially unstructured data,” she adds. “Having the right platforms will be essential, to support operations now and in the future.”

Less is more – using data to deliver pricing insight

With a relatively short history and a reliance on large amounts of data for pricing, cyber insurance is a class of business where new initiatives can be explored.

Doing just this, CFC launched a cyber insurance platform in June, enabling brokers to write business for SME clients. It requires brokers to provide just one simple piece of information – the SME’s website address – to generate a cyber insurance quote. “We can access hundreds of data points from the website address,” explains Andy Holmes, chief underwriting officer at CFC Underwriting. “These include everything from who hosts the website and the company’s email provider through to their cyber vulnerabilities and even which credentials have been stolen already.”

To be able to do this, it built a database that contains a wide variety of different sources of information that can inform pricing and selection. Holmes says that taking this approach improves the quality of the underwriting as well as the customer experience. “Everyone knows their website address so this avoids any guesswork or defensive conversations with clients,” he explains. “It also means we have an in-depth understanding of our insureds, which can feed into risk management.”

As an example, if Holmes is aware that criminals are targeting a particular type of business or technology, he can identify those insureds at risk and help them avoid a loss.

Technological transparency

The technology insurers deploy can also help them improve pricing and gain a competitive edge, with machine learning and artificial intelligence widely touted as the way forward. But, while these technologies can enhance data enrichment, they need to be carefully managed.

Left unchecked, unintended biases can creep in, distorting a pricing model, excluding customers and attracting unwanted regulatory interest. “It’s essential that insurers understand exactly what’s going on,” says Khan. “Where there’s an algorithm they don’t understand, there’s a conduct issue.”

This oversight must go beyond setting up the algorithm too. Ridge explains: “Algorithms are only right at a set point and can degrade over time or if they are presented with a different population. Insurers need to monitor any model they write and ensure it doesn’t change.”

As well as ensuring they stay within the FCA rules, this approach is also important for keeping the Information Commissioner’s Office on side. Article 22 of the GDPR gives specific rights to individuals with regard to automated decision-making and profiling. “For those insurers seeking to deploy AI in their business model, they must ensure the decision-making process is not solely automated and that there is some human intervention in the process,” says Mark Deem, partner at legal firm Cooley. “The insurer can’t simply abdicate responsibility: it retains accountability throughout and needs to understand what’s happening with the technology.”

Attracting talent

This brave new world also requires brave new talent. “Pricing teams are evolving,” says Bhamani. “It used to be the domain of the actuary but they’ve now been joined by data scientists and data engineers.”

Although the relationship between these disciplines was uneasy initially, he says that it has become much more friendly in the last couple of years. “Four years ago, actuaries would regard data science as a threat or competition but this has softened and they’re happy to work together now or to develop their own skills in this area,” he explains.

While the new data disciplines may have been accepted within pricing, insurers face challenges attracting this talent. “Data scientists and data engineers are in demand and insurers will find themselves competing against other sectors for this talent,” says Ridge. “They will need to create the right culture to attract them.”

As well as bringing in new talent, insurers must also ensure that existing employees feel part of the mix. With more technology being implemented, and some of the traditional ways of working likely to be scrapped, insurers risk seeing staff morale plummet if they don’t take them on this journey too.

Staff development

Overseeing this is something that Clutterbuck is dealing with at Allianz, where specialist roles have been created for the automation work that is taking place. Rather than see this as a threat, he says that employees welcome the new opportunities. “We’ve run workshops to explain how the business is evolving and outline the new roles,” he adds. “Employees are excited about the opportunity to develop their skills.”

Wells agrees. She says that when she started her managing general agent she came from AIG with a team of 22 with very traditional skills. “It has been really exciting and we’ve all learnt new skills and to think differently about the way we do business,” she explains. “The transition to the new world won’t happen overnight, which is great, but insurers might want to consider a bit of a rebranding exercise to attract the right people. The culture has to be right.”

And while insurers may be grappling with everything from data cleansing to recruiting data scientists, having the right culture is widely seen as the critical component and the one that may present the greatest challenge. “Companies that are successful have a particular paradigm and way of doing things,” explains Santiago Restrepo, associate director at BDO. “The success stories of today may find it difficult to steer to this new position.”

Certainly, successfully embracing the new technologies and ways of working will require insurers to react quickly and agilely to change. Ridge says that insurers are beginning to address this. As an example, he points to the way that insurers are looking to shorten the timescale involved with developing a model. “Presently, this can take months with a variety of hand-offs that would challenge the governance piece,” he explains. “By becoming more adaptive and flexible, and ensuring there is adequate governance and customer focus around their processes, they will drive savings and deliver brands that customers really trust.”

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk