Automation

Diary of an Insurer: Geo Underwriting’s Kate Bush

Kate Bush, trading director at Geo Underwriting, is setting the digital agenda, drinking Yorkshire tea, catching up on how the lambing season is going and returning boats to water.

Diary of an Insurer: CFC's Chris Mullan

Chris Mullan, head of data and artificial intelligence at CFC, juggles deeply technical work, product delivery and the fast-moving realities of AI adoption with life as a father of five, rifle shooting and South Downs walks.

Is the profit window closing for insurance legal services?

Amid rapid regulation and technological change, deputy editor Scott McGee reviews the current state of the insurance legal sector, where the market is heading, and what firms must do to stay competitive and post a profit.

Axa builds more than 60 agentic AI tools

Axa Group is currently working on more than 60 agentic artificial intelligence use cases, according to group chief data, AI and innovation officer Andreas Schertzinger.

Is pet insurance pulling on the leash or coming to heel?

Almost six years on from the Covid-19 pandemic, Scott McGee examines how the pet insurance sector has adjusted, how premiums have evolved, why new entrants are arriving, and where the market could be heading.

Diary of an Insurer: ManyPets’ Pierre du Toit

From pre-dawn toddler wake-up calls to board prep, model diagnostics and late-night electric-cello sessions, Pierre du Toit, chief data officer at ManyPets, offers an honest, energetic snapshot of balancing data leadership with real life.

Agentic AI vision fails to match reality for two-thirds of insurance firms

Two-thirds (65%) of insurance companies admit there is a gap between their agentic artificial intelligence vision and the current reality, according to research by automation platform Camunda.

Four biggest challenges facing insurers in 2026 revealed

Insurance Post reveals the four main challenges general insurers face in 2026 and the solutions experts from EY, the International Underwriting Association, AM Best, Moody’s, S&P, KPMG, Pathlight Associates and Sicsic Advisory say will matter most in the…

MGA Forecast of 2026

Entering 2026, MGA chiefs feel the sector is in a strong yet testing position buoyed by technology, specialism and capacity support, but facing a softening market that will reward those combining underwriting discipline, data-driven innovation and…

Claims and Legal Forecast of 2026

The claims and legal sectors stand on the cusp of transformation as we hurtle towards 2026, facing policy reform, accelerating innovation and rising customer expectations in the year ahead.

Insurtech forecast for 2026

Insurtech sector leaders expect to stand stronger, smarter and more pragmatic than ever in 2026 by shifting from experimentation to execution, embedding artificial intelligence at scale, strengthening data foundations and proving their value through real…

MGAs Review of the Year 2025

2025 was a landmark year for MGAs, marked by record growth, major partnerships, technological innovation and expanding global reach, even as soft market conditions and pricing pressures tested resilience across the sector.

Insurers Review of the Year 2025

Insurers managed to post profits amid a softening market in 2025, invested in technology and pushed to reaffirm the industry’s vital role in protecting society with the Labour government and regulators.

Claims & Legal Review of the Year 2025

From artificial intelligence-driven efficiencies and people-focused service to global expansion, 2025 saw claims and legal sector leaders raise their game when it comes to settling claims.

Insurtech Review of the Year 2025

Insurtechs came of age in 2025, shifting from disruption to deep integration, proving artificial intelligences real-world value, expanding globally, and cementing their role as essential partners driving insurance innovation and modernisation.

A Christmas Carol for insurance’s digital dilemmas

Editor’s View: Insurers to confront the ghosts of past technology missteps in order to claim a more connected, brighter future, according to Emma Ann Hughes who is under the influence of Charles Dickens this Christmas.

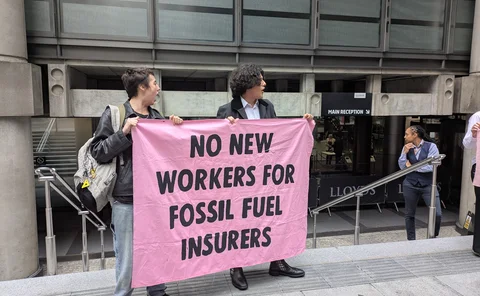

Climate activists disrupt S&P insurance conference

Climate change protesters disrupted S&P Global Ratings’ European Insurance Conference in London this afternoon (20 November), forcing multiple pauses to the programme.

Asia Pacific Insurance Technology Awards winners revealed

Insurance Post is delighted to announce the winners of the 2025 Asia Pacific Insurance Technology Awards.

Spotlight: Shifting fraud detection to the point of application

Financial pressures and new technology are boosting fraudulent activity to ever-higher levels. This spotlight highlights why application and identity fraud have become the fastest-growing and most challenging threats to detect, and how insurers can…

Spotlight: From siloed fraud teams to shared intelligence

Combating fraud in today’s environment demands both cutting-edge technology and a collaborative approach to stay one step ahead of increasingly sophisticated criminals. This spotlight sheds light on how underwriting, claims and fraud-prevention teams can…

Axa CIO reveals ROI on AI

Artificial intelligence has resulted in a significant uptick in the number of customers Axa retains, according to the insurer’s chief information officer Natasha Davydova.