Automation

Is the profit window closing for insurance legal services?

Amid rapid regulation and technological change, deputy editor Scott McGee reviews the current state of the insurance legal sector, where the market is heading, and what firms must do to stay competitive and post a profit.

Agentic AI vision fails to match reality for two-thirds of insurance firms

Two-thirds (65%) of insurance companies admit there is a gap between their agentic artificial intelligence vision and the current reality, according to research by automation platform Camunda.

Four biggest challenges facing insurers in 2026 revealed

Insurance Post reveals the four main challenges general insurers face in 2026 and the solutions experts from EY, the International Underwriting Association, AM Best, Moody’s, S&P, KPMG, Pathlight Associates and Sicsic Advisory say will matter most in the…

MGA Forecast of 2026

Entering 2026, MGA chiefs feel the sector is in a strong yet testing position buoyed by technology, specialism and capacity support, but facing a softening market that will reward those combining underwriting discipline, data-driven innovation and…

Claims and Legal Forecast of 2026

The claims and legal sectors stand on the cusp of transformation as we hurtle towards 2026, facing policy reform, accelerating innovation and rising customer expectations in the year ahead.

Insurtech forecast for 2026

Insurtech sector leaders expect to stand stronger, smarter and more pragmatic than ever in 2026 by shifting from experimentation to execution, embedding artificial intelligence at scale, strengthening data foundations and proving their value through real…

MGAs Review of the Year 2025

2025 was a landmark year for MGAs, marked by record growth, major partnerships, technological innovation and expanding global reach, even as soft market conditions and pricing pressures tested resilience across the sector.

Insurers Review of the Year 2025

Insurers managed to post profits amid a softening market in 2025, invested in technology and pushed to reaffirm the industry’s vital role in protecting society with the Labour government and regulators.

Claims & Legal Review of the Year 2025

From artificial intelligence-driven efficiencies and people-focused service to global expansion, 2025 saw claims and legal sector leaders raise their game when it comes to settling claims.

Insurtech Review of the Year 2025

Insurtechs came of age in 2025, shifting from disruption to deep integration, proving artificial intelligences real-world value, expanding globally, and cementing their role as essential partners driving insurance innovation and modernisation.

A Christmas Carol for insurance’s digital dilemmas

Editor’s View: Insurers to confront the ghosts of past technology missteps in order to claim a more connected, brighter future, according to Emma Ann Hughes who is under the influence of Charles Dickens this Christmas.

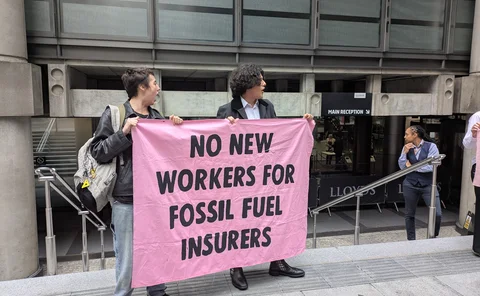

Climate activists disrupt S&P insurance conference

Climate change protesters disrupted S&P Global Ratings’ European Insurance Conference in London this afternoon (20 November), forcing multiple pauses to the programme.

Asia Pacific Insurance Technology Awards winners revealed

Insurance Post is delighted to announce the winners of the 2025 Asia Pacific Insurance Technology Awards.

Spotlight: Shifting fraud detection to the point of application

Financial pressures and new technology are boosting fraudulent activity to ever-higher levels. This spotlight highlights why application and identity fraud have become the fastest-growing and most challenging threats to detect, and how insurers can…

Spotlight: From siloed fraud teams to shared intelligence

Combating fraud in today’s environment demands both cutting-edge technology and a collaborative approach to stay one step ahead of increasingly sophisticated criminals. This spotlight sheds light on how underwriting, claims and fraud-prevention teams can…

Axa CIO reveals ROI on AI

Artificial intelligence has resulted in a significant uptick in the number of customers Axa retains, according to the insurer’s chief information officer Natasha Davydova.

Allianz to re-platform commercial products over next two years

Allianz Commercial is in the process of moving all its products over to a new platform, chief distribution officer Nick Hobbs has told Insurance Post.

Ex-Esure CEO warns of seismic shift from autonomous cars

David McMillan, former CEO of Esure, has warned that the rise of manufacturer-led insurance and self-driving technology could drastically shrink the UK’s £20bn personal motor market within a decade.

Insurers ‘shouldn’t have to wait’ to start automating

The take-up of AI and automation processes could be lessening insurers’ focus on complex digital transformation, according to Sasha Haco, CEO of Unitary.

Top 100 UK Insurers 2025: Allianz

Allianz is ranked tenth again in Insurance Post’s Top 100 UK Insurers list thanks to disciplined pricing, new partnerships, and digital transformation.

What will impact UK motor moving forward?

Given predictions of the UK motor insurance market going back into the red next year, experts have outlined the factors likely to impact performance and how the industry can mitigate those pressures.