Automation

Zurich to retrain 3000 UK staff over five years

Zurich’s analysis of its UK workforce has shown that the future impact of technology could mean 270 jobs go unfilled in the next five years if its team is not reskilled.

Brightside to put MGA Kitsune into run-off

Brightside has decided to put car and van managing general agent Kitsune into run-off less than two years after it was launched, CEO Brendan McCafferty has revealed.

Zurich’s Anita Fernqvist on embedding sustainability in organisational transformation

Anita Fernqvist, chief data officer and director of operations at Zurich UK, argues that advances in and adoption of new technology means reskilling for the future is more important than ever and looks at the opportunities and challenges for insurers.

Future Focus 2030: The Lloyd’s and London Market podcast

It is the year 2030. Following the success of 2019’s Blueprint One and 2025’s Blueprint Two [which also co-opted in the IUA and broader stakeholder representation], Lloyd’s and the wider London market is now ready for the highly anticipated third…

Future Focus 2030: The future of Lloyd’s and the London Market

As part of a monthly series, Post looks into the future at how the insurance industry might change, focusing on a specific issue. In the latest instalment David Worsfold looks at transformation of Lloyd’s and the London market in the post Covid-19 era

Sign up now for Post's Future of Insurance Work event

There is now just a fortnight to go before Insurance Post holds its Future of Insurance Work event.

Spotlight: Future of work - value your employees, your customers, and reap the benefits for your business

None of us were prepared for the Covid-19 pandemic, with few of us believing it possible, and the changes we’ve seen in society as a result may see permanent changes to the way we work and live in the future writes Paul O'Sullivan, head of commercial…

Blog: Tesla touchscreens - implications of high-tech vehicles for insurers

A German court recently fined a driver involved in a crash, ruling that the touchscreen controls used to operate the windscreen wipers should be classified as a distracting electronic device. With vehicles becoming increasingly high tech, DWF product…

ALKS cannot be classified as 'fully automated' warn insurers as driver charged in Uber case

As the driver in a fatal autonomous Uber car crash from 2018 was charged with negligent homicide, the insurance industry has warned more needs to be done before introducing Automated Lane Keeping Systems onto UK roads next year.

Allianz's Graham Gibson on using technology in claims

Graham Gibson, chief claims officer at Allianz Insurance, takes a look at how technology is bringing benefits in the claims arena

Rising Star: Alex Sorrie, Allianz Insurance

Alex Sorrie joined Allianz as a graduate after setting his sights on the financial services sector and has since led an international project working on a claims automation proof of concept.

Automated lane keeping systems advent raises insurance challenges

Insurers have welcomed the government’s consultation into the safe use of automated lane keeping systems in vehicles but warned against making the “huge leap” of believing this “clever bit of technology” is the same as an automated car.

Spotlight: Open insurance: Restoring confidence and seizing opportunities post Covid-19

The post Covid-19 insurance landscape is rapidly changing and insurers are increasingly aware that they must adjust and rethink in order to satisfy the needs of their customers and remain relevant. As a result, the pandemic may be the catalyst for…

Future Focus 2030: The future of property podcast - how IoT sensors, automation and granular data will shape the next decade

It is the year 2030. The explosion of internet of things devices has really taken hold impacting both the personal and commercial property markets.

Future Focus 2030: The future of property

As part of a monthly series, Post looks into the future at how the insurance market might change, with each part focusing on a specific issue through a 2030 lens. In the latest instalment, Jonathan Swift looks at how in 10 years new technologies from…

Future Focus 2030: The future of personal injury podcast - the pathway to reform

It is the year 2030. After a number of false starts the government finally introduced its Whiplash reforms in April 2022 following delays due to the extended impact of Brexit and Covid 19.

Future Focus 2030: The future of personal injury claims

In the second of a new monthly series, Post looks into the future at how the insurance market might change, with each part focusing on a specific issue. Jonathan Swift fast forwards a decade to look at how a new era of collaboration and ethics changed…

Spotlight: Technology: Intelligent fraud detection

The Covid-19 crisis has highlighted once again how fraudsters will use any opportunity to devise new means to make crooked money. While the insurance industry is constantly evolving to try and combat whatever the latest fraud is and is now harnessing the…

Spotlight: Technology: Maximising sales and underwriting results using a digital workforce

While data is at the core of every underwriting decision, for many insurance organisations using that data efficiently is a manual and time-consuming process

Spotlight: Technology: Managing claims surges in the digital age

Claims surges have been a frequent occurrence in recent years as events around the globe have hit insurers across multiple lines of business. The past year has seen Australian bush fires, the collapse of Thomas Cook, storms Ciara and Dennis and now the…

Future Focus 2030: The future of motor

In the first of a new monthly series, Post looks into the future at how the insurance market might change, with each part focusing on a specific issue. For the first instalment, Jonathan Swift fast forwards a decade to report on the changing face of the…

Blog: How automating arbitration can reduce insurance claims costs and complexity

Recent research from the Association of British Insurers found compensators pay out millions every day on repairs and bodily injury claims in the UK but according to Olly Savage, Minsitry of Justice data reveals they’re handling high volumes of injury…

Direct Line to cut 800 jobs

Direct Line Group is cutting 800 jobs over the next two years, the insurer has confirmed.

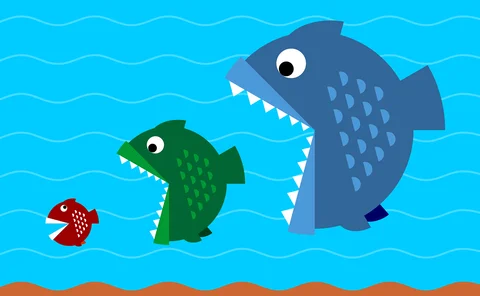

Analysis: Whiplash and insurer demand driving claims sector consolidation

Following Davies' acquisition of Keoghs further consolidation is expected in the claims sector and it could push mid-sized firms out of the picture.