Regulation

Labour unveils motor insurance taskforce to crack down on costs

Labour transport secretary Louise Haigh has promised her party’s motor insurance task force will “crack down on spiralling costs” and deliver a “fair deal” for drivers.

FCA launches premium finance market review

The Financial Conduct Authority has launched a review of the premium finance market, alongside the launch of a government motor insurance taskforce.

What insurers should expect from Labour’s Budget

The impact tax changes in Labour’s first Budget in 14 years could have on the insurance industry is the focus of the latest Insurance Post Podcast.

FCA’s Mills says Consumer Duty needn’t inhibit growth

Sheldon Mills, the Financial Conduct Authority’s executive director for consumers and competition, has insisted that the Consumer Duty is not the block to growth that some people think it is.

Why the FCA should slash red tape to save brokers

News Editor’s View: Scott McGee examines the impact of the Financial Conduct Authority’s Consumer Duty, debating whether the regulator's promise to reduce the weight of regulation is too little, too late for small brokers struggling as a result of red…

Why overseas capacity has become a concern for MGAs

Will Reddie and Bob Haken, partners at law firm HFW, explore the growing concern among managing general agents operating in the UK without capacity, which would put them in breach of regulations and runs the risk of criminal sanctions for both the…

How to meet the FCA’s expectations

Insurers need to be able to articulate the way they make money if they want to satisfy the Financial Conduct Authority, according to Michael Sicsic, founder and managing partner of Sicsic Advisory.

FCA claims Gap action will save consumers £70m

The Financial Conduct Authority has said consumers will save around £70m due to improvements firms must make to guaranteed asset protection insurance products.

Path forward after the FCA’s fair value review

After the Financial Conduct Authority’s damning thematic review into insurance products oversight and governance, DA Strategy associate director Pamela Grover-Morgan and consultant Szymon Binienda look at why firms are still falling short of expectations.

FCA remains ‘concerned’ about premium finance

The Financial Conduct Authority’s Sheldon Mills has said the regulator is still watchful and concerned about premium finance, but is encouraged that "progress has been made."

FCA responds to Sir Trevor Phillips questioning EDI delay

Financial Conduct Authority CEO Nikhil Rathi has said the Treasury Select Committee’s feedback on its diversity and inclusion proposals contributed to its decision to pause the work.

ABI’s Gurga on why the regulator should follow the Chancellor’s positive lead

Hannah Gurga, director general of the Association of British Insurers, says regulators should take note of Chancellor Rachel Reeves’s optimism at this week’s Labour Party conference.

PRA to reduce oversight of Lloyd’s managing agents

The Prudential Regulatory Authority has said that Lloyd’s managing agents will face a “lower level of supervisory interaction”, as the regulator moves to deliver on its competitiveness and growth objective.

Sir Trevor Phillips warns insurers face a ‘reckoning’

Sir Trevor Phillips, former head of the Commission for Racial Equality, has revealed that “more than any other industry,” the insurance sector needs to tackle the disparate way it treats customers.

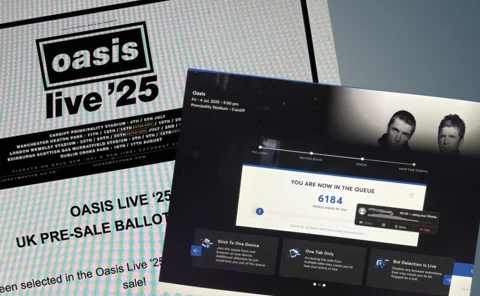

Lessons insurers should learn from Ticketmaster’s dynamic pricing

Editor’s View: Emma Ann Hughes questions whether the fallout from Ticketmaster’s dynamic pricing approach to selling Oasis tickets could have an impact on insurance premiums.

Electric vehicles and the future of motor insurance

How will the rise of electric vehicles and the FCA’s Consumer Duty affect the car hire and replacement vehicle market?

Fixed recoverable costs in low value clinical negligence claims

Pursuant to Sir Rupert Jackson’s proposals from 2017, the civil litigation landscape has recently faced imminent change vis-à-vis fixed recoverable costs, namely, the amount of legal costs that a winning party can recover from a losing party.

ABI starts allyship training after Sexism in the City

The Association of British Insurers has rolled out allyship training to its member firms in response to the Treasury Select Committee’s Sexism in the City findings.

Spotlight: Why insurance can’t afford to ignore RegTech

With growing regulatory demands, Zoë Parsons, marketing manager of REG Technologies, points out that RegTech is increasingly a necessity rather than a luxury for insurers.

CII criticises insurers’ profiting from premium finance

The Chartered Insurance Institute has questioned the ethics of making money from customers who pay monthly for insurance after Which? found several motor and home insurers were charging what the consumer watchdog called “excessively high levels of…

Spotlight: Tackling insurance’s regulatory tsunami

Waves of regulatory initiatives are driving up costs, reducing profitability and slowing down business. How can insurance firms respond to these challenges?

Spotlight: Insurance’s regulatory burden – are we to blame?

The insurance industry is under immense pressure from an increasing regulatory burden, but to what extent are firms themselves to blame for failing to adopt modern technology and processes?

Which? reveals insurer premium finance APRs

Research conducted by Which? has found that several motor and home insurers are charging what the consumer watchdog called “excessively high levels of interest on monthly payments.”

Electric vehicles and the future of motor insurance

How will the rise of electric vehicles and the FCA’s Consumer Duty affect the car hire and replacement vehicle market?