Insurance Census 2019

The demographics of Britain are changing. The population is becoming older and more diverse, with more than one-fifth over the age of 65, and a higher percentage than ever before from black, Asian and minority ethnic backgrounds living across the country. Post revisited its popular Census research to find out how closely the sector reflects the society it serves. With so much focus on diversity, gender equality and inclusion, two new areas have been included in the census: sexual harassment and mental health

Methodology

A total of 377 online respondents took part in the Post Census Survey. These employees work in 212 different companies across the UK, spanning the insurance industry from insurers, brokers and managing general agents to loss adjusters, service providers, technology and legal firms and also trade associations. Insurers and brokers were together responsible for 73% of responses, with slightly more insurers than brokers taking part. Over three-quarters of respondents completed the whole surveys while others chose to omit certain questions.

Only 14 companies decided to take part in this year’s Census, despite repeated requests and multiple opportunities to submit data. Some companies stated they did not have the time, while others explained they did not hold certain data, namely in the fields of sexuality, sexual harassment and mental health. For mental health, only three companies submitted data. Similarly, despite having received comment on all topics from several industry-leading figures and organisations, only one company chose to address the sexual harassment findings. Is it significant that sexual harassment is mostly commonly carried out by senior employers, and no senior male within insurance companies to whom key findings were sent wished to comment but instead chose to comment on other statistics?

It is important to note that where company data has been given, this is not an accurate reflection of the whole sector.

Demographics

Gender and female leadership

There appear to be fewer females holding the position of CEO or C-suite than in 2017: the number of respondents working in a company headed by a female CEO has dropped by half to just 5%, while female director roles have also decreased.

“Companies are failing themselves, women and the economy by not promoting the evident female talent in the same numbers and at the same speed as their male counterparts into senior roles. In the face of such strong economic headwinds, how can UK Plc continue to advocate the under-promotion of some of our most prestigiously qualified and talented women we have.” Lorna Fitzsimons, CEO, The Pipeline

“The sector is doing a terrible job at bring women to the top table and no doubt wasting a great deal of talent along the way. Having said that, it was always going to take a generation for real change to take place – it’s just a worry that we may be headed in the wrong direction.” Howard Lickens, CEO, Clear Insurance

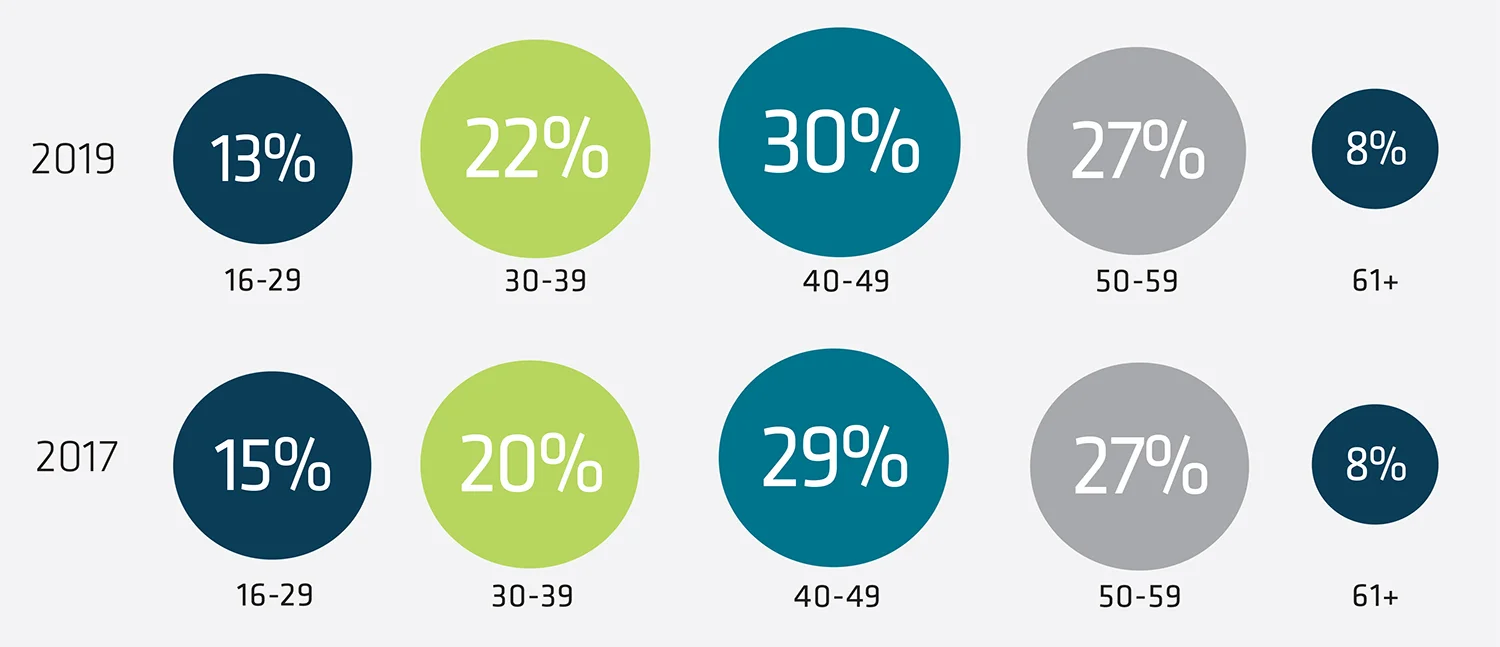

Age

The distribution of the UK insurance workforce has remained relatively constant compared with two years ago: the average age of employees remains 39.

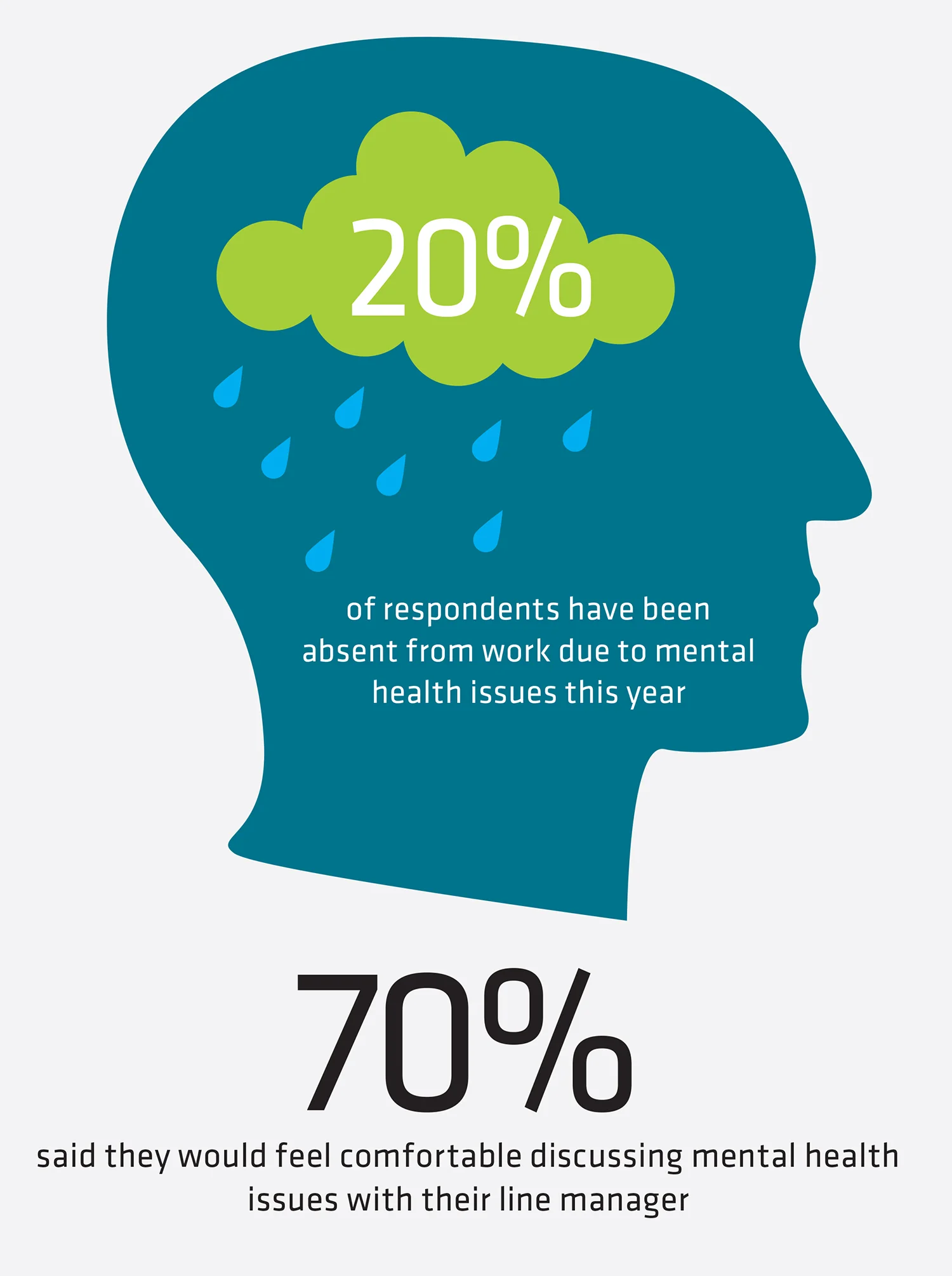

Mental health

The finance and insurance industry is responsible for the highest annual costs per employee in relation to mental health, according to research by Deloitte, ahead of public health and other public services and within insurance itself, nearly one-fifth of respondents had been absent from work due to mental health issues this year.

Government and mental health organisation figures state one in four people will suffer a mental health problem at some point in their life and last year, over half of all working days lost in the UK due to ill-health were due to stress, depression or anxiety.

“The next step for all of us as employers is to work out how to further close that gap for the other 30%. For example, we invite all line managers to receive training on how to manage mental health in the workplace.” Jost Wahlen, senior HR manager, Allianz

“The very fact that mental health was not included as a question before tells its own story. The stigma we Brits have about talking about mental health problems is slowly dissipating. How many line managers would know how to support their staff? A stress support service helps everyone in the business and ultimately makes for a healthier and more productive working environment?” Matthew Reed, managing director, Equipsme

“It’s great to see mental health included in the survey for the first time this year. Creating a supportive, positive working environment is essential to maximising performance.” Lisa Meigh, director of HR and learning, Covéa Insurance

“While it is obviously sad to learn that a quarter of respondents have been absent from work this year because of mental health issues – principally stress, depression and anxiety I imagine – we must all surely welcome the increasing willingness to acknowledge this problem.” Lord Hunt of Wirral, chairman, British Insurance Brokers’ Association

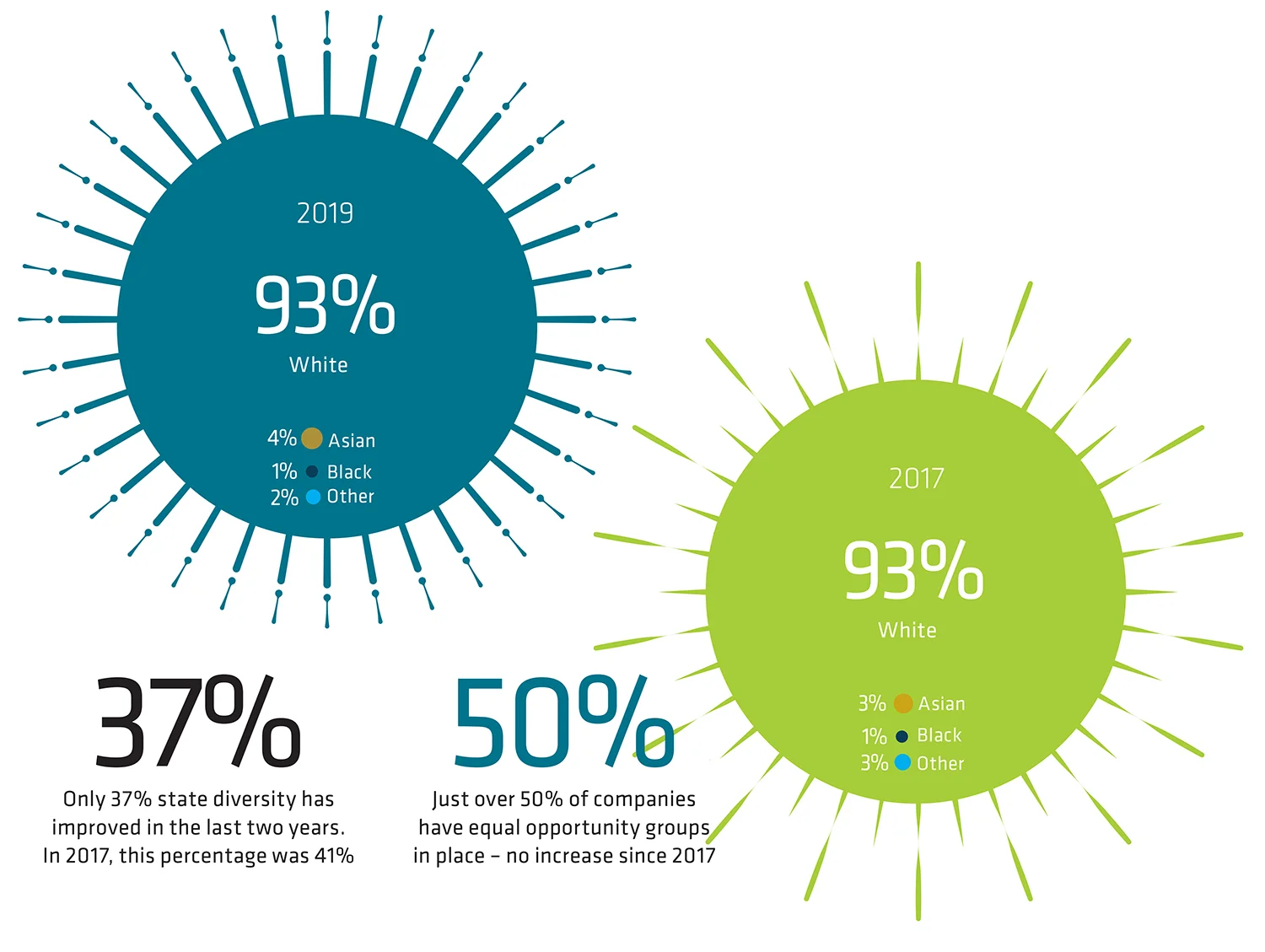

Ethnicity

Since the Insurance Census 2017, insurance has experienced a drop in its diversity figures, with fewer than two-fifths of respondents stating diversity in their company had improved in the last two years.

Asian employees have risen slightly but Just 7% are BAME employees: for the UK, government puts this figure at 15%; insurance is woefully behind the country

“To fix this takes real leadership and acceptance of the premise that inclusivity leads to better business outcomes and is the right thing to do. Cultural change takes time but the realisation has dawned.” Lisa Meigh, director of HR and learning, Covéa Insurance

“We recognise that our sector still has work to do in terms of diversity and inclusion and it is something that British Insurance Brokers’ Association is actively addressing as part of our commitment to help our members to understand the value and inclusion of diversity and inclusion.” Steve White, CEO, Biba

Sexuality

The number of people who identify as lesbian, gay or bisexual in the UK is increasing year-on-year, a stark difference to the insurance industry, where diversity of sexual orientation among employees has decreased from 7% in 2017 to 6% today.

“We need to make the industry a more attractive career choice not only for women but for members of the BAME and LGBT communities and to people with a disability. But attraction is only one side of the that retaining diverse talent through an inclusive, open and respectful culture where everyone feels comfortable is critical too. One doesn’t work without the other.” Steve Collinson, head of HR, Zurich UK

“Having an inclusive culture is essential if we’re going to attract and retain the best people within our industry and our individual businesses.” Lisa Meigh, director of HR and learning, Covéa Insurance

“I can see no good reason why this industry should not more closely reflect the society it serves – and serves so well. Let us all continue to make this industry as open and attractive as possible to all, whatever their gender identity, sexual orientation or family background.” Lord Hunt of Wirral, chairman, British Insurance Brokers’ Association

Sexual harassment

#MeToo has thrust sexual harassment into the spotlight in recent years and according to the House of Commons, 29% of UK employees have experienced some form of unwanted sexual behaviour in the workplace. Within insurance, figures are also shocking but comment from industry was lacking.

“These diversity and sexual harassment statistics are an eye-popping reminder of how the insurance industry needs to take action to improve and modernise. It is not enough to expect the industry to gradually change to reflect society. Senior executives of the UK’s insurance businesses need to be open and transparent about what they are doing to actually change the situation rather than just talk about it – there’s too much talk and too little action currently. Leaders must stand up and be counted, or risk alienating customers and potential talent.” Charlotte Halkett, managing director, insurance product, Buzzvault

Overall reaction

“These results are disappointing and serve as a stark reminder of how much work needs to be done. But we must not give up. This survey shows the challenge facing the industry to ensure that it reflects the society it serves. These latest findings should galvanise people in the industry to turn warm words into concrete action.” Huw Evans, director general, Association of British Insurers

Full census

The full report is free for premium subscribers. Contact CSqueries@infopro-digital.com

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk