Diversity

UK insurance boards slash gender pay gap to 3%

The gender pay gap on UK insurance company boards has narrowed dramatically falling from 28% in 2020 to just 3% in 2024, according to EY’s latest Financial Services Boardroom Monitor.

Lloyd’s insists diversity network funding is secure

Lloyd’s has stated funding for its inclusion and partner networks will remain unchanged for 2026 to 2027, despite recent media coverage suggesting otherwise.

Claims & Legal Review of the Year 2025

From artificial intelligence-driven efficiencies and people-focused service to global expansion, 2025 saw claims and legal sector leaders raise their game when it comes to settling claims.

Insurers boost family policies as board ethnic diversity slips

The number of providers offering family-friendly policies at the end of 2024 rose significantly compared with 2023, while board-level representation of ethnic minority groups has fallen, according to new data from the Association of British Insurers.

Big Interview: Donna Scully, Carpenters Group

Donna Scully, director and co-owner of Carpenters Group, discusses with Insurance Post the challenges of her upbringing and its positive impact in ensuring both her business and personal causes are approached with kindness.

Hidden risks in insurers’ culture and misconduct data

Insurers are under growing regulatory pressure to treat non-financial misconduct as a core conduct risk, according to Loka Venkatramana from Pathlight Associates, who says they should use cultural and behavioural data with the same rigour as financial…

Lloyd’s flags sharp decline in future female underwriting leaders

Lloyd’s is facing a shrinking pipeline of female underwriting talent, with new data revealing women remain significantly under-represented at senior levels.

Staysure enters Irish market; Rokstone’s cyber unit; Send’s CTO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Diversity & Inclusion in Insurance Award winners revealed

Tara Foley, CEO of Axa UK & Ireland, has been named Diversity & Inclusion Leader of the Year at Insurance Post’s Diversity & Inclusion in Insurance Awards 2025.

Five insurance trailblazers to celebrate on International Men’s Day

Editor’s View: Ahead of International Men’s Day on Wednesday (19 November) Emma Ann Hughes reflects on the male trailblazers who are reshaping the insurance industry by leading with empathy, allyship and action.

Diary of an Insurer: A-One’s Sarah Smith

Sarah Smith, regional operations director at A-One Insurance Group, balances strategic planning, client mentoring, team development, and community involvement all while navigating a challenging insurance market and driving growth as part of the Clear…

Culture clash: Tackling non-financial misconduct in insurance

From toxic behaviour to weak reporting systems, Rob Mason, director of regulatory intelligence at Global Relay, explains why insurers must get serious about embedding accountability and confronting misconduct head-on.

Throwback Thursday: EU shapes insurance & Allied Dunbar’s ambition

Insurance Post’s Throwback Thursday steps back in time to October 1990 to remind you what was going on this week in insurance history when the European Commission was reshaping insurance.

Culture and conduct now define leadership in insurance

The Financial Conduct Authority’s new non-financial misconduct rules make culture and conduct a core compliance issue for insurers, which Sarah Ouarbya, partner for risk and regulatory consulting at Forvis Mazars, argues will reshape expectations of…

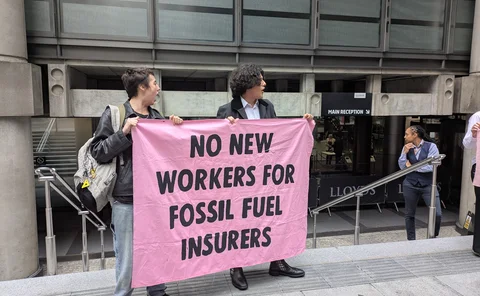

Protesters target Lloyd's careers event

Protesters have targeted the Dive Into Careers Conference at Lloyd’s today (10 October).

Big Interview: Kelly Ogley, Howden

Kelly Ogley, CEO of Howden consumer and local commercial (C&LC), talks with Scott McGee about the increasing severity of change within the motor industry, A-Plan’s transition to Howden, and after 39 years in industry, looking at leaving a legacy to be…

How the AI revolution can unlock neurodiverse insurance talent

As artificial intelligence takes the insurance industry by storm, Damisola Sulaiman analyses the unexpected benefits AI implementation can have for creating a workplace that is inclusive by design for neurodiverse employees.

Marsh’s Fort slams ‘rigid’ insurance culture stifling ethnic talent rise

Shannan Fort, international cyber product leader at Marsh, argued insurance’s “rigid” culture is the challenge preventing racial inclusion in leadership.

Hold senior management to account so social mobility goals are met

Introducing social mobility targets into senior management responsibilities was a key takeaway from a Dive In panel debate.

Protesters interrupt closing events of Dive In Festival

The plug was pulled on one of the final sessions of this year’s Dive In Festival on Thursday afternoon (18 September) after a climate change activist stepped onto the stage.

Dive In proves insurance superheroes no longer need masks

Editor’s View: Insurance once rewarded only Superman-style displays of strength, but as Emma Ann Hughes observes, this year’s Dive In shows the sector now thrives when Clark Kent qualities are embraced.