Analysis: How the industry was shamed by the gender pay gap

It was never going to go well. Even a year ahead of the results, industry figures were predicting that the industry would shame itself when the gender pay gap numbers were published.

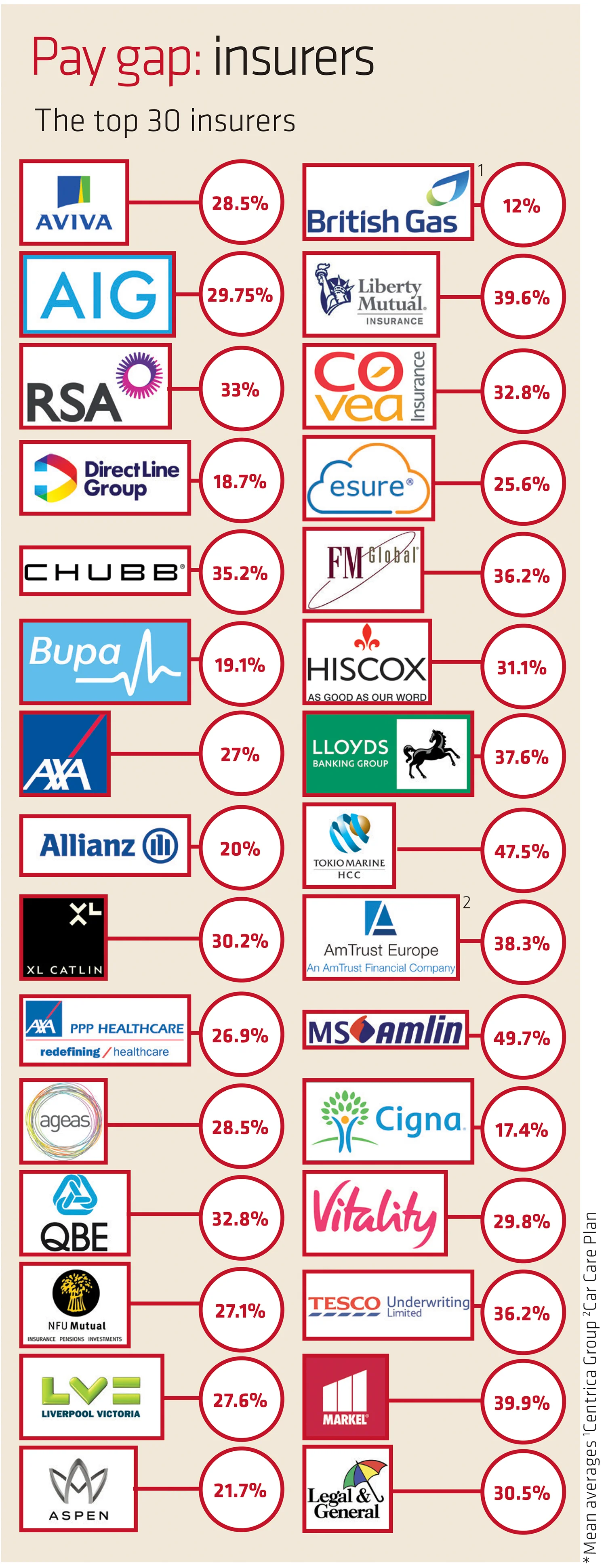

The result? The industry, and financial services more broadly, had mean averages of 25.9%, the worst of any sector. In terms of median, it was second worst behind construction at 22.1% compared to 24.8%.

By comparison, the UK mean national average is 14.5% and the median is 9.7%.

“Financial services are one of the worst sectors, and insurance is slightly worse than financial services overall,” said Jon Terry, UK financial services people leader at PWC.

“Insurance is a subsect of one of the worst industries, and it’s pretty bad within that.”

Methodology

On 6 April, over 10,000 private and public sector organisations employing over 250 people were required to publish their gender pay numbers on a government website.

The gender pay gap is the percentage difference between average hourly earnings for men and women within an organisation. It does not indicate by how much men are paid more than women for the same role. Instead, it often reflects the extent to which women occupy senior roles within an organisation.

The first insurance firms to publish their numbers did so grudgingly, often with caveats. Zurich UK announced it had a 25.4% gap. CEO Tulsi Naidu said the methodology did not give a true picture of women’s role within the organisation.

She said: “The gender pay gap is not the same thing as having equal pay, and we are confident that men and women in our organisation are paid equally for the same and similar jobs.

“We’ve calculated the figures in line with government regulations and, like many others in our industry, we have found that differences in average pay are down to several different factors.

“Generally speaking across financial services and in insurance specifically, women are under-represented in senior UK leadership roles and also in more highly paid technical and specialist roles such as actuarial and underwriting. This has certainly had an impact on our results here.

“We also see a greater proportion of women choosing to work part-time and taking career breaks – this also affects our gap results.”

There are objections to the way the gap is calculated. It does not account for pro-rata salary for part timers, instead relying on absolute salaries.

Terry said a frequent complaint is that women are generally more likely than men to work part time, which skews the result.

“I am somewhat dismissive around those comments. Yes there are valid points to be made around the methodology. There are unintended consequences, I accept all that.

“If the methodology is changed – and I suspect there will be some change in the methodology – that’s not magically going to change the numbers for the industry.

“There are no degrees of bad in relation to this. If the numbers are 27% or 29% they are still bad. They are still twice the national average, and the national average is bad.

“It’s true there are problems with the methodology and it needs to be sorted out. But that is distracting from the fact that the industry has a genuine issue and it needs to deal with that as a priority. It’s around the edges if it’s an extra 2% or 5%.”

Causes

So why does insurance perform so poorly? It’s a lot to do with the image problem of the industry, said Tali Shlomo, people engagement director at the Chartered Insurance Institute.

“The whole concept of male and female roles exists,” she said. “It’s traditionally been roles that are client facing and relationship building.

“The gap that we’re seeing now is due to historic behaviours and biases. It’s only now that we’re seeing what these biases actually are we are able to put interventions in place.”

Karen Beales, CEO of UK General, said she had encountered those perceptions throughout her career.

“I’ve been in a room where people have told me that a more senior role would not suit you because it’s more of a male-type role,” she said. “That was within the last 10 years.”

Shlomo said that bias tended to apply more toward women after they reached typical child-bearing age of mid-30s.

“We have all said there are less women in senior roles,” she said. “What tends to happen is that if you’re in a senior role you’re of a certain age. Median pay gap is around 2% for full-time workers in that 30-year-old age bracket.

“When you reach your 40s it widens to 14%, when you reach your 50s it widens further. Why is age playing a factor in the widening of the gap?

“Is it because from the child-bearing age of 35, we are starting to have biases toward women, and not to giving them the same opportunities as their male counterparts?”

Beales said women can often miss management opportunities owing to taking time off for maternity leave.

She said: “Certainly within insurance, ladies leave in their 30s to have a family, they then miss that opportunity for career progression in mid-tier management in some cases. They have up to 12 months out of the business.

“They then miss that opportunity and end up behind their male peers. Conversely, we find it easier to recruit at that more senior level for ladies. Once you get beyond that mid-30s age, it becomes a bit easier again.

“I don’t think there’s an answer to that, other than when you’re recruiting you’re aware of that and offer some flexibility.”

However, she is cautious over overt efforts to tackle that through quotas. “The counter to that is I wouldn’t want to think I’m only CEO because I’m female. It’s important for me to know that I’m here because of my abilities. When we recruit, we hire who we think is most suited to that role.”

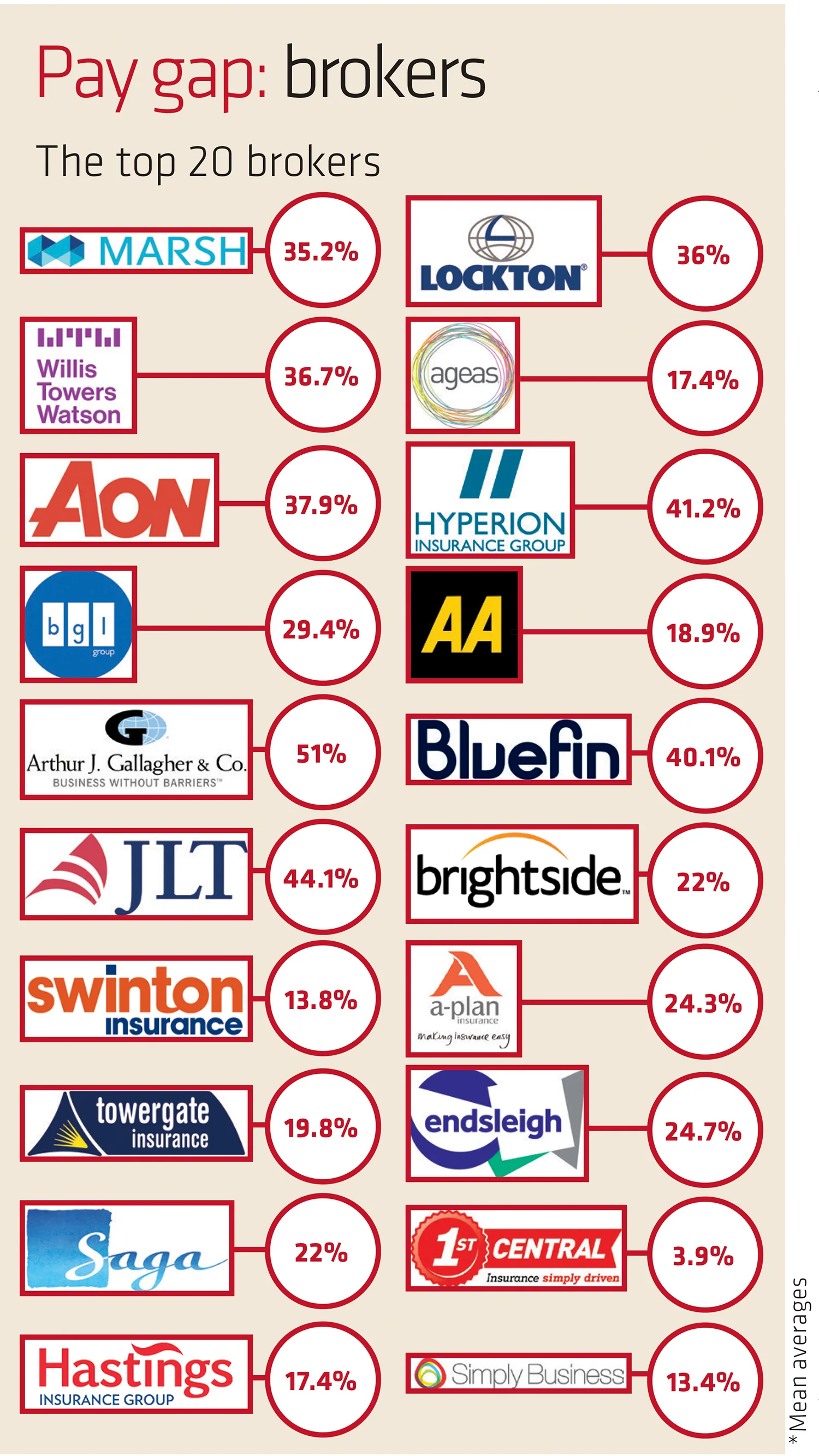

The highest gap of the top 20 brokers listed is Gallagher, with a mean gap of 51%, although the highest in the industry was Integro, with a mean gap of 75%.

Elisabeth Ibeson, UK HR director at Gallagher, said the organisation was committed to tackling the issue head on.

“What our own gender pay gap data ultimately shows is a lower proportion of women than men holding senior roles — senior management, senior sales, and senior production roles —within our organisation. This falls short of where we want to be.

“A lack of senior women in insurance broking is a historical challenge, as can be seen in the generally higher gender pay gaps reported by London-based firms focused on wholesale and/or reinsurance broking.”

“That’s where the real challenge lies for all of us. Before any organisation can close its gap, it must first thoroughly understand the underlying causes.

“This a complex issue with no quick or easy solution that will bring change overnight. Any action must be evidence-based, monitored and measured over time and not based on assumptions.”

“Simply setting quotas is not the answer. Not only can they drive the wrong behaviours, but they can create new wedges between colleagues and alienate other parts of a workforce.”

How long to fix?

The numbers just published relate to data collected from 2016. There is every chance that the next set of numbers, released in April next year will be worse.

“If businesses had a good year for 2017, it’s likely their gender pay gaps are going to get worse,” said Terry. “The performance-related bonuses will be more likely going to men than women than they were in 2016 when the results were worse.

The issue is clearly historic and deep rooted. So how long is it likely to take in order to be fixed? Terry is less than sanguine.

“It will take a significant amount of time. It will take another generation of leaders; at least five years and probably a decade.

“That’s in order to half the current pay gap, to get to the national average. Not to get to parity. And that is provided the businesses within the industry treat the pay gap not as one of 15 things they need to do, but as a genuine business priority.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk