Blog Post

Blog: Product recall, Brexit and Covid-19 – The triple threat to consumer safety

Evidence suggests product recalls are a growing issue in the food sector. Andrew Robinson, head of product liability and recall at Sedgwick International UK, explains why cooperative, closer monitoring and consistent and open dialogue will be essential,…

Blog: Funding options for Covid BI claimants

Ben Pilbrow, partner at Shepherd and Wedderburn and legal advisor to the QIC Action Group, discusses the implications of the Financial Conduct Authority’s High Court intervention against insurers for funding claims.

Blog: Advising cruise ship owners in a Covid-19 enforced shutdown

The current pandemic has hit the cruise liner industry hard with countless ships sitting unused around the globe. Royston Ford, strategic portfolio manager for marine at RSA, explains how technology is helping insurers to keep ships insured and out of…

Blog: Trak Global's Nick Corrie on why telematics is more about crashing, not driving

Telematics have proved their worth in the aviation sector but Nick Corrie, CEO at Trak Global, explains how with the pandemic changing driving behaviours more drivers want these black boxes on their side when it comes to motor claims.

Blog: The changing workplace - from the practical to the emotional, how we choose to work is changing

The world of work has been rapidly changing over recent years as the influence of technological, social and environmental factors has repeatedly challenged the status quo. And significant as it has been, Munira Hirji, head of commercial management at…

Blog: The new noise-induced hearing loss?

Nearly two million workers in the UK are at risk of developing hand-arm-vibration syndrome, a debilitating, permanent condition caused by working with hand-held power tools. While it might not attract the same attention as other occupational diseases,…

Blog: Underinsurance - how brokers can avoid it

To get the right answers you have to ask the right questions. This is true in most avenues of life. It is never more true than when setting insurance cover. Without the correct advice, it is difficult to be accurate in the sums insured. Mark Pierce,…

Blog: Environmental enforcement undertakings - what insurers and brokers need to know

Environmental criminal liability in England and Wales has recently undergone a period of significant change. Prosecutions have become fewer in number and fines for prosecutions that do take place have become much larger, according to Aidan Thomson and…

Blog: Discount rate consultations - what do insurers need to consider?

The legal and political landscapes across the United Kingdom and Republic of Ireland vary considerably and no less so when it comes to the personal injury discount rate. With negative (and different) discount rates and methodologies adopted in both…

Blog: Playing catch-up - the state of digital talent in the UK insurance industry

The UK insurance workforce has a lower share of digital skills than that of other industries according to Kapil Chandry, senior partner, and Tom Welchman, partner, at McKinsey. Now they say is the moment to act.

Blog: Covid-19 and the impact of emerging risks on the art market

The art market has a Covid-sized hole in its sales. Going online may be the key to its future – but it’s risky. Robert Read, head of fine art at Hiscox, explains why insurers can help.

Blog: Coronavirus, or how I learned to stop worrying and love the hardening market

A hard market is traditionally where specialist insurers and forward-thinking capacity providers thrive. As such Floodflash co-founder Ian Bartholomew is confident new resilient insurance businesses will emerge from the post-pandemic economic downturn

US Covid-19 liability shields: What do they mean for UK insurers?

As US states introduce a new wave of legislation intended to encourage businesses to reopen without the fear of an onslaught of Covid-related lawsuits, Andrea Best and Kristi Garrett of law firm Mc Dermott, Will & Emery ask whether these liability…

Blog: What will the new normal look like in insurance?

Across the business landscape, talk of how to adjust to the ‘next’, or ‘new’, normal has become the only game in town. Laura Drabik, chief evangelist at Guidewire Software, argues while many are tired of these instant clichés, the fact is that we are all…

Blog: Premium finance opportunities in a post-pandemic era

In the aftermath of Covid-19, Owen Thomas, Premium Credit’s chief sales officer reflects, on some key changes to the insurance industry and the increasing role insurance premium finance will play.

Blog: Holding the line - how networks are helping insurers manage the pressure

Millions of people around the world continue to work from home as part of measures to restrict the spread of coronavirus. But with social restrictions easing in many countries across Asia and Europe, thousands of brokers who swapped the physical trading…

Blog: The rise in escape of water claims

Escape of water claims across the insurance sector often form the highest proportion of all claims notified and the number and cost of those claims continue to rise. John O’Shea, partner and head of property damage and recovery at BLM, and Paul Redington…

Blog: The rise in casualty claims post Covid-19

As the UK emerges from the Covid-19 pandemic, with lockdown restrictions easing and many sections of the economy back up and running, Anthony Baker, president of the Forum of Insurance Lawyers and partner at Plexus Law takes a look at what new casualty…

Blog: The legalisation of rental e-scooters and its impact on the insurance industry

The UK government recently took the decision to legalise the use of rental electric scooters on public roads. Glyn Thompson, head of the motor sector focus team at the Forum Of Insurance Lawyers and technical lead motor at Weightmans, looks at what the…

Blog: Micro-business motor policies - using data to make better pricing decisions

Many small, local retailers have diversified and pivoted to take phone and online orders for home delivery during the pandemic. Jonathan Guard, director of commercial insurance for UK and Ireland at Lexis Nexis Risk Solutions, believes more needs to be…

Blog: Employees' mental health and returning to the workplace

As lockdown eases and society moves towards establishing some kind of new normality, we've seen employers undertaking surveys of employees to better understand their views on coming back to the office. Lesley Allen, partner at law firm Clyde & Co, asks…

Blog: Rebalancing the BI bad publicity - how insurers can rebuild public trust with positive PR messaging

Delays in comment sign off to interference in influencing messaging. Consultant Mark Bishop polled insurers and brokers about the sector's Covid-19 response and concludes lessons need to be learned in terms of balancing bad publicity in the future.

Blog: Covid-19 - time to re-evaluate

The coronavirus pandemic has hit people hard in a manner that the insurance industry can’t compute. Bundeep Singh Rangar, CEO of Premfina, looks at what lessons insurers can learn from the crisis.

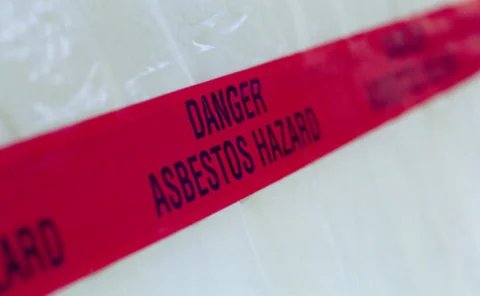

Blog: Preparing for the next asbestos - silicosis and insurance

With the All Party Parliamentary Group for Respiratory Health’s call to arms for the reform of workplace exposure limits to silica dust, Jim Byard, insurance partner at Weightmans, explores the likely impact on the insurance industry, and how it can…