Blog Post

Blog: Dealing with a hardening market - risk management and loss control during and post Covid-19

With the current insurance market hardening at a rate not seen in over a decade, Risk Solved non-executive Richard Thomas argues those firms that drive improved risk profiling and begin to fully appreciate the quality of the risks within their portfolio…

Blog: The changing shape of the London Market

Recently capital raisings by insurers aimed at ensuring they have sufficient capacity to support their trading partners and clients during the Covid-19 crisis have been widely reported. Clare Lebecq, CEO of the London Market Group believes the ability of…

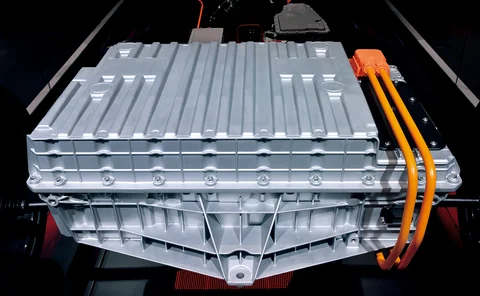

Blog: Electric vehicles - the risks associated with lithium batteries

With their ultra-low emissions, electric vehicles are a key part of the UK’s greener future. However, after reports of cars spontaneously catching fire, Andy Miller, technical risk control manager, Allianz UK, explains safety concerns could put the…

Blog: Credit investments - what challenges and opportunities do insurers face?

Despite increased sentiment and some rallies in markets, Lionel Pernias, head of buy and maintain at Axa Investment Managers believes that there are still plenty of challenges ahead for insurers' investments, particularly in their credit portfolios.

Blog: Is coronavirus the catalyst insurers need to shake up how they treat SMEs?

A survey for the US National Federation of Independent Businesses showed that 76% of small businesses rate the impact of Covid-19 as profound. Sabine VanderLinden, co-founder and managing partner of the Alchemy Crew, explains why SMEs could be some of…

Blog: Learning lessons from Covid-19

The Covid-19 crisis is unprecedented in the modern era and it is at such times that we tend to take stock and think differently about the world. Alex Kirykowicz, manager at Frontier Economics, reflects on the role that insurance markets have played and…

Blog: Covid-19 and its impact on Italy's insurance industry

The impact of Covid-19 has been felt across the global insurance industry and, for Italy's insurance industry more specifically, the largest and most direct impact will be from the high rates of hospitalisation in the country during the pandemic and the…

Blog: Smart telematics - driving the evolution of insurer-customer relationships post Covid-19

While the future is always difficult to predict, it is almost impossible in times of global uncertainty such as these. LeakBot CEO Craig Foster explains for the insurance industry it becomes particularly challenging to rely on what is happening now as an…

Blog: Brightside's Richard Beaven on Pride month and why promoting inclusion is even more important today

As an industry there has been slow progress to move the needle on our ‘pale, male and stale image’ and while we continue to see signs of change we should all be driving towards greater inclusion explains Richard Beaven, chief operating officer at…

Blog: Eight steps to keeping climate change insurable

The effects of climate change, such as rising sea levels and above-average temperatures, have long been apparent, however Swiss Re’s CEO, Tava Madzinga argues the resulting risk landscape is now more dynamic than ever.

Blog: Covid-19 - why the insurance industry needs to act as one voice

The 1998 romantic comedy, Sliding Doors, starring Gwyneth Paltrow alternates between between two storylines, depending on whether or not she catches a train. It is essentially a ‘what if’ tale, like much of our lives at the present time, writes Ashwin…

Briefing: Insurtech buys incumbent – is Hippo’s deal for Spinnaker a pointer to the future as unicorns spread their wings?

The news today that unicorn insurtech Hippo has entered into an agreement to acquire Spinnaker Insurance - subject to regulatory approval - certainly highlights the continued maturity of the sector.

Blog: Global reinsurance market - what can we expect to see from 2020?

Very few people have 20/20 vision and there is no exception to this when looking forward to what impact the year 2020 will have on the reinsurance market writes Gavin Coull, London Forum of Insurance Lawyers executive committee member and partner at…

Blog: Data lakes - what are the benefits to the insurance industry?

Increasing interest in big data is a growing trend within financial services and the insurance business is no exception, according to Alexandra Foster, director, insurance, wealth management and financial services at BT.

Blog: The future role of insurers in a post Covid-19 society

Paradoxically, uncertainty is the one certainty in today’s pandemic regime - the insurance industry is facing a far more indeterminate present and future writes Paul Coleman, managing director of NPA Insurance.

Delegated authority arrangements - what problems can arise for insurers?

Binding authority agreements, where managing general agents and other coverholders are authorised to underwrite on behalf of insurers, have been increasingly popular in recent years as insurers seek more diverse routes to premium income. With this…

Blog: The measure of indemnity in property damage loss?

Mike Ledgerton, head of major loss at Questgates, reflects on the Court of Appeal decision in Endurance Corporate Capital Ltd v Sartex Quilts & Textiles Ltd., which has potentially far reaching consequences to the measure of indemnity.

Blog: Tinnitus and minor whiplash claims – a cause for concern?

There is an increasing frequency with which tinnitus is appearing alongside minor whiplash injuries in road traffic accident claims. Catherine Burt, head of motor fraud at international law firm DAC Beachcroft, asks if insurers should be worried about…

Blog: How has lockdown affected policyholders requiring alternative accommodation?

Imagine being ‘locked down’ away from your own home; without all your personal belongings and in your ‘safe place’ – your home. Alisa Gold, marketing and business development co-ordinator at ICAB, explains that's the reality for thousands of…

The NED Blog: Covid-19 is not a solvency issue

Being a non-executive director of an insurance business is never boring but it’s fair to say that navigating the way through the current Covid-19 crisis is a completely new challenge and there are critical lessons that can be learnt from past crisis…

Crawford & Co's Andrew King on why Covid-19 means the role of risk manager has never been more important

The risk manager’s time has come as realisation dawns on how interconnected and vulnerable we all are in light of Covid-19. That is the view of Andrew King, head of Crawford Forensic Accounting Services UK & Ireland, who warns the spectre of large…

Blog: The future of catastrophic injury claims

We have seen a great deal in the press about the immediate impact of Covid-19 on the insurance claims landscape, including motor and credit hire. BLM’s head of catastrophic injury, Andrew Hibbert, believes there are a number of things the insurance…

Blog: Covid-19 - safeguarding home workers’ health and safety

The risk posed by Covid-19 has led many employers to set up home working for all or some of their employees as a way of reducing the risk to employees of exposure to Covid-19. Clare Bone, partner and solicitor advocate at BTO, argues the fact that an…

Blog: Covid-19 lockdown - how will it impact motor insurers and the repair industry?

As countries pull the lockdown lever in response to Covid-19 Tom Helm, head of Claims Consulting at Willis Towers Watson, and David Shepherd regional managing director at Solera ask: what do early global repair industry statistics show, what might we…