Blog Post

Blog: Insurtechs won’t eat your lunch, but they will pull up a seat at the table

Increased collaboration means insurers no longer need to worry about insurtechs taking their market share but Laura Drabik, chief evangelist at Guidewire Software, explains this integration must be done correctly or the market will face unhappy customers…

Blog: The stigma of stigma

This weekend we will see the first same sex couple on Dancing on Ice as Steps singer H dons his skates with partner American pro-skater Matt Evers. This comes weeks after rival reality TV show Strictly Come Dancing featured a same sex couple's routine in…

Penny Black's Social World: January 2020

Putting a dent in dementia, ridding rough sleeping and raising money for the Rainbow Trust.

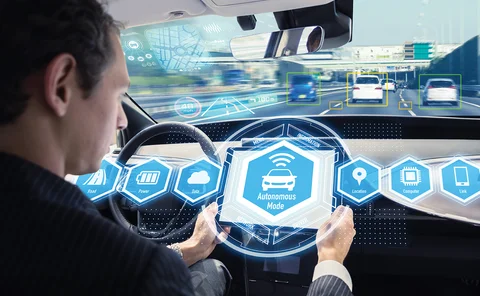

Blog: Adas data shortage for insurance is about to get sorted

Advanced safety features not only differ in performance and description among different manufacturers, but even among models by the same car manufacturer. Andrew Ballard, senior global product manager at Lexis Nexis Risk Solutions, believes deep data…

Blog: From disruption to collaboration - why insurtechs need to change the narrative in 2020

The coming year is set to be something of a watershed for insurtech. Craig Foster, CEO at Leakbot, believes far from disrupting the insurance sector, insurtech is beginning to define it and providers now have a crucial role.

Blog: Will the FCA ban automatic price rises in 2020?

The regulator has noted concern that competition isn’t working well for all consumers in the house and motor markets but Tony Tarquini, director of insurance for Europe, the Middle East and Africa at Pegasystems, believes a ban on automatic price rises…

Blog: (We) Working through Lemonade’s IPO woes

I wasn’t surprised to see that Lemonade has reportedly shelved its plans for an initial public offering, amid troubles in investor Softbank’s portfolio.

Blog: The changing face of the SME market

The SME market is changing, with more IT consultants, gig workers and freelance project managers emerging alongside traditional businesses. To support both the old and new Helen Bryant, director of SME markets at Allianz Insurance, argues the insurance…

Blog: Cuvva-ing all the bases with statistics

Post senior reporter Emmanuel Kenning wonders about Cuvva’s 3% claim.

Blog: Fail it or nail it?

Post news editor Jen Frost mulls general insurance appetite for innovation and, somewhat unintentionally, stumbles on Amanda Blanc as a common theme.

Blog: Shorter and flexible trial schemes - why aren’t insurers using them more?

Insurers will know that the litigation process is neither short, nor timely. Yet, that is changing, writes Stephen Netherway litigation partner at City law firm Devonshires.

Blog: Aviva, ERS, ? … What Amanda Blanc did next

Her appointment as a NED of Aviva triggered one former colleague to boast 'It’s coming home, it’s coming home, insurance is coming home'. Jonathan Swift reflects on what lies ahead for Amanda Blanc here, at ERS and where she might pop up next.

Insurtech 100: August - October 2019 quarterly update

As a host of firms featured in the top 100 insurtech ranking raise money, develop new products and spin-off their own start-ups, Matt Connolly, founder and CEO of Tällt Ventures argues that incumbents are been left behind as the insurance sector reaches …

Blog: Event cancellation - the role of the loss adjuster

Last month’s torrential rain that saw hundreds of homes and businesses in Yorkshire and the Midlands devastated by flood water served as a stark reminder of the destructive impact that the weather can have. But this can also have a severe impact on…

Blog: If the market is serious about stamping out harassment it cannot reward bad behaviour

For a market suffering from serious reputation issues when will insurance learn it must start making serious changes?

Blog: Are MGAs a desirable route to market for insurtechs?

There is so much talk about collaboration between insurtechs and insurers or managing general agents, but John Price, chief operating officer at Scheme Serve, asks is this collaboration out of design or necessity and are managing general agents a good…

Blog: What do Norwich Union and John McClane have in common? They Die Hard

The general public might still be split on whether Die Hard is a Christmas movie or not. Jonathan Swift wonders if the resurrection of Norwich Union will prove just as divisive.

Blog: Future-proofing the broker model

The insurance market seems stuck on the idea that digitisation and a move to app-based insurance products, will negatively impact brokers. Inzura CEO Richard Jelbert explains why they should be seen as an opportunity instead.

Blog: Model risk management in insurance - what does the future hold?

Risk management within the insurance industry has drastically changed within the last 10 years and, according to Henry Umney, CEO of Cluster Seven, this is mainly due to regulatory responses to the 2007 financial crisis.

Blog: A demanding future – future trends that will define insurance in 2020

The insurance industry stands on the precipice of profound change – technology-driven disruption, changing customer expectations and the arrival of new competitors are shifting the industry’s challenges according to David Rush, Europe, Middle East and…

Blog: Machinery breakdowns - what are the risks to businesses?

Although cyber takes the headlines, machinery breakdown can be equally damaging to businesses, according to Owen Lewis, group manager for account engineering at FM Global's London operations, with a recent analysis of the company's client losses…

Driving Out Distraction: The impact of mental state on driving

There can be many distractions when driving a car but Jo McGowan, human resources director at First Central Insurance & Technology Group, asks what happens when these are inside your own head?

Blog: Indemnities in real estate - where do the opportunities lie for brokers?

For many years, indemnities have aided real estate development projects and transactions writes Michael Grimwood, business development manager at CLS Risk Solutions. It has traditionally been placed within the London market due to the complex nature of…

The NED Blog: Regulation and the regulators

The regulatory agenda is always something of a concern to the independent non-executive director in the insurance market and keeping a close eye on the 2019 and 2020 plans from both the Financial Conduct Authority and Prudential Regulatory Authority is…