Home - Standard

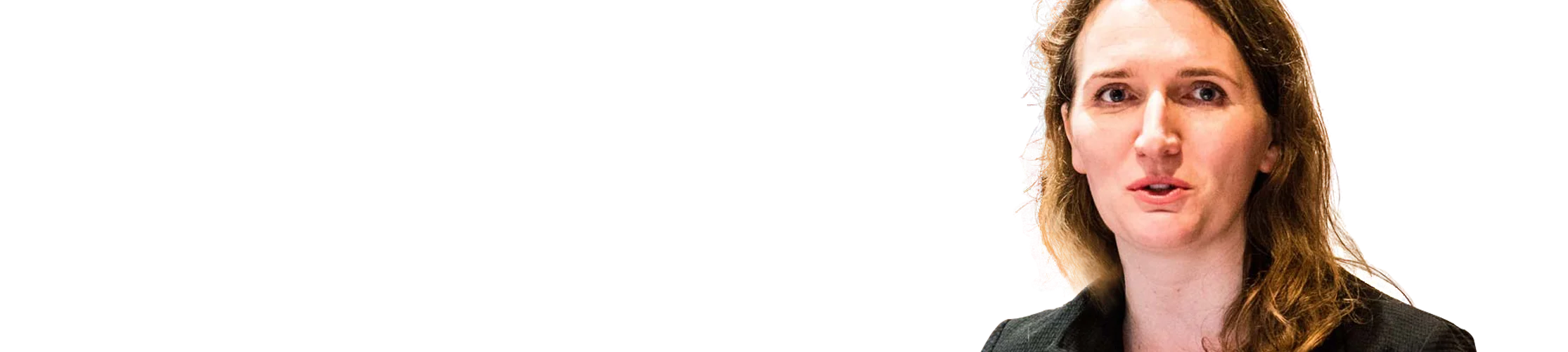

Q&A: Nikki Lidster, Zurich

Zurich UK’s head of SME Nikki Lidster talks to Insurance Post about the firm’s growth in 2025, its plans for 2026, and how it revamped its products this year.

False Lego claim dismantled brick-by-brick

A man has been jailed for 28 months following an investigation by the Insurance Fraud Enforcement Department into several fraudulent insurance claims, including false reports of stolen Lego sets.

Throwback Thursday: ‘Goldfinger’ of Lloyd’s attempts comeback

Insurance Post’s Throwback Thursday steps back in time to December 1985 to remind you what was going on this week in insurance history when ‘Goldfinger’ of Lloyd’s, Ian Posgate, was trying to return to the market.

Esure CEO already heading for the exit

Peter Martin-Simon, who took on the role as CEO at Esure in October, will leave his top job at the insurer in April.

Editor’s Choice

Have your say: Shape the future of Insurance Post

Insurance Post wants you to help shape the future of the award-winning publication by taking part in its latest readership survey.

Broker Review of the Year 2025

A softening market put downward pressure on brokers revenue in 2025 but businesses that embraced digital breakthroughs and delivered exceptional service have succeeded in holding on to their clients in a competitive market.

Claims & Legal Review of the Year 2025

From artificial intelligence-driven efficiencies and people-focused service to global expansion, 2025 saw claims and legal sector leaders raise their game when it comes to settling claims.

Insurtech Review of the Year 2025

Insurtechs came of age in 2025, shifting from disruption to deep integration, proving artificial intelligences real-world value, expanding globally, and cementing their role as essential partners driving insurance innovation and modernisation.

Insurance matrix

NFU Mutual leads motor insurance market

NFU Mutual, LV and Saga are strengthening motor insurance customer loyalty as we race towards 2026 through better claims experiences, according to the latest Fairer Finance research, while others are falling back due to weaker service experiences.

Commercial insurance market shrinks as trades grow

A decade of mergers, exits and product withdrawals has reduced provider and product numbers across most commercial insurance segments with the exception of tradesman and professions, which are now driving the only area of growth.

Teens see cyber risks clearly – but don’t know insurance basics

Today’s teenagers understand the risks that will shape the insurance market of 2045 but are confused about the cover they need today, research has revealed.

Top 50 Reinsurers of 2025 revealed

Swiss Re’s adoption of IFRS 17 has propelled it to pole position on this year's Top 50 Reinsurers ranking, which Christopher Pennings, financial analyst at AM Best observes, highlights how the new accounting standard continues to reshape global reinsurance standings.

Sponsored content

About

This content is provided by third-party contributors.