Pet insurance

Aviva to launch pet insurance product this year

Insurance Post can exclusively reveal Aviva is developing its own pet insurance product, with a view of launching in Q4 this year.

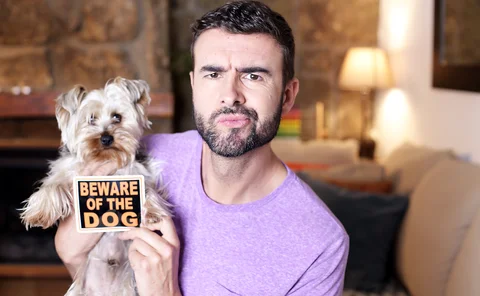

Big Interview: Andrew Leal, Waggel

Andrew Leal, CEO and co-founder of Waggel, chats with Insurance Post about the challenges and opportunities in attempting to build the “most human pet insurer”.

More than half of UK customers use credit to pay premiums

57% of customers use a form of credit to pay for one or more insurance policies they have, a Premium Credit survey has shown.

Pet insurance’s widening gap: More products but less providers

Pet insurance product numbers are soaring while provider consolidation, rising vet fees and shifting cover trends make the cover increasingly complex for consumers, Defaqto’s latest analysis shows.

Which? super-complaint shows insurance is a race to the bottom

James Daley, managing director of Fairer Finance, argues Which’s super-complaint lays bare long-standing problems in policy quality, claims performance and comparison-site competition and pushes for better purchase information to halt the industry’s…

Devilish details from the Autumn Budget for insurers

Insurance Post rounds up the insurance industry’s reactions to the Chancellor’s Autumn Budget, including comments on insurance premium tax, national insurance, and electric vehicle tax.

Pet insurers under fire for blindsiding vets with VetEnvoy halt

Independent vets claim they were blindsided after Allianz and several pet insurers failed to communicate non-Allianz brands will be removed from digital pet claims platform VetEnvoy, now known as Petios.

Jensten buys broker; Pen's renewables product; Zurich UK's head of compliance

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Q&A: Etienne Legangneux, Vet-AI

Etienne Legangneux, CEO of Vet-AI, discusses the opportunities for the firm’s AI triage tools to assist insurers in reducing claims and retaining customers in an increasingly price competitive market.

Admiral reveals progress on pet insurance ambitions

Pritpal Powar, pet director at Admiral, has shared the insurer is “very close” to its goal of becoming a top five pet provider in the UK.

Big Interview: Mike van der Straaten, Antares

Mike van der Straaten, CEO of Antares, sits down with Harry Curtis to discuss QIC Global’s rebirth as Antares, why it swapped its Maltese entity for a UK one, and its retail strategy.

Admiral argues CMA vet probe could unlock uninsured pet market

Admiral pet director Pritpal Powar has argued the Competition and Market Authority’s investigation into the veterinary services market could help insurers tap into the uninsured pet owner market.

Diary of an Insurer: Staysure’s Simon McCulloch

From strategy sessions to Friday walks with his dog, Staysure Group’s chief growth officer Simon McCulloch shares how he balances a packed schedule of product innovation, trading performance reviews, and big-picture planning with moments to reset and…

Top 100 UK Insurers 2025: Admiral

Admiral has climbed from seventh to fifth place on this year’s Insurance Post Top 100 UK Insurers list, thanks to strong profit growth and the acquisition of More Than's renewal rights.

Top 100 UK Insurers 2025: Direct Line

Direct Line Group remains in third place on the Top 100 UK Insurers List 2025, but will disappear from next year’s rankings as the provider becomes part of Aviva.

Top 100 UK Insurers 2025: Aviva

Aviva Insurance Limited is ranked number 1 and Aviva International Insurance Limited is ranked number 2 once again on Insurance Post’s Top 100 UK Insurers list.

Fairer Finance demands FCA probe into pet cover limits

Fairer Finance has accused pet insurers of adding “deceptive” inner limits to policies marketed as comprehensive, which could leave owners facing thousands of pounds in unexpected vet bills.

IFB expanding into new lines with five-year strategy

The Insurance Fraud Bureau has today launched its five-year strategy in which it plans to bring about a more connected industry in the fight against fraud.

Axa’s road safety initiative; Marshmallow’s migrant offering; Bridgehaven joins ABI

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Insurers should turn to YouTube to demonstrate value

Insurance firms should utilise social media platforms such as YouTube to demonstrate value to customers, delegates at the Defaqto conference have heard.

Blog: Why knowing your customer is critical for pet insurers

Rising costs and growing complaints are testing the UK pet insurance market like never before. CRIF’s Sara Costantini explores how truly knowing customers and their pets can build trust, reduce risk and meet rising regulatory expectations.