Fraud

It’s insurtech Jim, but not as we know it - Lemonade’s PRA authorisation shows intent

Content director's view: Jonathan Swift looks at Lemonade's landmark PRA authorisation and two second claim record and contemplates whether the once start-ups trek to the mainstream is entering the final frontier.

Q&A: Chris Sawford, Verisk

As inflation drives upward pressure on premiums, Chris Sawford, managing director of claims at Verisk, reveals how he plans to help insurers tackle pain points in the claims lifecycle.

Shortlist revealed for 2023 Claims & Fraud Awards

Today we can reveal the shortlist for the 2023 Insurance Post Claims & Fraud Awards.

AI in insurance: Potential risks and benefits

As insurers strive to stay ahead of fraudsters, artificial intelligence is emerging as a formidable weapon.

Essex car racer’s insurance claim is fast and fraudulent

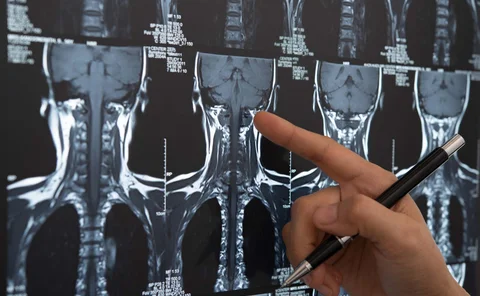

An Essex mechanic has had his £30,000 insurance claim for injury thrown out of court after he failed to mention he had previously broken his spine, pelvis, neck, and ankle while banger racing.

Ifed reports surge in opportunistic fraud

The City of London Police’s Insurance Fraud Enforcement Department has reported a growing number of people making fraudulent insurance claims as a result of cost-of-living pressures.

Rise of the AI insurers

David Worsfold examines can how artificial intelligence can be used to reimagine the insurance experience for customers, transforming it from a transactional, reactive model to a proactive, more personalised one.

Wallife launches digital identity theft insurance in the UK

Italian MGA Wallife has identified a big protection gap in the UK insurance market and has launched its digital identity solution to protect consumers.

Jensten and Hiscox partner; Aston Lark buys HNW book; Axa XL appoints reinsurance CEO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Facebook identity crisis hits insurance fraudster with £51K bill

A Barnsley motorist’s fraudulent claim for £15,000 has been thrown out after a Facebook photo proved he knew the “independent” witness to his accident.

Deadline for the 2023 Claims & Fraud Awards days away

The deadline for the 2023 Claims & Fraud Awards is just days away if you want to be in the running to win one of these prestigious prizes [5pm on 2 June].

Media risks in the digital age

Analysis: David Worsfold examines the implications of the Online Safety Bill for insurers of content creators, publishers, website hosts and social media platforms.

NFU Mutual catches fraudster who tried to claim £54K for gardening

An insurance fraudster who tried to claim £54,000 for 40 years’ worth of gardening was found fundamentally dishonest by a judge and added to the insurance fraud register.

Escape of water fraud - hiding in plain sight?

The great freeze at the turn of the year saw a huge rise in fraudulent escape of water claims, particularly from unoccupied properties.

Claims Apprentice 2023: Episode 3 - Travel claims: fact or fiction?

Having navigated the Data Escape Room in the last episode, the latest challenge sees the Claims Apprentices take part in an insurance-related gameshow.

DWF bosses reveal growth plan following restructure

Matthew Doughty, CEO of Insurance at DWF, has revealed the legal and business service provider is looking to grow by doing more end-to-end business with existing clients, attracting new insurers and hiring more partners “from competitors”.

Pet insurance fraudster collared by the law

A finance officer at a veterinary practice, who made more than £37,000 in fraudulent pet insurance claims by editing invoices obtained from her employer, has been sentenced.

Claims Apprentice 2023: Episode Two – Data Escape Room

Now that the apprentices have been put into two teams, and their names have been decided upon, it is time for the them to tackle their first challenge.

Insurance Taskmaster: Detecting motor fraud in and around Euro 96 (1996)

In this episode, the contestants wake up and it is the summer of 1996. They are on the front line, combatting the burgeoning issue of insurance fraud.

Entries open for the 2023 Insurance Claims and Fraud Awards

The 2023 Claims & Fraud Awards are open for entries with a deadline of 5pm on 2 June.

Facebook posts help Axa catch out claimant

A Norwich man who claimed a minor car accident left him unable to work was caught out because he posted photographs of himself on Facebook swinging from a zipwire.

Tackling insurance fraud requires a 360-degree view

Oleg Zadalia, principal solutions consultant, fraud and identity at LexisNexis Risk Solutions, reveals how the latest innovations in fraud prevention are helping insurers strengthen their defences at key stages of the customer journey.

Mitigating the impacts of economic uncertainty using artificial intelligence

Insurers are not immune to the conditions driving uncertainty in our economy. They can, however, take real steps to ensure their business is protected from many of those risks.

LV catches out lawyer who exaggerated her symptoms

A non-practicing lawyer from Merthyr Tydfil who attempted to claim more than £250,000 from LV for injuries resulting from a vehicle collision has had her call for compensation thrown out.