Fraud

What are the most common types of insurance fraud?

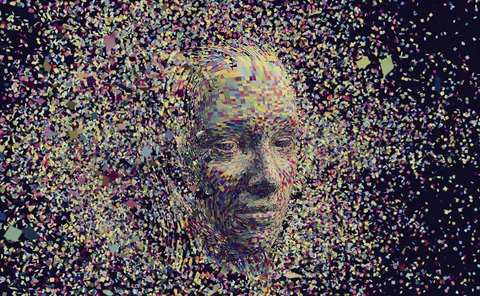

From policy fronting to ghost broking to generative AI, this infographic provides an overview of the most common types of insurance fraud.

Aviva exits Singlife joint venture; Clearspeed and PWC partner; Cila elects president

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Fraudulent four jailed over 'crash for cash' claims

Four fraudsters have each landed themselves a sixth month jail sentence after taking part in a ‘crash for cash’ scam.

How insurers are putting the pedal to the metal for mobility trends

Analysis: Fiona Nicolson explains what insurers looking to stay in the fast lane, as mobility trends develop, need to do to satisfy drivers and maintain profits.

Unveiling the future of commercial insurance: navigating risk, trusting data and empowering clients

Insurance Post, in partnership with Crif, conducted a comprehensive survey to explore the risks associated with the commercial insurance sector.

Fundamentally dishonest fraudsters ordered to pay Zurich £30k

Two fraudsters have been found to be fundamentally dishonest and ordered to pay £30k in legal fees following an attempt to fraudulently seek damages against Zurich.

Synthetic ID fraud - a growing threat to the insurance industry

Synthetic ID fraud is a growing threat, with fraudsters using fake identities to commit crimes, and it is becoming increasingly difficult to detect. Izabela Chmielewska outlines how this impacts upon the insurance industry, and what insurers can do to…

‘Crash for Cash’ fraudsters shifting focus to rural and residential areas

The City of London Police’s Insurance Fraud Enforcement Department has said ‘crash for cash’ scammers are evolving their tactics after reported cases of opportunistic fraud soars by 61%.

How insurers are tentatively embracing AI

Analysis: Frances Stebbing explores how insurers are using generative AI, while recognising the risks and preparing for the incoming regulation for this type of technology.

Roundtable: Strengthening the insurance industry’s defences against tomorrow’s fraudsters

Insurance Post in partnership with LexisNexis Risk Solutions, hosted a roundtable discussion where specialists delved into the evolving landscape of insurance fraud and the industry’s ongoing efforts to stay ahead of fraudsters.

Value of average insurance fraud hits record £15,000

The Association of British Insurers has revealed the value of the average fraudulent claim in 2022 rose 20% to £15,000.

Embedded insurance: Blind to the risks?

Analysis: David Worsfold examines whether wrapping up insurance with other products risks obscurity, especially if there is a poor understanding of consumer behaviour in a digital environment.

Food delivery fraudster faces jail

A food delivery driver who fraudulently claimed nearly £80,000 from Aviva in motorbike hire costs has been jailed for seven months.

Government launches consultation to ban scam calls

Plans to ban cold calls for financial products such as insurance have been set out with the launch of a government consultation.

Ghost broker sentenced for £302K insurance policy scam

A ghost broker who charged more than 900 unsuspecting motorists £300 each for fraudulent motor insurance policies has been sentenced.

Axa XL’s carbon emissions product; Defaqto’s updated Matrix software; Flock appoints CFO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Insurance fraud: Survey reveals impact of economic downturn

Insurance fraud is a growing problem in troubled times. To shed light on the current challenges and opportunities faced by the industry, Insurance Post collaborated with LexisNexis Risk Solutions to conduct its annual fraud survey. Izabela Chmielewska…

Q&A: Alex Martin, Clearspeed

Alex Martin, CEO and co-founder of AI-enabled voice analytics provider, and British Insurance Award winner Clearspeed, explains to Scott McGee how the business has gone from helping the armed forces spot attackers to helping insurers catch fraudulent…

Four insurers save £650K by challenging credit hire costs

Admiral, Hastings Direct, KGM Underwriting Services and LV General Insurance have successfully challenged the prices charged by credit hire firms in recent weeks, according to law firm HF.

Aviva catches fundamentally dishonest fraudster

Aviva and HF Solicitors have successfully fought a fraudulent claim involving alleged injuries brought by a senior finance professional

Qover partners with Zurich; Keoghs takes team from Plexus; Allianz appoints CIO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Allianz, LV and Zurich to discuss speeding up fraud detection in Insurance Post webinar

Whilst some insurance fraudsters are getting smarter at using modern technologies to embellish their false insurance claims; other more opportunistic policyholders are being driven to seek illicit gains as the cost-of-living crunch means money is tighter…

Ways to tackle economics-driven insurance application fraud

Nick Jackson, partnerships director of CDL, explains how to detect quote manipulation or misrepresentation among those feeling the pinch.

Surge in synthetic ID and Al fraud threatens UK insurance

The UK insurance sector continues to experience a surge in fraudulent activities, leading to significant losses for insurers.