Data analytics

City Minister on why the government is supporting insurance as the engine of the economy

City Minister John Glen is confident the new UK framework for insurance linked securities will help the market grow.

Blog: How to make your cyber offering stand out

Cyber insurers can gain market share by differentiating their products. Benedict McKenna, vice-president and London operations claims manager at FM Global, explains how.

Mark Collins replaces Robin Challand as CIO at Ageas

Mark Collins is to replace Robin Challand as chief information officer at Ageas following Challand’s appointment as claims director at the company in January of this year.

Blog: Video killed underinsurance

The technology that can radically change household insurance has nothing to do with smart home devices, argues Charlotte Halkett, managing director of insurance product at Buzzvault, who bets on video surveys.

Esure broadened risk appetite to spur motor growth, says Ogden

Esure has been able to grow its motor book substantially over the past three years as a result of a more relaxed risk appetite.

Updated: QBE claims boss replaces Ashton West at helm of MIB

Ashton West OBE is to retire as CEO and executive director of the Motor Insurers’ Bureau, being replaced by former QBE group chief claims officer Dominic Clayden.

China-backed hackers can cause insurers 'extensive' losses

China-backed hackers have the technical capabilities to cause insurers extensive losses, a consultant warned.

AIG's Steve Agutter on combining robotic insight and human touch

Claims adjusters need to embrace automation but it's their human touch that will win - or lose - customers, explains Steve Agutter, head of claims at AIG International.

Calling all brokers: Insurance Post brings back biennial survey

Insurance Post has launched its 2018 UK Broker Survey and we need your input on the key issues facing the industry.

Blog: What does the first Insurtech Impact 25 listing say about the state of the sector?

“We have no doubt that we have missed some Fords and included some Tinchers. But who ends up a Ford and who ends up a Tincher is not pre-determined.”

Buzzvault announces long-term growth plans following Munich Re tie-up

Exclusive: Buzzvault Insurance has entered a five year strategic partnership with Munich Re Digital Partners with plans of releasing products to market by Q3 2018.

Lloyds Bank insurtech and innovation head joins Oxbow as a partner

Christopher Hess, formerly the business development director at Lloyds Banking Group's insurance arm has joined management consultancy Oxbow Partners.

Lloyd’s to pilot use of artificial intelligence

Lloyd’s will launch a think tank to drive the use of analytics and artificial intelligence in the market.

Interview: Charlotte Halkett and Darius Medora, Buzzvault Insurance

Charlotte Halkett, one of the founding members of Insure the Box, caused waves when she moved to launch an insurance business of a removals booking firm Buzz Move in September last year.

Aon's Jane Kielty on providing local service to international SMEs

As SMEs in the UK face increasingly complex insurance needs, Jane Kielty, managing director, national at Aon Risk Solutions, reflects on how the industry can respond to these.

IFB enters partnership with Mohawk Security to boost investigation strategies

The Insurance Fraud Bureau has signed a contract with Mohawk Security in order to more effectively combat fraud.

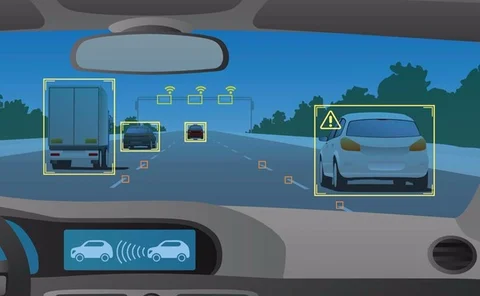

Driverless car data access a 'big priority' for ABI

Insurers need to have access to the accident data produced by connected cars, a conference heard.

Clearer definition of autonomous driving needed: Thatcham

The government needs to clearly define what constitutes autonomous driving in order that insurers can properly determine liability, a conference heard.

MIB could help OEMs share accident data with insurers

The Motor Insurers’ Bureau could act as a platform for car manufacturers to share with insurers accident data generated by autonomous vehicles, a conference heard.

Axa's Williams warns motor insurers against becoming obsolete

Motor insurance is going to be "massively impacted” by the advent of autonomous vehicles, a senior Axa executive has warned.

Blockchain-driven insurtech completes $1m funding round led by insurance executives

Insurtech firm Inzura has completed a $1 million funding round led by senior industry figures.

Interview: ABC Investors - Bunker, Cassidy, Castle, Horton and O’Roarke

With their restrictive covenants expiring at the end of 2017, the former LV general insurance management are now free to re-enter the market. Jonathan Swift speaks to the quintet about their new consortium ABC Investors, digital innovation and what it…

Former Aviva director develops broker customer data sharing platform

Broker Insights has developed a platform which uses broker customer data to help insurers identify business opportunities.

QBE's Phil Dodridge on navigating the digital tempest

Threatened with disruption, insurers need to augment their business model, argues Phil Dodridge, head of business intelligence and disruption at QBE European Operations.