Claims inflation

Markerstudy to use tough PL market to fuel further growth

Following its merger with Atlanta Group, Markerstudy Group said the current squeeze of the personal lines market, and the added pressure of more strict regulation, presents an opportunity to grow the business further both organically and through…

Vitality drops out of car insurance market after just two years

Vitality has dropped out of the personal lines motor market after just two years, announcing that it is “no longer offering new car insurance policies,” Insurance Post can reveal.

Top 30 European Insurers revealed

Allianz and Axa have held on to the top two spots on Insurance Post's Top 30 European Insurers 2023 list and accounted for slightly under a quarter of total GWP in the dataset, which was produced by AM Best.

Top 30 European Insurers 2023: Claims inflation bites

Europe’s 30 largest non-life insurers have demonstrated solid top-line growth over the past two years, following a drop in 2020.

Motor insurance payouts rose faster than premiums in Q2

The Association of British Insurers has revealed that motor insurance payouts rose by 29% in Q2, up to £2.5bn, outpacing premiums.

Value of average insurance fraud hits record £15,000

The Association of British Insurers has revealed the value of the average fraudulent claim in 2022 rose 20% to £15,000.

Q&A: Gary Brown, McLarens

Gary Brown, CEO of McLarens, speaks to Insurance Post about the loss adjuster's growth, global claims trends and preparing for catastrophic events.

Allianz CEO anticipates 'strong rate' environment for rest of 2023

Colm Holmes, CEO of Allianz Holdings, has warned the insurance giant will need to continue to rate “to cover the impact of inflation” in the latter half of this year.

Hiscox achieves tenfold increase in H1 profits

Aki Hussain, group chief executive of Hiscox, has revealed how a decision to preserve capital over the last few years has paid off with bumper profits at the start of 2023.

Could a motor insurance crisis become a political storm?

Content director's view: As Zurich pulls out of the personal lines broker market, and with motor far from being flavour of the month for investors and capacity providers, Jonathan Swift asks could a combination of withdrawals and lack of new competition…

Reclaimed parts driving motor insurance profitability

Analysis: Fiona Nicolson examines how reclaimed parts have become a vital solution to the ongoing parts shortages affecting body shops and motor insurers.

BoE braces insurers to handle more cash-strapped customers

The Bank of England has warned higher interest rates increasing debt-servicing costs will result in general insurers having to handle a growing number of people financially squeezed in the coming months.

Why insurers’ COOs and insurtechs need to combine forces

Editor’s View: Emma Ann Hughes says it is time chief operating officers in the insurance industry realise holding the key to floors of servers isn’t going to save them from regulatory action.

Motor premiums will ‘need to go up further’ to manage claims costs, says ABI’s Skeet

The Association of British Insurers’ director of general insurance policy, Mervyn Skeet, has told Insurance Post that motor premiums will “probably need to go up further” because claims costs are still increasing.

Ways to tackle economics-driven insurance application fraud

Nick Jackson, partnerships director of CDL, explains how to detect quote manipulation or misrepresentation among those feeling the pinch.

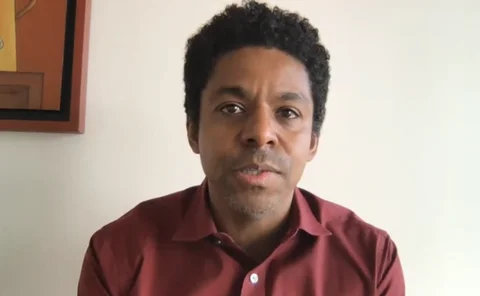

Profile: Rodney Bonnard, EY

Rodney Bonnard, head of insurance for EY, chats to Scott McGee about his 30 years in insurance, the “profitability crisis” within personal lines, and how insurers need to be redefined for the future of insurance.

Insurers must right their wrongs for vulnerable customers, says FCA

Home and motor insurers need to put the “wrongs right” and “improve their treatment” of vulnerable customers as the cost-of-living squeeze continues.

Tough times ahead for motor insurers after ‘worst performing year in a decade’

Motor insurers should expect further losses this year as high inflation and low premium costs continue to hound the sector, reports say.

Bank of England says claims inflation will continue to affect every insurer

The Bank of England has provided feedback to the market from its review on the effect of claims inflation and whether insurers took recommendations on board.

Watch Zurich, Allianz, Markel, Guidewire and SS&C discuss claims inflation

The industry is facing the brunt of rising inflation across most lines of insurance as carriers see claims expenses mounting.

Hastings exposes dishonest solicitor who tried to inflate claim values

HF and Hastings Direct have beaten a claimant solicitor’s attempt to inflate claim values by up to £50,000.

Tackling soaring vehicle repair costs in the motor industry

Pete Thompson, director of product at Motor Repair Network, explores key tactics insurers can employ to streamline claims processes and reduce costs.

Claims Apprentice 2023: Episode six – The Final Interviews

With the three team tasks done and dusted, it is time for the six candidates to come face-to-face with Kennedys’ very own Sir Alan Sugar – Claire Mulligan – and put forward a case as to why they should be crowned the winner of 2023 Claims Apprentice.

Trade Voice: ABI’s Mervyn Skeet on why higher insurance bills may not be the hardest price rises to stomach

Mervyn Skeet, director of general insurance policy at the Association of British Insurers, argues that increasing home and motor insurance premiums need to be seen in a wider context of rising prices.