Claims inflation

Top 100 UK Insurers 2024: Axa

Axa grabs the eight spot on Insurance Post’s Top 100 UK Insurers 2024 list.

Top 100 UK Insurers 2024: Allianz

Allianz has made significant strides to increase the brand’s presence in the UK and remains in the Top 10 of Insurance Post’s Top 100 UK Insurers List.

Top 100 UK Insurers 2024: Admiral

As Admiral celebrates the 20th anniversary of listing on the London Stock Exchange, the only Welsh company in the FTSE 100 has leapt from eighth place on last year’s Top 100 UK Insurers List to seventh place in the 2024 rankings.

Top 100 UK Insurers 2024: Drastic turnaround in profitability

Major players pulling out or significantly scaling back their personal lines propositions, while others saw commercial lines profits soar, has significantly shaken up Insurance Post’s Top 100 UK Insurers rankings in 2024, according to Ben Diaz-Clegg,…

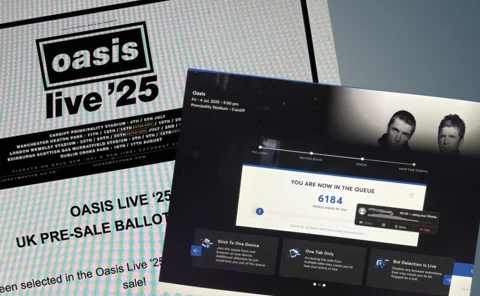

Lessons insurers should learn from Ticketmaster’s dynamic pricing

Editor’s View: Emma Ann Hughes questions whether the fallout from Ticketmaster’s dynamic pricing approach to selling Oasis tickets could have an impact on insurance premiums.

Top 30 European Insurers of 2024 revealed

The top 30 European non-life insurers achieved another year of solid top line growth in 2023 with the average growth rate of the companies being 9.8%.

Diary of an Insurer: Charles Taylor’s Rose Goad

Rose Goad, claims team leader at Charles Taylor Assistance, works with aviation clients, helps the UK and Singapore team stay connected and shares her love of Formula 1.

Big Interview: David McMillan, Esure

David McMillan, CEO of Esure, on why he isn't frightened to shed volume in order to protect profitability, the pain points of the provider's digital transformation plus how customer expectations are now shaped by Uber's activity rather than Aviva's…

Axa UK GI records £103m underwriting loss in 2023

Axa’s UK general insurance company made a £103m underwriting loss in 2023, accounts filings have revealed.

Circular economy: A fresh approach to property repairs

Nick Turner, head of surveying at Woodgate & Clark, on the steps that need to be taken for insurers to adopt the circular economy in property repairs.

Property insurance payouts hit record quarterly high

Insurers paid £1.4bn in claims for property damage during the second quarter of the year, according to the latest data from the Association of British Insurers (ABI).

Allianz UK profits surge 55%

Allianz UK has reported a 55% increase in operating profit to £174.8m for the first six months of 2024, compared with £112.8m for the same period in 2023.

Why are HNW MGAs dropping like flies?

After numerous MGAs operating in the high-net-worth space have either been sold or gone into run-off over the last few years, Scott McGee asks what does it take to survive in this space?

Diary of an Insurer: Allianz Partners’ Matt Crawford

After cycling from London to Paris in 24 hours, Matt Crawford, head of sales for roadside assistance at Allianz Partners, keeps motors running during his working week and learns lessons from the provider's travel insurance business.

Green shoots, but claims managers predict inflation to continue into 2025

Senior claims managers are seeing property claims inflation ease, but expect it to remain high for the foreseeable future; with suppliers turning their backs on insurance work being cited as a factor.

Insurance market has rushed automation – survey

Many technology professionals at insurers and MGAs believe the market has rushed into automation, according to a survey by RDT Tech.

Ageas reveals AI has saved business more than £4m

Ageas has saved more than £4m due to the use of artificial intelligence, with £2m of the savings coming from AI-enhanced fraud models.

What does Winslow’s hiring splurge say about DLG’s future?

Content Director’s View: Jonathan Swift takes stock of Direct Line Group CEO Adam Winslow’s new look executive team and asks whether it has the attributes to succeed.

Home insurance premiums continue climb as motor dips

Pearson Ham’s latest Premium Price Index has revealed that home insurance prices continued to increase in May, while motor decreased slightly.

Labour repeats call for premium investigations

Shadow transport secretary Louise Haigh has promised to call on the Financial Conduct Authority and Competition and Markets Authority to investigate the cost of motor insurance.

FCA warns insurers against subletting regulatory responsibilities

The Financial Conduct Authority’s head of department for insurance market interventions, Caroline Gardner, has revealed the regulator’s concerns about providers keeping an eye on their claims handling partners.

Motor to return to profitability in 2024

Data Analysis: The latest Oxbow Partners motor insurance report proves to be encouraging reading for those operating within the space.

What is going on with electric vehicle insurance?

Post Podcast: What pushed up the price of electric vehicle insurance plus the steps providers are taking to ensure premiums are affordable is the topic of the latest Insurance Post Podcast.

One in 10 claim images flagged for potential fraud

One in 10 images from claims have been flagged for fraud concerns, according to Kaye Sydenham, Verisk’s anti-fraud product manager.