Technology

Spotlight on Digital: Insurance claims - The path to digitisation

A Post and SS&C Blue Prism survey found that 86.8% of insurer respondents believe that digitising all or part of the claims journey is the best way to improve the customer experience. Padraig Floyd explores how much progress is being made to achieve this…

Axa’s Fleming: Insurers need to innovate as consumers compare insurers to tech giants

As customers start to compare insurers to tech giants including Amazon and Apple, Anna Fleming, retail chief underwriting officer at Axa urged insurers need to innovate to provide customers with the seamless journey they expect.

Watch Aviva, Policy Expert and others discuss how insurers ‘level up’ to respond to market challenges and the pressure to drive profitable growth at a lower cost

Climate change. Inflation. demanding consumers. regulation. M&A activity. Insurance looks nothing like it did a decade – or even five years ago.

Claims Apprentice 2022: Episode two – Claims handling challenge

Now that our final six contestants have been put into teams and decided upon names, it is time for the apprentices to tackle their first task.

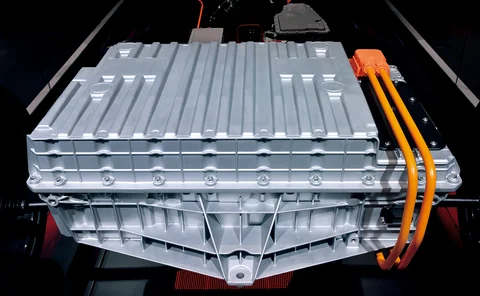

HV batteries ‘break the claims process’ and stymie adoption of electric vehicles

Insurers “can’t recognise the value” of high-voltage batteries within the claims process, an industry expert has warned.

Insurers ‘no longer aligned with tech advances in automotive’

Driver-centric models are “no longer sufficient” to properly assess motor risk in the age of advanced driver safety systems, Swiss Re has found.

Blog: Brand legacy vs digital innovation within the insurance industry

As customers now expect their insurance provider to have strong digital capabilities, companies can no longer rely on brand loyalty alone to appeal to their audiences. Kelly Ward, chief sales and distribution officer at Axa Partners UK, considers how…

Panel flags lack of understanding from consumers as biggest barrier to getting hold of data

It is “incredibly” important consumers understand how their data is used to remove the barrier insurers are facing when trying to get hold of data, a conference has heard.

E-scooters come with significant risks and require regulation: Axa’s Distefano

Axa’s managing director for home and motor Marco Distefano has urged regulators and insurers to get to grips with the risks presented by e-scooters, though they remain illegal on UK roads.

Telematics still perceived as difficult, but demand for usage-based products expected to increase: Ageas’ Clarke

While the demand for usage-based insurance products is expected to increase, driven by the reduction in driving, telematic products are still perceived as difficult, a conference has heard.

Managing supply chain without risk trade-off is like 'building an aircraft in the air', says Swiss Re

Swiss Re is developing a database tool to map supply chains that it believes will allow clients to track and predict risk as disruptions account for almost 40% of a supplier’s economic performance.

Intelligence: Managing the fire risks associated with lithium-ion batteries

With lithium-ion batteries becoming commonplace in everyday life, Post investigates the risks associated with them, and how insurers are incorporate such risks into policy terms.

Telematics watch: Driving everyone out of the Covid-19 pandemic

Among the many things upended by Coronavirus was the nation’s driving habits. Igo4 telematics data from the past two years shows that Covid-19 not only changed how much we drove but how we drove. And as we emerge from the pandemic, the trends in the data…

Carbon insurer Kita explores 'brand new market for the insurance industry'

Appointing itself the 'world's first carbon insurer', nascent Lloyd’s Lab start-up Kita is aiming for managing general agent status within the year and hopes to start insuring carbon reduction and removal products by early 2023.

Q&A: Kirsten Early, McLarens

After a year in the role, Kirsten Early global head of third-party administration at Mclarens, tells Post about how the role of TPAs is evolving and McLarens ambitions for its TPA offering.

Webinar: Watch Aviva, RSA and others discuss how to optimize hybrid workforces - and avoid the great resignation

Most insurance businesses have effectively been operating in a hybrid manner since Covid-19 restrictions required most employees to work from home.

Vast majority of public would not drive a fully automated vehicle

Most people would not be happy to drive a fully autonomous vehicle, a survey commissioned by Post has found.

Insurance Post launches VRM data accuracy tool for the motor insurance industry

Insurance Post subscribers can now benefit from our Vehicle Data Check tool to help validate VRM data.

Editor's comment: Back to the motor future

I recently visited London’s West End to see the musical of Back to the Future and was amused to see how much the world has changed since the film was aired.

Cyber Cube inks deal with Kroll to access 'frontline intelligence' during cyber catastrophes

Cyber Cube has struck a deal with risk consultancy Kroll that will give it access to “frontline intelligence” during unfolding cyber catastrophes.

Results-led approach to AI could “take the fear away” for sceptical parties

A results-led approach to using artificial intelligence in traditional human-led areas of insurance could help smooth implementation, an insurance expert has explained.

Data Analysis: Awareness campaign needed for drivers before accelerating introduction of AVs

Exclusive: A survey commissioned by Post found there are significant gaps in knowledge when it comes to self-driving vehicles, prompting calls for more education of drivers on the distinction between driver assistance and self driving.

Insurance Hound: Most read by insurers in March, April and May 2022

Which topics have insurers been reading most about?

Capgemini: only 8% of insurers 'Resilience Champions'; Allianz mulls Home & Legacy disposal; CII reports £4.4m deficit; and Questgates buys

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.