Technology

Blockchain and insurance: Is there still life in this tech solution after B3i entered into insolvency?

Blockchain was touted as the technology that could revolutionise the insurance and reinsurance industry. Yet, in July, the high-profile blockchain consortium B3i entered insolvency after it failed to raise funding. Martin Friel explores what went wrong,…

Infographic: Intelligent decisioning - turning a simple claim into a touchless claim

Even a “simple” claim may contain complexities that force automated systems to escalate, tying up claims adjusters as they work to verify minor details.

DAP integration with modern core systems

With increasing competition in the P&C insurance market, the pressure to deliver on claims experiences that alleviate customer anxiety and speed up the claims process is high.

Omni-experience vs omni-channel in insurance

Omni-experience is about creating flexibility for customers, employees and the various technologies and tools you deploy for people to navigate them fluidly, as their situation and preferences dictate.

World Life and Health Insurance Report - Key highlights

Wellness-centric strategies can strengthen customer relationships and spark new growth for life and health insurance providers.

The rise of parametric insurance

Parametric insurance is characterised by offering predefined pay-outs that will be paid based on predetermined events or parameters taking place, regardless of the actual loss caused.

Axa's Tara Foley: Moja is already attracting younger customers than other brands

During its first month of trading Axa’s new digital start-up Moja has attracted customers that are on average a decade younger than its other brands, Insurance Post can reveal.

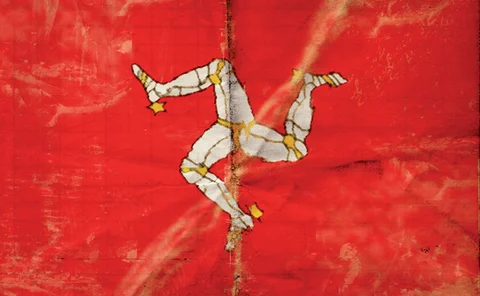

Isle of Man hosts insurtech 'accelerator'

A four-month ‘accelerator’ programme that kicked off in late September is at the centre of the Isle of Man’s plans to position itself a “centre of excellence” for insurtechs.

Briefing: Going Blanc again - Lemonade and Trov, a tale of two US insurtech pacesetters and their different paths to the UK

With Lemonade entering the UK market this week in partnership with Aviva, Jonathan Swift reflects on the similarities between its push and that of Trov in 2016. Not least the role of Amanda Blanc.

Applied Systems looks to use US strength in mission to be ‘number one in UK’

Speaking to Post at the Applied Net conference in Nashville, CEO of Applied Europe, Tom Needs has said that having a US arm of the business allows the UK and Ireland to experiment and innovate more.

IIL and Marsh’s Chris Lay calls on the industry to create a more resilient world in these turbulent times

The industry’s responsibility to encourage greater resilience comes hand-in-hand with imperatives around recruiting and retaining talent, and embracing and implementing technological solutions, argues Christopher Lay, president of the Insurance Institute…

The European Insurance Technology Awards are open for entries

Entries are open for the The European Insurance Technology Awards which are hosted by Insurance Post in partnership with sister Inforpro Digital brand L’Argus de l’assurance

Spotlight: Payments - The competitive difference in digital adoption

Digital adoption has been a key focus for the insurance industry in recent years. Vincent Belloc explains why regulation changes mean insurers need to double down on these efforts to develop more customer-centric experiences while keeping privacy a top…

Video: Leveraging digital trends in insurance - Part two

How can insurers leverage digital trends?

Dive In Festival: Leaders want more effort to promote diversity to avoid the next version of the internet becoming a 'dystopian nightmare'

Industry leaders have highlighted concerns about gender parity in leadership within emerging technologies, including the metaverse, advocating it is still a “very male dominated field”.

Video: Leveraging digital trends in insurance - Part one

How can insurers leverage digital?

Trade Voice: LMA’s Sheila Cameron explains why the Data Council's digital drive is a breakthrough for the industry

Sheila Cameron, CEO of the Lloyd’s Market Association and chair of the London Market Group’s Data Council, reflects on the efforts to foster digital trading in the London market and what the industry stands to gain from leaving analogue processes in the…

Accelerate speed to market for general insurance products

How can insurance technology leaders respond rapidly to changes in business strategy and the need for portfolio remediation?

Blog: Artificial intelligence & machine learning in insurance

As the insurance industry continues to realise the value of AI, new applications for the technology will be employed for continual enhancement of the customer experience.

Telematics watch: How the technology is helping to shape EV insurance

Historically, telematics has been used to rate driver risk to bring down insurance. But the growing popularity of electric vehicles has created driver concerns for which telematics may have the answer. Igo4 CEO Matt Munro discusses how the technology can…

Video: What is digital in the insurance industry?

This short video highlights how digitalisation within insurance has evolved beyond process automation and how digital technologies today can help insurers to enhance the customer experience.

Insurance fraud - but not as we know it

The UK insurance market is heading for unchartered waters when it comes to insurance fraud.

How different views on digital transformation impact customer experience

Digital transformation is fundamental to insurers’ drive for customer-centricity, but a misalignment in strategic goals is slowing progress.

Upcoming webinar: Watch Scor and Ms Amlin discuss how operational automation can increase efficiency and boost profitability

Insurance organisations today are under more scrutiny than ever from auditors and stakeholders alike. In response, many continue to shift their efforts from the digital transformation of front-end functions to driving higher levels of efficiency and…