Technology

Compare the Market CEO dismisses ChatGPT taking over PCWs

Compare the Market CEO Mark Bailie has argued the question of Chat GPT taking over from price comparison websites is “fundamentally flawed”.

Real-world AI implementation and your action plan

AI can drive competitiveness in insurance, but only with the right platform, expertise, implementation strategy, and partnership. This content sheds light on business scenarios of AI in action, implementation strategies and the critical success factors…

Guidewire eyes retail broking and reinsurance for ‘next chapter’

Guidewire is experimenting with building solutions to connect its customer base of primary insurers with reinsurers and retail brokers, the company’s group vice president Charles Clarke has told Post.

Yates exits EIS after almost four years

Rory Yates announced Friday (31 October) was his last day as chief strategy officer at EIS Ltd.

Insurers double tech hires as AI climbs agenda

UK insurers have more than doubled the number of new board appointees with technology expertise over the past year, outpacing their banking and asset management peers.

Technology arms race to fuel London market M&A

Companies in the London market will increasingly pursue peer-to-peer technology integration driving greater facilitation and more mergers and acquisitions, Guidewire’s London market lead Jamie McDonnell has predicted.

Guidewire CEO maps insurance sector’s AI transformation

Guidewire CEO Mike Rosenbaum has outlined how he thinks generative artificial intelligence and large language models will change the insurance industry.

Insurers ‘shouldn’t have to wait’ to start automating

The take-up of AI and automation processes could be lessening insurers’ focus on complex digital transformation, according to Sasha Haco, CEO of Unitary.

Q&A: Mark Miller, Insurevision

Mark Miller, founder and CEO of Insurevision, discusses with Insurance Post how the firm’s artificial intelligence computer vision technology has the capacity to begin telematics 2.0 and fulfil the untapped potential of the original technology.

Verisk puts Ignite on the market

Sources have told Insurance Post that Verisk is considering options with its software house Ignite, with a sale among the possibilities.

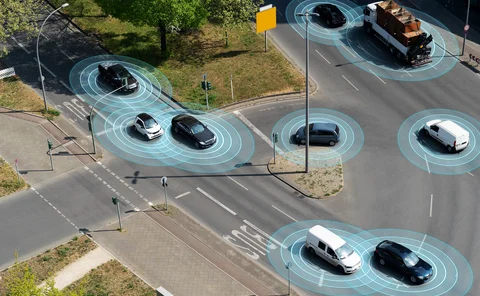

Majority of Brits concerned about self-driving vehicle safety

An Allianz survey has found British people are the most concerned in Europe about self-driving cars.

Mea CEO argues AI can now impact combined ratio

Mea CEO Martin Henley has argued agentic artificial intelligence success could be measured against its impact on an organisation’s combined ratio.

Why MGA’s suppliers are more than a support act

View from the Top: Mike Keating, CEO of the Managing General Agents’ Association, examines the ecosystem of suppliers that underpins the UK’s MGA community.

60 Seconds With... Resilience’s Si West

From fending off cyber villains to mentoring global security teams, Si West, director of customer engagement at Resilience, blends digital defence with dad jokes and a dash of Queen.

CEO voices – A Sollers interview series: Interview with Ken Norgrove, CEO of Intact Insurance

Climate change is the top challenge. Reinsurance, nature-based solutions, and AI in pricing and claims are key. Success lies in blending tech and people. This article explores how digital claims, broker ties, and commercial lines can boost UK market…

Could Applied be lining up a bid to buy a UK software house?

Deputy Editor’s View: It has been a few months now since Applied Systems pulled its Epic product from the UK. However, Scott McGee asks if they are lining up an even more shocking move?

MS Amlin predicts AI will replicate outsourcing consequences

The impact of artificial intelligence on the insurance workforce will be similar to the effect of outsourcing, according to MS Amlin chief people officer Gemma Lines.

Q&A: Haris Khan, Novee

Haris Khan, CEO and co-founder of Novee discusses how the firm will execute its mission to solve efficiency and data visibility challenges for underwriting technology.

NTT Data targeting ‘accelerated growth over the next three years’

NTT Data has acquired Derry-based insurance technology consultancy Alchemy, with the firm endeavouring to take aim at insurers utilising Guidewire products.

AI that could hit insurers with wave of court cases wins backing

Artificial intelligence-driven claims technology capable of causing a surge in court-bound insurance disputes has won the financial backing of a law firm backing and is now being piloted with a major loss assessor, Insurance Post can exclusively reveal.

AI video tech three times better than telematics at predicting risk

Artificial intelligence-powered video telematics technology is three times better at risk prediction accuracy than traditional telematics inputs.

Staysure assembles specialist team for AI chatbot

Staysure has assembled a team of conversational artificial intelligence specialists to continuously monitor and refine its AI webchat assistant Susi.

Allianz UK creates head of AI role

Allianz UK has appointed Mansoor Reehana to the newly created head of artificial intelligence role.

Ransomware costs soar as cyber claims decline

The financial fallout of ransomware is mounting, even as the number of cyber insurance claims received declines, data from Resilience has revealed.