Technology

Blog: Diary of an insurtech start-up, episode 2: Silicon Valley

James Stuart Clarke, head of sales and partnerships at Digital Fineprint, compares the start-up scenes of San Francisco and London in the second instalment of his behind-the-scenes look at insurtech disruption.

Digital Collective Blog: Getting the CFO on board

Most corporate data is ultimately used to feed financial systems and drive C-level decisions, so having the chief financial officer as an ally or even as a sponsor for your insurance core system transformation seems like an obvious choice. Adam Lamkin,…

Blog: Know your customer... and your opposition

‘In the midst of chaos, there is also opportunity', wrote the great military strategist Sun Tzu a mere 25 centuries ago. His observation still holds true in these strange times of disruption. And seizing the opportunity is vitally important to modern…

Driverless cars law stalled by general election

The government’s driverless cars bill will have to be reintroduced from scratch in the next parliament after the general election.

Ian Penny to take over as chief information officer at Hiscox following Wharton's departure

Ian Penny has been appointed as chief information officer for Hiscox, taking over from Gareth Wharton who is joining a newly formed cyber initiative at the company.

Chubb's Jeremy Miles on the battle between algorithms and service

Last month, The Economist magazine featured a provocative article on disruption of the insurance sector that examined how businesses are using technology to re-engineer the underwriting model.

Blog: Whiplash, discount rate, Vnuk and driverless cars on the road ahead

The Association of British Insurers’ announcement that motor insurance premiums hit their highest recorded levels at the end of last year is another reminder that change is long overdue in the personal motor market. That’s coming but will it be enough?

Blog: How to destroy data securely

As an insurance company, it is absolutely essential to take extra care when destroying documents or materials containing any sort of personal or financial information.

Blog: IoT 2017 - It's not all about data

As an insurer, understanding the Internet of Things and solutions it offers to our customers is one of our key priorities. But we also know that if we only think about IoT and insurance from one perspective, it can lead to the wrong answer. We need to…

Blog: Take part in IMIA photo competition

Can advances in imaging technology really help engineering risk underwriting? Richard Radevsky, executive committee member of International Association of Engineering Insurers, believes they can.

British Insurance Awards: 2017 shortlist revealed

Today we reveal the companies that will be in the running for the 23rd British Insurance Awards at the Royal Albert Hall.

Q&A: David Nayler, British Insurance Law Association

David Nayler took the chair of British Insurance Law Association in October last year, a body whose membership derives from brokers, insurers and legal firms. He has worked at Aon for 11 years, most recently as head of financial and professional, legal…

Blog: Next Gen Claims - a perfect storm is looming

Why insurers that recognise and understand the implications of the digital and data revolution will lead the way in building new claims capabilities, stealing a march on competitors.

This Month in Post: Rates, start-ups and fraud

Spring is in the air and it's a time well-known for cleaning out the old and starting anew. As I continue to unpack boxes and work out where to put all of the fairly useless things I have collected over the decades, the industry has been taking its own…

Tech-driven commercial insurance broker Konsileo enters market

Tech-driven commercial insurance broker Konsileo has entered the market and is in the process of recruiting mid-market brokers.

How connectivity can improve our health

By 2020 it is estimated there could be 30 billion connected devices worldwide – more than four devices for every person alive.

Startup Trov secures $45m for expansion efforts

On-demand insurance provider Trov has secured $45m (£36m) of investment for its global expansion efforts.

RMS expands cyber risk models to include physical damage

RMS has expanded its range of cyber models to include cyber physical models to help insurers weigh up the cost of risk.

Plum high net worth home insurance to include cyber cover

Plum underwriting has included cyber and data risks cover into its high net worth and mid net worth home insurance products.

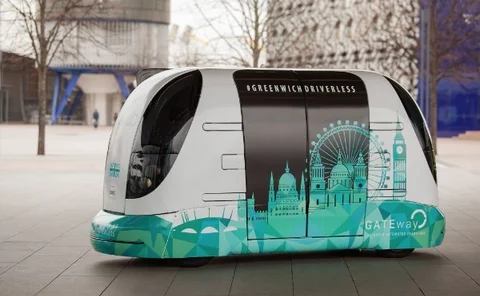

RSA takes part in study of autonomous vehicle prototype

RSA is taking part in a study of prototype autonomous vehicles as driverless shuttlebuses take to London roads.

Interview: John Nelson, Lloyd’s of London

It is the most prestigious chairmanship in UK insurance. But next month, John Nelson will step down after six years in the role of Lloyd’s chairman. He talks to Ryan Hewlett about steering the market through one of its most turbulent periods

Willis Towers Watson and AIG launch cyber cover for global airlines

Willis Towers Watson and AIG have created a cyber insurance product designed to combat the emerging risks facing global airlines.

FM Global launches interactive global flood map

FM Global has launched its interactive global flood map for executives and risk managers.