United Kingdom (UK)

Analysis: Risks, challenges and opportunities of commercial use of listed buildings

Underinsurance casts a long shadow across the world of listed properties, especially when owners are constantly expanding commercial activities. Experts warn that there can be many traps for the unwary or naïve, many of which do not come to light until…

Broker Network makes fifth ‘powerhouse’ acquisition

Broker Network has bought a West Sussex commercial broker with turnover of £2.9m.

XL Catlin adds Brexit continuity clause to policies

Policies issued by XL Catlin’s London operations will include contract continuity clause to offset any fallout from the UK’s exit from the European Union.

City Minister on why the government is supporting insurance as the engine of the economy

City Minister John Glen is confident the new UK framework for insurance linked securities will help the market grow.

Blog: How to make your cyber offering stand out

Cyber insurers can gain market share by differentiating their products. Benedict McKenna, vice-president and London operations claims manager at FM Global, explains how.

Ombudsman launches review following undercover investigation

Thousands of complaints against insurers may need to be re-examined after a TV investigation found staff at the Financial Ombudsman Service were woefully undertrained.

Munich Re to cut 900 jobs as reinsurer targets profits surge in 2018

Munich Re is to axe 900 jobs as part of cost saving efforts in its reinsurance business.

This week in Post: Claims, costs and closures

This week I was lucky enough to climb on the top of a lift with one of Allianz’s engineer surveyors and take a trip up and down a building.

Blog: Medical hope for mesothelioma patients and asbestos insurers

Possible mesothelioma treatment will require a new approach to asbestos claims, explains Ian Harvey, head of claims strategy at Pro Global.

Rising Star: Matthew Vamplew, DAS UK Group

Starting in the industry as a business consultant at Cognizant Technology Solutions, Matthew Vamplew has quickly worked his way to innovation manager at DAS UK Group.

Markel International to cease writing London open market property

Markel International has ceased writing London open market property business, making three redundancies.

Aston Lark buys masonic broker Ingram Hawkins & Nock

Aston Lark has bought specialist broker Ingram Hawkins & Nock in a deal that will add £10m of premium to the group.

Aviva hires LV and Zurich bosses in commercial growth plan

Exclusive: David Carey and Mark Campbell have left Zurich and LV respectively to join Aviva, as the company bolsters its commercial business.

MCE to pull out of Ireland following ‘incredibly disappointing’ loss of passporting

MCE Insurance will cease writing business in the Republic of Ireland from next year as a result of a loss of passporting from Brexit.

Axa denies U-turn after customer has excess refunded from Liverpool car park fire

Exclusive: Axa has denied it has made a U-turn after a customer had their excess refunded from the Liverpool car park fire.

Blog: 'Beast from the East' hits farms hard

The 'Beast from the East' has killed sheep, stopped milk collections and destroyed farm buildings. Graham Plaister, loss adjuster at Agrical, describes the tempest of claims blowing through the sector.

Zurich’s Thomas Liebi on the spectre of inflation

After the stock exchange jolts earlier this month, Thomas Liebi, head of US & UK market strategy at Zurich, analyses whether inflation fears are justified.

UK General launches cyber personal lines product

UK General has launched a personal lines cyber insurance product to cover loss from cyber bullying, defamation and insured data held on smart devices.

Mark Collins replaces Robin Challand as CIO at Ageas

Mark Collins is to replace Robin Challand as chief information officer at Ageas following Challand’s appointment as claims director at the company in January of this year.

Canopius appoints Davison and Meyer to COO and CFO after buyout

Canopius has named Laurie Davison as group chief operating officer and Nigel Meyer as group chief financial officer.

Loss adjusting and insurtech gains fail to stem Charles Taylor profit decline at full year

Well-publicised gains in Charles Taylor’s loss adjusting and insurtech arms saw revenues jump 25% in 2017 but failed to push the insurance services provider to profit.

Blog: Video killed underinsurance

The technology that can radically change household insurance has nothing to do with smart home devices, argues Charlotte Halkett, managing director of insurance product at Buzzvault, who bets on video surveys.

NMU to close Letchworth office in restructure

Munich Re service company NMU is closing its Letchworth office in a restructure of its Southern Region operations.

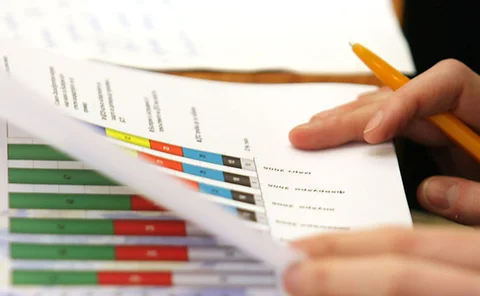

Motor premiums climbed by over 10% in 2017

Premiums for all types of motor insurance increased in Q4 2017.