Claims

This week: Proceedings and premiums

This week the UK has been focused on court cases and Inquiries.

Sedgwick UK shakes up leadership team after Cunningham Lindsey merger

Stewart Steel has been named CEO of Sedgwick UK, which will be formed from a merger of Cunningham Lindsey and Vericlaim.

Konsileo to offer 'bespoke' customer data for underwriting

Konsileo said its service will improve the claims process for insurers by providing underwriters more insight into risks.

HDI's Jens Wohlthat on the need for hardening

Natural catastrophe risks reveal the need for industrial cover rate hardening, writes Jens Wohlthat, member of the HDI board of management.

Blog: Insurers should cover recyclables price volatility

The reluctance of current players in the waste sector to manage recyclables price risk presents opportunities for the insurance sector, explains Surabhin Chackiath, waste and resource management consultant at SLR Consulting.

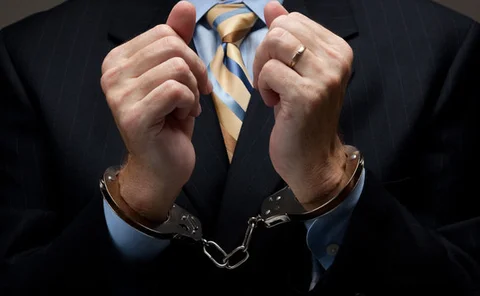

Das v Asplin: Prosecution outlines arguments on fraud charges

The trial of former Das CEO Paul Asplin continued today (18 April) at Southwark Crown Court.

Motor premiums have already started to fall: Fitch

Insurers have already started to reduce motor premiums ahead of the government’s proposed whiplash and discount rate reforms.

Blog: Time to talk about psychological rehab

Insurers must embrace psychological rehabilitation in the same way that they have physical, explains Jonny Cook, founder and chairman of Corporé.

Cunningham Lindsey to be rebranded Sedgwick following acquisition

Cunningham Lindsey will be subsumed under the Sedgwick brand following the acquisition of the adjuster last year.

Ghost broker jailed after making £321,000 of false car insurance claims

A ghost broker who used victims’ details to make £321,000 of false car insurance claims has been jailed.

British Insurance Awards: 2018 shortlist revealed

C'mon everybody, it is shortlist time!

Blog: Not taking hands off the wheel just yet

UK laws, roads and infrastructure are getting ready for self-driving cars but motorists remain reluctant to adopt this technology, points out Simon Walker, group CEO of First Central.

FCA vows to bring dual pricing under the spotlight

The financial watchdog has vowed to tackle the problem of dual pricing in the coming year.

Underwriting pressure drives negative outlook for London market

Underwriting pressure from the high cost of doing business have caused Fitch Ratings to report a negative sector outlook for London market reinsurance and insurance in 2018.

Analysis: Business interruption - Lost in translation

Specific terms and technical meanings can be misinterpreted and the difference in language used by insurers and insureds could lead to underinsurance when taking out business interruption cover

Blog: Value your complaints

Artificial intelligence can spot dissatisfaction trends but only good complaint handling will help insurers get value out of those insights, explains Mark Parnaby, managing director of Cynergie, a Davies company.

Month in Post: He’s back and will bite at your ankles

There is always something troubling about a disembodied head. More so, when it is Arnie’s head and it is shouting at people at the bus stop.

Blog: Intellectual property insurance still under valued despite rise of cyber attacks

There still appears to be a significant disconnect between the understanding of cyber risks and the response to them at board level. RGL Forensics partner Ben Hobby explains that as a result companies might have already suffered, or are about to suffer,…

Cat bond issuance hits $3.1bn in Q1

Insurers and reinsurers sponsored $3.1bn (£2.2bn) in catastrophe bonds in the first quarter of 2018, up 34% from the first quarter of 2017, according to data analytics provider PCS.

Downstream energy sector suffers worst loss in nearly a decade

The downstream energy sector suffered its worst loss record for nearly a decade in 2017 with low rating levels exacerbated by one of the worst catastrophe loss years on record.

Interview: Matthew Reed, Equipsme

A veteran of brokers Towergate and Hyperion Group, and latterly insurer Axa, Matthew Reed is now fronting his own insurtech. Here he speaks to Jonathan Swift about how the managing general agent plans to make it easier for brokers to sell corporate…

Brokers informed: W&I for bricks and mortar

Warranty and indemnity insurance has seen significant growth in the real estate sector over the last few years. And, with the cover offering significant advantages to those involved in real estate deals, many expect it to become a standard part of any…

Aviva's Rob Townend on making sure policyholders benefit from whiplash reform

The whiplash reform and discount rate change can be positive for customers, but Rob Townend, managing director at Aviva UK general insurance, warns the challenge for the industry will be to demonstrate these measures have indeed benefitted policyholders.

Blog: How to stop silicosis becoming the new asbestos

Silicosis could result in claims if employers don't manage risks correctly, explains Andy Miller, technical risk control manager at Allianz UK, wondering whether a tougher approach might be needed.