Insurtech

Insurers told to embrace disruption rather than dabble in it

Insurers have been told by Spain’s biggest insurer to go for transformation at scale by overhauling their core business and processes, rather than dabbling in just a few systems and products.

Intelligent AI aims to slash commercial property underinsurance

Anthony Peake, CEO of Intelligent AI, intends to launch a reinstatement platform that aims to slash commercial property underinsurance.

Mapfre is testing generative AI

Mapfre, Spain’s biggest insurer, has confirmed it is already testing generative artificial intelligence.

Q&A: Chris Sawford, Verisk

As inflation drives upward pressure on premiums, Chris Sawford, managing director of claims at Verisk, reveals how he plans to help insurers tackle pain points in the claims lifecycle.

Joined-up data is key to Consumer Duty compliance

Risto Rossar, founder of insurtech Insly, says insurers that still rely on Excel, Word, and a mishmash of management systems will fail to comply with the FCA's Consumer Duty.

The content conundrum: Humanised insurance is as varied as humanity

In order to support humanised insurance, we must understand some key facets of humanity. This blog highlights the conundrum of insurance automation for a software provider and why humanised insurance is as varied as humanity.

AI in insurance: Potential risks and benefits

As insurers strive to stay ahead of fraudsters, artificial intelligence is emerging as a formidable weapon.

Case study: Regional property insurer

This case study explores how a regional property insurer’s partnership with LTIMindtree and Duck Creek led to the launch of a direct-to-consumer channel for personal lines homeowners’ products, allowing for a true multi-channel experience for their…

Commercial renewals leave businesses open to cyber attacks

Current industry practices around commercial insurance renewals leave businesses vulnerable to cyber attacks, the founders of an industry-backed data sharing platform have said.

Seven signs your customer engagements are producing unhappy policyholders

Insurers are tasked with the challenge of engaging effectively with customers as they journey through the policy lifecycle.

Luko joins Admiral; Stubben Edge launches capital arm; Aspen appoints reinsurance CUO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Q&A: Thomas Hauschild, Omnius CEO

A self-confessed ‘claims nerd’, former chief product officer Thomas Hauschild took over as CEO of claims automation insurtech Omnius in February. He talks to Jonathan Swift about taming the legacy systems ‘animal’, and finding shortcuts to get the best…

Reinsurance management: The biggest risk in insurance?

Reinsurance is a vital function, empowering insurers to offer more coverage to more customers at a more competitive price.

Customer success story: Saxon Insurance becomes a virtual carrier

Saxon Insurance serves the Cayman Islands community, which is comprised of approximately 50,000 inhabitants.

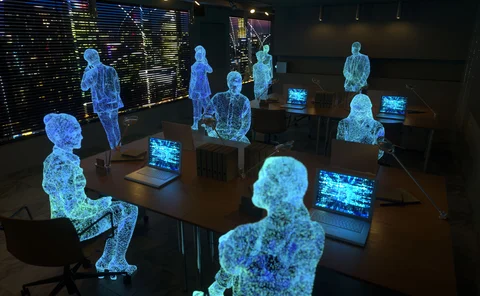

Are you ready for the rise of robo-insurers?

Editor’s View: Emma Ann Hughes examines how artificial intelligence has the potential to disrupt the entire traditional insurance value chain and wonders whether human insurers are ready for it?

Insurance innovators Nordics roundtable: Seizing the ecosystem opportunity

Trust, value and flexibility are the key principles shaping embedded insurance offerings in the Nordics.

Adapting to the Post-Covid landscape: Self service insurance solutions

The insurance industry has seen a shift in customer preference towards self-service portals, due to the rapid rise of tech-savvy customers.

Insurtech Lukango seeks to shake up UK SME market with Markel tie-up

Startup Lukango is looking to revolutionise the UK microbusiness market by replicating $4bn insurtech Next's stateside success this side of the Atlantic.

A beginner's guide to underwriting workbenches

Underwriting workbenches represent an opportunity for insurers and MGAs to increase their competitive edge by automating administrative processes, augmenting data sets and increasing regulatory compliance. Download this report to find out more.

Infographic: Global consumer insurance insights 2023

The 2023 Global consumer insurance insights survey gathered in-depth feedback from over 2,000 insurance consumers across 13 countries, delving deep into their purchasing habits, and openness to new products and communication methods from insurers.

Building humanised experiences together

This workbook is designed to give insurers the opportunity to develop a plan to create humanised experiences.

Why inefficiency is an insurer issue

Graham Gordon, product and strategy director for Property and Casualty at Sapiens, explains why intelligent workflows and process automation is key to insurer's getting ahead of the game.

Exploring the impact of the ‘cost-of-living crisis’ on pet insurance sales and renewals

At a recent roundtable discussion hosted by Insurance Post, in collaboration with CRIF, an expert panel discussed the influence of the current cost-of-living crisis on pet insurance sales and renewals.

Defining humanised insurance technology

How can the insurance industry provide customer experiences that are empathetic and experiences that connect people with higher levels of engagement?