Claims

Legal Update: Nervous shock claims restrained

The end of the 2015 to 2016 parliamentary session brought an end to the progression of the Negligence and Damages Bill, which would have extended the class of potential secondary victim claimants to include not only the immediate family of an injured…

East coast storms to cost Australia's insurers A$235m

According to the Insurance Council of Australia June's east coast storms will cost insurers A$235m (£120m) in claims.

Storms Elvira and Friederike will dampen French and German earnings

Storms Elvira and Friederike will dampen the first half 2016 earnings of French and German insurers, though it is unlikely there will be any negative rating actions as a result, according to AM Best.

Blog: Harnessing the power of social media to tackle insurance fraud

Social media is providing insurers with a time-saving and cost-effective weapon in their armoury to fight fraud

Crawford & Co launches Alternative Business Structure

Jason Spencer will join Crawford in setting up the alternative business structure (ABS) in order to deliver a wider variety of services.

Official fraud stats are ‘spurious’, legal campaigners claim

The claim that fraud adds £50 to the average insurance premium is just “plain wrong”, legal campaigners have claimed.

Zurich, Vnuk and broker commission in the news; new Airmic chair interviewed

Insurance news and Post exclusives of the past week, in case you missed it

IMPRC 2016: Veil must be lifted on insurance to gain trust

The insurance industry needs be more transparent on what is does in order to gain customer traction and trust.

IMPRC 2016: Marketing professionals define what makes a brand powerful

Three leading insurance marketing professionals were each given 400 seconds to outline their communication strategies at a ‘pecha kucha’ session at an industry conference.

DAC Beachcroft’s Claims Solutions Group launches new Innovations Lab

DAC Beachcroft has responded to calls for the insurance industry to be more innovative with the launch of its Innovations Lab - a research and development hub.

Blog: Why insurers should get access to public sector data

There is now scope for insurers to benefit from wider sources of intelligence to validate claims

IAG receives 10,000 claims from storms

Australian giant IAG has received around 10,000 claims from Australia's deadly east coast storm.

Flood investment shouldn’t be about ‘sticking a plaster’ in an emergency, ABI warns

The government needs to “take the politics out” of decisions about flood defences, the Association of British Insurers has said.

Sponsors could seek ‘disgrace’ insurance claim against Sharapova

Sponsors of Maria Sharapova may be eligible to pursue an insurance claim against her under a ‘disgrace clause’, should her ban be upheld.

North of the Border: Key differences on the Insurance Act

The landscape of Scottish law will feel quite familiar to someone who deals primarily in English law but can be a trap for the unwary where it differs

Legal Update: The ins and outs of opting out

New provisions in the Consumer Rights Act 2015 allow opt-out collective actions

Working group launches review of revised rehab code

Industry bodies have begun a review into the revised rehabilitation code, six months after it went live.

Pet claims database to launch as fraud detection tool

A national record of pet insurance claims has been launched as a tool in the fight against fraud.

Cost to insurers from French floods could be €2bn

Damages from the floods affecting Paris and the surrounding areas could almost reach €2bn, one of the country’s biggest insurers has warned.

Insurance Council of Australia declares catastrophe in Tasmania and Victoria

As the result of a deadly east low storm, the Insurance Council of Australia has declared a catastrophe in Tasmania and Victoria after a similar declaration in New South Wales yesterday.

Digital: Snooping in the age of social media

The access that private and public bodies have to our personal data has been a continual point of debate in the electronic age and the current passage through the Houses of Parliament of the Investigatory Powers Bill is a case in point

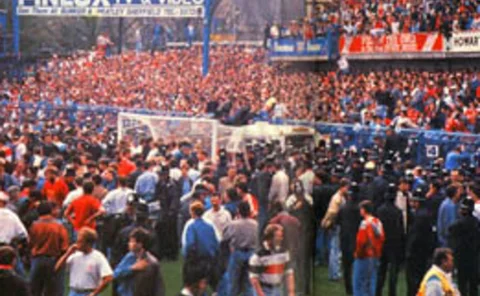

Hillsborough compensation ‘won’t be covered by insurance’

The taxpayer could face a bill of several million pounds from compensation payouts to the families of the victims of the Hillsborough disaster, Post can reveal.

Three dead after powerful New South Wales storm

A weekend of intense storms over New South Wales have left three dead and a trail of damage.

Post Claims Awards: AIG, Allianz, Aviva, LV and RSA's Paton among the winners

RSA group claims director Bill Paton was last night acclaimed as the achievement award winner at the Post Claims Awards.