Brexit

This month: Reputation, climate change and technology

This month’s issue looked at reputational issues the sector is facing and what needs to be done to improve the industry's reputation going forward.

Interview: Dominic Clayden, Motor Insurers’ Bureau

The newly appointed CEO of the Motor Insurers’ Bureau discusses modernisation, Brexit, whiplash portals, and Lewis v Tindale with Martin Croucher

This week: heatwave, hurdles and honours

Our neighbours in France may have hit their highest ever recorded temperature this week as the heatwave that struck Europe saw schools closed, but Post revealed motorists holidaying there will not be able to claim compensation if they are struck by an…

The MGAA's Peter Staddon on evolving MGAs

Many managing general agents are turning to digitalisation to enable them to look deeper into their books of business, Peter Staddon, managing director of the Managing General Agents' Association, explains this will allow the MGAs to see potential…

Blog: Will Brexit fundamentally change the dynamics of travel insurance?

The UK's withdrawal from the EU could leave many travellers with pre-existing medical conditions struggling to get cover. Aquarium Software's product marketing director Mark Colonnese suggests a solution whereby insurers bid against each other to cover…

Financial services Brexit bill approaches £4bn as preparations slow

Major financial services firms had spent nearly £4bn preparing for life after Brexit as of 31 May, according to EY.

Brexit: UK motorists unlikely to get compensation from hit and runs in France

Exclusive: Motorists driving in France will not be able to claim compensation if they are struck by an uninsured or untraced vehicle after Brexit.

Insurers issue motor claims inflation warning over new technology

Exclusive: The complexity of repairing semi-autonomous vehicles has seen claims inflation rise significantly in the past year, insurers have warned.

Blog: Aviva's plan to split its UK business is more of a reset than a shake-up

This week Aviva has been tipped to unveil a new structure which will again see its UK general insurance and life/pensions businesses split. Jonathan Swift reflects on why this should not come as a surprise as history dictates the insurer has never been…

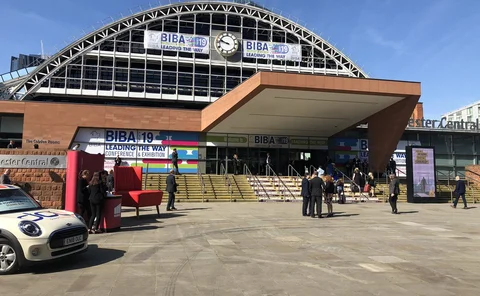

This week in Post: Conference, cuts and conservative leadership

This week, along with the rest of the team, I attended the British Insurance Brokers’ Association conference. I knew it would be an action-packed week - but nothing could prepare me for what was ahead.

Analysis: Managing the M&A insurance risk

It was the Competition and Markets Authority that recently put paid to Sainsbury’s and Asda’s marriage plans, but there are plenty of other risks that also regularly threaten the success of mergers and acquistions – ranging from the uncovering of…

Clyde & Co establishes presence in Dublin ahead of Brexit

Clyde & Co has opened an office in Dublin to ensure its Irish law insurance practice can continue to operate seamlessly as the UK leaves the EU.

Analysis: Consolidators look to Europe for acquisitions as UK competition grows

The UK has seen a wave of consolidation in regional broking over the past few years, making competition for viable targets a challenge. In response, several consolidators are starting to look to Ireland and Europe as a potential area of expansion.

Discount rate: Are insurers being too optimistic?

In anticipation of the new discount rate announcement, expected by 5 August 2019, many insurers have already started to price and reserve at 0%

Claims costs drive an increase in van insurance premiums

Claims costs have driven an average premium increase of 35.1% since April 2014, Consumer Intelligence has found.

Flagging personal lines see Covéa's profits slashed

Covéa Insurance saw its underwriting profit slashed to £1.8m in 2018 compared to £12.4m in 2017, as its personal lines business felt the impact of claims inflation and adverse weather.

Brexit and fair pricing lead FCA general insurance agenda for 2019/20

The Financial Conduct Authority has set out its priorities for the year ahead in its 2019/20 business plan, identifying Brexit as its “immediate priority”.

Trade credit claims mount as UK tops global insolvency forecasts

Trade credit insurer Atradius has forecast that global insolvencies are set to rise for the first time in 10 years, with the UK facing the highest increase of all advanced markets.

French insurer to set up UK branch as Brexit fail-safe

French insurance company La Parisienne Assurances will establish a third-country branch in the UK, in order to continuing operating in the country after Brexit.

Pukka halts UK branch Brexit plan

Exclusive: Pukka has shuttered a dormant UK branch that would have acted as a contingency if the UK and Gibraltar lost passporting arrangements.

Special Report: Motor Insurance Research 2019

What’s fueling motor insurance today? Michele Bacchus talks to the industry and gives the low-down on what’s heading down the highway towards insurers in both the fast and slow lanes

This week: All change... please!

The more things change, the more they stay the same. So runs a French expression that feels apt in a week that saw Brexit delayed, leaving us all wondering whether we will be able to talk about anything else ever again.

Brexit could fuel motor price uptick after year of falling premiums

Despite motor insurance premiums falling 6.7% in the past year, data analytics company, Consumer Intelligence, has warned that concerns over Brexit could be causing premiums to creep upwards.

Liberty redomiciles its European insurance company to Luxembourg

Liberty Mutual Europe has completed its re-domicile from the UK to Luxembourg.