Technology

Ecclesiastical is cautious about generative AI for complex tasks

Ecclesiastical’s generative artificial intelligence technology is not ready to support high value or complex task replacement, according to group technology director Graeme Howard.

Hiscox’s Tipper on why creative AI demands respect

Max Tipper, head of media at Hiscox UK, considers whether the media and creative businesses are ready to safely use generative artificial intelligence, and whether insurers are ready to provide the protection these companies need.

Consumers want Amazon and Tesla embedded insurance products

Four out of 10 consumers would be comfortable with the idea of buying insurance from companies such as Ikea, Amazon, or Tesla when making purchases from those brands, according to Guidewire’s Insurance Consumer Survey 2024.

Unforeseen impact of generative AI on insurance

Rory Yates, chief strategy officer of EIS, explains why labelling everything as generative artificial intelligence is confusing at best, and at worst could be a very dangerous mistake.

Who is liable if AI in healthcare fails and causes harm?

Law firm DAC Beachcroft’s Simon Perkins and Stuart Wallace reveal what could happen if a claim is made against a healthcare provider that relies on artificial intelligence to spot diseases.

Diary of an Insurer: Peppercorn AI's Nigel Lombard

Nigel Lombard, CEO and founder of insurtech Peppercorn AI, shares a week in the life of a start-up, which includes remote working, investor meetings and gaining B Corp status.

Axa and Zego reject generative AI for pricing

Axa and Zego have ruled out using generative artificial intelligence for pricing due to compliance concerns.

Three key takeaways from ITC DIA Europe 2024

Artificial intelligence can be used to close the digital gap in insurance; meanwhile, some feel that generative AI is just a temporary hot topic, according to experts gathered at ITC DIA Europe, which took place in Amsterdam this week.

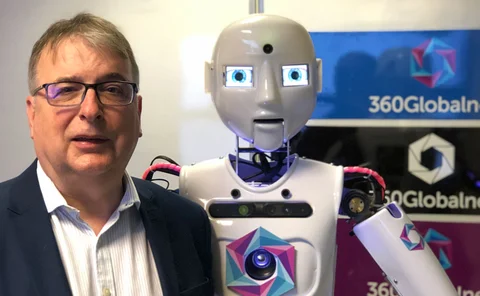

Q&A: Paul Stanley, 360Globalnet

Paul Stanley, CEO & founder of 360Globalnet, speaks to Insurance Post about the software firm’s growth, digital claims, and the benefits of no-code systems.

Video Q&A: Mind Foundry’s Selim Cavanagh

Mind Foundry director of insurance Selim Cavanagh recently caught up with Insurance Post content director Jonathan Swift to discuss the use of generative AI within the insurance space.

Contractual requirements boost cyber insurance adoption

A cyber expert at Marsh has warned contractual obligations driving businesses to purchase cyber insurance could be a double-edged sword.

Q&A: Richard Clarkson, WTW

Richard Clarkson, global market leader, global specialty for insurance consulting and technology at WTW, explains how the business is working to help global specialty carriers reduce costs across underwriting, trading, and technical actuarial processes.

NHS cyber attack highlights dangers of underinsurance

Hospitals across the capital have declared a critical incident after a cyber attack caused operational havoc to medical services.

Big Interview: Cécile Fresneau, QBE

Cécile Fresneau, managing director of the insurance division of QBE’s European Operations, reveals her growth plans, hopes for generative artificial intelligence and her efforts to boost the number of female senior underwriters.

Impact of fraud reaches unprecedented UK levels

In the UK, the impact of fraud on individuals, businesses and the public sector has reached unprecedented levels.

Three examples of intelligent automation in insurance

Intelligent automation in insurance is a powerful tool that reduces human error and the need to perform repetitive tasks manually.

How AI can place insurers in the green lane

Bill Brower, senior vice-president of global industry relations and claims sales at Solera, explains how artificial intelligence will be pivotal in moving the needle on insurer's environmental, social and governance goals.

Applied building momentum as it enters pilot with Aviva

After increasing the number of brokers on its Epic platform in 2023, Applied Systems Europe CEO Tom Needs said he expects to match that growth again this year.

How Labour could reduce the cost of motor insurance

Analysis: Emma Ann Hughes examines efforts by the industry to push down motor insurance premiums and whether politicians could force providers to take more extreme action.

Overcoming the challenge of insuring self-driving vehicles

Andrew Ballard, product principal for LexisNexis Risk Solutions, Insurance, explains how the Automated Vehicles Bill could help ensure insurers have access to the data needed to insure self-driving vehicles.

Diary of an Insurer: Claims Consortium Group’s Jeremy Hyams

Jeremy Hyams, founder of Claims Consortium Group and Synergy Cloud, spends his week looking for missing school shoes, cooking up a storm, talking high-level strategy, exploring international opportunities and new predictive insurance tools.

Industry told not to worry about AI job losses

A panel on artificial intelligence held at the British Insurance Broker’s Association conference in Manchester assured the audience that they won’t be “replaced by robots”.

Electric opportunities for total loss claims

Collaborative partnerships between insurers and replacement vehicle suppliers can help smooth the transition to zero emissions, as James Roberts, head of insurance sales for Europcar explains.

Q&A: Daniel Grimwood-Bird, McKenzie Intelligence Services

Daniel Grimwood-Bird, head of sales and marketing at McKenzie Intelligence Services, shares how the provider of geospatial data and analytics plans to insurance industry plans to make it big in the UK and US.