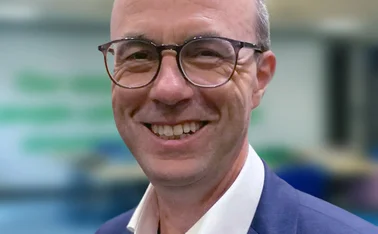

Diary of an Insurer: Zurich’s Louise Colley

Balancing early starts, strategic planning and hands-on leadership, Louise Colley, director of retail protection at Zurich UK, lifts the lid on what it takes to run the business.

Monday

The day starts with a 5.30 am walk with Ollie, my energetic German Shorthaired Pointer, who tends to sniff out the pheasants at this time of year!

These early walks – less enjoyable in the dark but made safer by his flashing collar – offer a chance to gather my thoughts before diving into the week ahead. I normally plan the week ahead on Sunday night, so I have a good sense of the day.

Running an end-to-end business with a 385-strong team means every week brings variety which I love: underwriting and pricing meetings, proposition design conversations, discussions on operational planning, distribution opportunities, marketing brainstorming and more.

My first meeting is a weekly check-in with my direct reports, focused on trading, operations and any exceptions.

I continue to be delighted with business performance across all metrics – 2025 was an exceptional year. We close our meeting discussing the performance of Zurich’s new Learning Hub, which is an on-demand learning platform designed for advisers so they can fit learning around their busy workloads.

Afterwards I catch the train from Doncaster to Swindon. This is my productive window where I tackle the mailbox and deliberately swap Teams messages for phone calls where I can. There’s something refreshing about the efficiency of a direct conversation. One and done, as I say.

After arriving at our Swindon Life Headquarters, it’s upstairs for some filming. We’re creating an internal promotion video to showcase the breadth of opportunities in retail protection, perfect for inspiring potential new joiners and those who work in other parts of the business.

The rest of the day is spent meeting with people from across the company including a colleague visiting from Zurich Switzerland to discuss our performance and strategic plans for 2026, aligning our vision and next steps.

Monday evening is spent at the hotel, grateful for some quiet time to catch up on work!

Tuesday

An 8am meeting with our operations and underwriting manager sets the tone for the day. We’re focused on transforming underwriting processes to drive growth and efficiency, with Kaizen sessions scheduled alongside our continuous improvement team.

The energy in the room is palpable and it’s only 9am. I believe real innovation comes from collaboration.

Later that day we have our quarterly business review, which brings together the CEO, CFO, and key team members. We celebrate double-digit growth and market outperformance, which is a testament to our collective dedication. A catch-up with the group protection team follows, discussing an exciting new proposition we are co-creating.

Following this I have a few more meetings including a pricing meeting which is focussed on performance and future plans. I also take some time out of my day to coach a colleague by providing career advice – as an international coaching federation qualified coach this is a responsibility I take seriously and feel very passionate about.

My dinner plans for this evening are meeting a peer at Fratellos which is a chance to unwind and connect, sharing stories about life, work and the realities of menopause-induced 3am night sweats. These moments remind me of the human side of leadership.

Wednesday

Wednesday I am travelling bright and early to London for meetings with distributors and reinsurers. I find these sessions invaluable for keeping a finger on the pulse of market developments.

Today we’re running another live event for the Zurich Learning Hub. We’ve continued to see lots of registrations from advisers and protection professionals, so I’m really excited to hear what the industry thinks about it.

I head back home while tackling emails on the train and don’t make it back until late that evening. Thankfully, I don’t have to walk Ollie when I’m finally home.

Thursday

Working from home means a less hurried morning walk with Ollie, which is great to clear my head ahead of the day.

My morning starts with a reinsurer preparing for a panel discussion I’m joining in a few weeks to discuss customer experience.

We have been doing some great things with the global Zurich customer experience team to understand the challenges faced by customers and advisers, so excited to shine a light on those points!

Afterwards I had a meeting to explore themes and what will be discussed for the 2026 Senate. We will reconvene in February but there’s lots of opportunity to explore especially with the FCA protection market review study in progress.

The rest of the day is packed with meetings covering everything from underwriting to operations and distribution.

Friday

My Friday morning walk begins with a podcast – Sarah Raven on gardening.

I’m currently preparing to winter-proof my fern trees, so I spent some time googling before ordering loft insulation and sacking. I love spending time in the garden but even my downtime can be productive!

The day is a blur of meetings which largely had a governance focus spanning Consumer Duty and audit. Navigating the evolving regulatory landscape is critical for continuing to build trust and deliver on our promises.

This time of year, is also filled with end-of-year reviews, so I spent a few hours prepping for those. I’ve been trying to make a habit of using time-saving tools like Copilot and our own-branded tool ‘ZuriChat’ more, and they make quick work of summarising meeting notes and achievements for me.

It’s Friday evening now – the end of the week. Generally, I keep my social plans for Saturday night, so it’s a quiet evening spent at home with the family over dinner – an Indian takeaway from a local restaurant and a glass of my favourite red wine.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk