News

Allianz Partners launches three new 'innovation centres'

Following the launch of its Automotive Innovation Centre in 2014, Allianz Partners has created three further 'innovation centres'.

Zhong An shoots five places up Chinese P&C rankings, underwriting hits continue

Zhong An is now the 13th top player in China’s property and casualty market. It has moved five places up the rankings since the end of 2017.

LMA names Navigators’ Cameron as CEO

The Lloyd’s Market Association has named Sheila Cameron, currently head of International Operations at Navigators Underwriting, as CEO.

Apollo snaps up Aspen in $2.6bn deal

Aspen Insurance has entered an agreement with investment manager Apollo that will see it sell all remaining shares in the business for $42.75 (£33.15) per share, a total of $2.6bn (£2bn).

Acord streamlines testing process

Global standards body Acord is making it simpler for trading partners to connect when they use Acord Standards for the first time or upgrade to its newer version.

Driverless experts: Autonomy to lead to ‘brutal’ insurer consolidation

Autonomy experts expect the advent of driverless cars to result in massive amounts of consolidation and change in the motor market, with mid-size personal lines players most at risk.

This week in Post: One every minute

For those of us back in the office while the holiday season continues it might seem like time is moving slowly but the Association of British Insurers revealed this week that for every minute we count down until silly season is over and the out of office…

Reinsurers turn to M&A to stay relevant as challenging market forces bite

Global reinsurers have turned to mergers and acquisition deals over the last year in order to remain relevant in the face of challenging market conditions, but S&P maintains a neutral view on this trend.

CMC regulatory burden should fall on insurers too, argues legal sector

Claimant lawyers have slammed the financial watchdog’s proposal to regulate claims management companies, arguing it unfairly penalises practicing firms and that insurers should be made to take a share of the burden too.

Beat Capital snaps up Paraline syndicate

Venture capital firm Beat Capital Partners and Bermuda-based insurance holding company Paraline are to merge.

Rising star: Stephen Southern, Insure the Box

Southern cut his teeth in a sales role at the AA, now he is compliance monitoring officer at Insure the Box

ABI calls for regulatory certainty as no-deal Brexit advice published by government

A regulatory deal is urgently needed to address Brexit contract issues for the insurance sector, the Association of British Insurers has said.

Construction industry to assess insurance access post-Grenfell

The Construction Industry Council has launched a survey to assess the impact of the Grenfell fire on insurance cover for the construction sector.

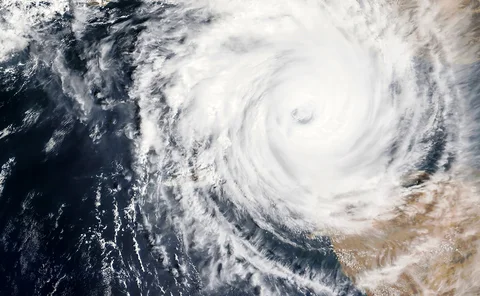

Losses expected as Hawaii bunkers down for cat 4 Hurricane

The insurance and reinsurance industry is braced for losses as category 4 Hurricane Lane continues to track towards the islands of Hawaii.

Four family members sentenced for ‘crash for cash’ claims worth over £40,000

Four men have been sentenced for carrying out a series of ‘crash for cash’ frauds, and then claiming against fraudulent insurance policies.

Ardonagh Group reports income boost of 9.1% at H1

The Ardonagh Group has reported income growth of 9.1% as both income and profit climb in the first six months of 2018.

Analysis: How Amazon could make waves in claims

With talk abound of a possible Amazon entry into insurance distribution, what could an Amazon entry into claims look like?

Ecclesiastical sees premium up at H1 but profit and COR take a hit

Ecclesiastical saw strong premium growth in the first half of 2018 but pre-tax profit took a 54% nose dive.

Insurance businesses among FSCS list of in default firms

The Financial Services Compensation Scheme has declared nine firms, including three insurance businesses, in default, possibly opening the door for consumers to be compensated for any losses incurred.

Updated: Partner Re firms fined €1.5m for Solvency II breach

The Central Bank of Ireland has fined two Dublin-based subsidiaries of Partner Re €1.54m (£1.35m) for breaches of the European Union regulation on solvency requirements.

One insurance scam seen every minute in 2017

Over half a million attempts at insurance fraud were detected in 2017, equivalent to one fraud every minute.

Liiba urges Prime Minister to rethink post-Brexit equivalence regime for brokers

The London and International Insurance Brokers’ Association has written to the Prime Minister raising concerns over the government’s planned equivalence regime for brokers post-Brexit.

Hannover Re names Swiss Re's Henchoz to replace CEO Wallin

The CEO of Hannover Re, Ulrich Wallin, is to step down and retire from the reinsurance giant in 2019 and will be replaced by Swiss Re’s Jean-Jacques Henchoz.

Regulation of CMCs to cost £16.8m

The cost of regulating claims management companies could be £16.8m with the bill falling on the firms themselves, according to the Financial Conduct Authority.