News

Jaguar Land Rover hack now ‘costliest in UK history’

The Cyber Monitoring Centre has categorised the recent malicious cyber incident affecting Jaguar Land Rover as “the most economically damaging cyber event to hit the UK”.

Prima aims for UK scale after rapid rise in Italy

Despite recent regulatory hurdles, Prima’s UK manager, Nick Ielpo, has shared his plan for the company to replicate its digital-first success in Italy in the UK motor insurance market.

Biba survey finds improvements in insurer service

Gracechurch and the British Insurance Brokers’ Association have released the latest findings from their UK Insurers Monitor, revealing several improvements to service scores but a lag in claims.

NTT Data targeting ‘accelerated growth over the next three years’

NTT Data has acquired Derry-based insurance technology consultancy Alchemy, with the firm endeavouring to take aim at insurers utilising Guidewire products.

SRG MGA secures £100m of Aviva capacity

The underwriting pillar of Specialist Risk Group, MX Underwriting, has signed a multi-year delegated distribution agreement with Aviva to support its subsidiary Trilogy Underwriting.

Mazur ruling: A seismic shift for insurance?

A recent ruling at the High Court could give the legal and insurance industries another headache to worry about.

Early insurance involvement breaks ‘vicious’ carbon finance cycle

Insurers providing risk assessments for carbon projects before they start could end the “vicious cycle” of financing delays, according to Artio chief operating officer and co-founder Ibrahim Sarwar.

PIB confirms departure of CFO

PIB Group has confirmed its CFO David Winkett has departed the company.

Covéa’s new CEO vows to prioritise profit over growth

Covéa’s incoming CEO Xavier Laurent has pledged to build on his predecessor Georges de Macedo’s turnaround success by keeping the UK business focused on profitability.

ABI pressed to make insurers cover subsidence for 10 years post-claim

The Association of British Insurers has been called on to specify insurers maintain clay shrinkage subsidence cover for 10 years after repairs in its guidance.

FCA reveals pendulum swing in Gap payouts

The latest Financial Conduct Authority data for fair value measures has shown that, following regulator intervention, more money is being paid out in Guaranteed Asset Protection insurance claims than is coming in through premiums.

PWC’s launch; Bentley’s insurance product; Howden’s group CFO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Ecclesiastical names former Ageas UK CEO as chair

Ecclesiastical’s parent company, Benefact Group, has named Francois-Xavier Boisseau as its next chair.

AI that could hit insurers with wave of court cases wins backing

Artificial intelligence-driven claims technology capable of causing a surge in court-bound insurance disputes has won the financial backing of a law firm backing and is now being piloted with a major loss assessor, Insurance Post can exclusively reveal.

AI video tech three times better than telematics at predicting risk

Artificial intelligence-powered video telematics technology is three times better at risk prediction accuracy than traditional telematics inputs.

FSCS intervenes as Premier Insurance enters administration

The Financial Services Compensation Scheme has stepped in to protect the 16,000 UK customers of Premier Insurance Company after it entered administration yesterday (14 October).

Watchdog outlines vet reforms that could cut pet insurance costs

The Competition and Markets Authority has today published its provisional decision in its market investigation into veterinary services for household pets in the UK.

Staysure assembles specialist team for AI chatbot

Staysure has assembled a team of conversational artificial intelligence specialists to continuously monitor and refine its AI webchat assistant Susi.

‘Predator’ jailed after fraud bust involving pregnant woman

A man who manipulated women he met on dating sites – including one who was seven months pregnant – into taking part in staged car crashes has been sentenced to 20 months in prison.

How has Trump’s approach impacted Net Zero plans?

Insurance Post is inviting ESG and sustainability leads at insurance companies to take part in a short survey examining how US President Donald Trump’s approach to climate and energy policy has influenced Net Zero strategies over the last year.

Big Interview: Graeme Trudgill, Biba

Graeme Trudgill, CEO of the British Insurance Brokers’ Association, talks to Insurance Post about volatility in the treasury, his thoughts on Rachel Reeves and why 2025 has been Biba’s “most successful year ever”.

FCA defends ‘awful lot’ of work done amid Which? super complaint

The Financial Conduct Authority has said it has already done an “awful lot” of insurance work, in response questions about the Which? super complaint.

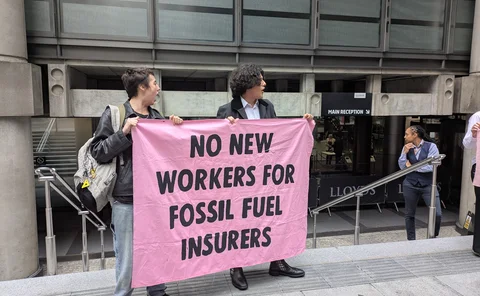

Protesters target Lloyd's careers event

Protesters have targeted the Dive Into Careers Conference at Lloyd’s today (10 October).

PIB buys Ross Gower Group; Zego x Clearspeed; Miller's head of P&I

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.