News

CII and FCA warn AI could put vulnerable customers at risk

The Chartered Insurance Institute has unveiled new guidance to help firms better support vulnerable customers, and warned a rush to adopt AI tools risks compounding harm for those most in need.

Property insurance pay-outs hit record £4.6bn

Association of British Insurers members paid out a record £4.6bn in property insurance claims during the first nine months of the year.

Davies ties half of leadership pay to sustainability goals

Insurance Post can exclusively reveal half of Davies’ group executive committee now have their renumeration linked to the firm’s responsible business goals.

Lloyd’s flags sharp decline in future female underwriting leaders

Lloyd’s is facing a shrinking pipeline of female underwriting talent, with new data revealing women remain significantly under-represented at senior levels.

FCA’s Sheldon Mills to exit regulator

Sheldon Mills, executive director of consumers and competition at the Financial Conduct Authority, is set to leave the City watchdog.

Neal to be paid £2m by AIG without working a day

AIG has agreed to pay John Neal $2.7m (£2m) despite the former Lloyd’s CEO failing to work a day at the insurer, new filings have revealed.

Staysure enters Irish market; Rokstone’s cyber unit; Send’s CTO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Insurance broker jailed after pocketing customer payments

An insurance broker who diverted payments totalling more than £133,000 into his own personal bank account has been sentenced to more than five years in prison.

Lessons to learn from Lloyd’s investigation into Neal

Editor’s View: Lloyd’s examination of former CEO John Neal’s conduct raises difficult questions about oversight, culture and transparency, which Emma Ann Hughes argues the insurance market can no longer afford to shrug off.

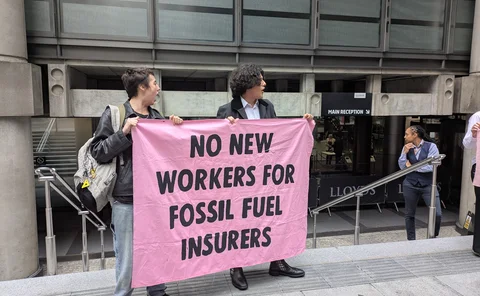

Climate activists disrupt S&P insurance conference

Climate change protesters disrupted S&P Global Ratings’ European Insurance Conference in London this afternoon (20 November), forcing multiple pauses to the programme.

Zurich’s Clayton named IFB chair

Zurich UK’s Scott Clayton has been named chair of the Insurance Fraud Bureau, with effect from 1 January 2026.

Premier Insurance policies to end in December

The joint administrators for Premier Insurance Company Limited plan to end policies on 1 December 2025, according to an update from the Financial Conduct Authority issued today (20 November).

Lloyd’s opens investigation into Neal’s workplace relationship

Lloyd’s has opened an investigation into the conduct of former CEO John Neal, after rumours of a workplace affair swirled.

Q&A: Jake Wells, Meshed

Jake Wells, co-founder and chief operating officer of Meshed, discusses the insurtech’s vision of providing high quality service to small-to-medium businesses through the artificial intelligence-native broking platform.

Ripe enters holiday homes market with Schofields acquisition

Ripe has acquired holiday homes insurance specialist Schofields Limited, marking its entry into the holiday homes space, subject to regulatory approval.

Davies CEO warns agentic AI investment ‘imperative’ for survival

Davies group CEO Dan Saulter has argued investment in agentic artificial intelligence is an “imperative” and not an “option”.

Claims fraud interceptions continue to top £1bn

£1.16bn worth of fraudulent general insurance claims were identified in 2024, according to the Association of British Insurers’ latest data.

AIG cancels John Neal’s president appointment

AIG has announced John Neal will no longer be joining the insurer as president next month due to personal circumstances.

Jensten buys broker; Pen's renewables product; Zurich UK's head of compliance

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Axa CIO reveals ROI on AI

Artificial intelligence has resulted in a significant uptick in the number of customers Axa retains, according to the insurer’s chief information officer Natasha Davydova.

ABI urges MPs to hardwire insurance into national resilience

The government must embed insurers at the heart of national resilience planning and involve the sector at the earliest stage of major policy decisions, Association of British Insurers director general Hannah Gurga told industry leaders.

Markel names MD for new London Market business

Markel Insurance has today named Rohan Davies as managing director of its newly created London Market business.

Laka raises £14.1m in series B round

Laka has raised £14.1m in its series B funding round, following the green mobility insurer securing a £6.5m venture debt facility from HSBC Innovation Banking.

Government introduces Bill to bolster cyber resilience

The UK government has today (12 November) introduced a new Bill to parliament aimed at strengthening cyber security for the nation’s essential public services.