News

IPT expected to rake in nearly £60bn in next five years

The Office for Budget Responsibility has upgraded its five-year forecast for insurance premium tax forecast, revealing it’s set to take in £57.8bn in the next half-decade.

Zurich and Beazley agree £8.2bn deal

Zurich Insurance Group has agreed the terms of a firm all-cash offer to buy Beazley for £8.2bn.

Ki delivers record $171m profit in first standalone year

Ki saw a record pre-tax profit of $171.4m (£128.2m) in its first year as a standalone company.

Ashleigh Gwilliam departs nCino

Ashleigh Gwilliam, former head of insurance at Full Circl, an nCino company, has confirmed via LinkedIn that he has departed the business.

Iran missile strikes spark risk repricing

The joint assault by Israel and the United States against Iran have sent shockwaves through global insurance markets, triggering risk repricing and renewed scrutiny of accumulation exposure across marine, aviation and specialty lines.

Katharine Braddick to succeed Woods at PRA

Katharine Braddick CB has been named the next deputy governor for Prudential Regulation at the Bank of England and CEO of the Prudential Regulation Authority.

Bspoke's capacity deal; Mission's MGA launch; Hiscox's CUO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Soft market tempers Axa UK’s personal lines gains

Axa Group has reported 5% growth in property and casualty gross written premiums to £58bn, driven by commercial lines and strong new business in personal lines globally, but softer pricing in UK & Ireland dragged down personal lines rates.

Average storm claim value more than doubles since 2017

Recent data has indicated the rising cost of covering storm damage, with the average cost in 2025 reaching £1,242.

Allianz CEO outlines strategy to manage expenses

Despite volumes remaining fairly stable in 2025, Allianz UK CEO Colm Holmes has outlined how the insurer managed to increase profitability by 30%, including the 650 redundancies it made last year.

Allianz UK CEO anticipates ‘difficult trading year’ ahead

Despite almost a 30% increase in operating profits, Allianz UK CEO Colm Holmes believes 2026 is going to be a “difficult trading year”.

Aviva’s Washington out as Probitas CEO

Aviva’s MD of global corporate and specialty at Aviva, and CEO of Probitas, Matt Washington is leaving the business to “pursue opportunities outside of Aviva”.

Threat actors showing dramatic shift in cyber-attack executions

Data has indicated a dramatic shift in how threat actors are executing prolonged attacks on organisations.

Ageas Group sees continued growth following Esure and Saga deals

Ageas Group has recorded a 9% growth in revenue, as well as a 33% increase in operating profit thanks to “transformative M&A”.

Hiscox delivers record profit and plots next phase

Hiscox has delivered its third consecutive year of record profits and set out ambitions for further acceleration through to 2028.

Stanford replaces Thaker as Sompo UK CEO

Aspen UK CEO Sarah Stanford will lead all of Sompo UK’s property and casualty insurance operations, replacing outgoing CEO Bob Thaker.

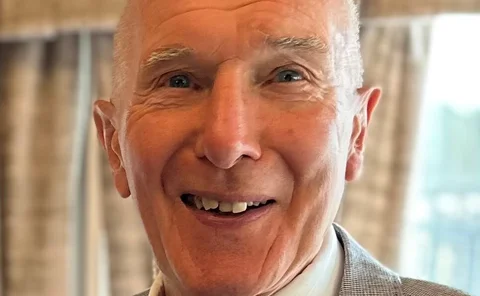

Caravan Guard founder Peter Wilby passes away

Peter Wilby, founder and chairman of caravan insurance firm Caravan Guard, has passed away at age 78, his family has announced.

Aviva appoints Chris Cochrane as group CIO

Aviva has appointed Chris Cochrane as group chief information officer with effect from summer 2026, replacing the retiring John Cummings.

FCA outlines insurance regulation plans

The Financial Conduct Authority has promised to improve access to insurance, scrutinise claims handling, get to grips with artificial intelligence and cyber risks, plus slash red tape over the year ahead.

Phil Bayles confirmed as Everywhen’s broking CEO

Phil Bayles has been named as Everywhen’s general insurance broking CEO, after having served as chief commercial officer since 2021.

City of London launches rival to Biba conference

The City of London Corporation has announced the launch of their inaugural Global Risk Summit.